For much of the year, the BRICS bloc has seen a renewed focus on de-dollarization. Indeed, its 2023 annual summit ended with a five-nation expansion plan and several initiatives to help boost local currencies. Now, amid the expansion of the BRICS bloc, both China and Saudi Arabia are set to drive the global end to the US dollar.

Saudi Arabia was one of the five nations set to join the alliance. Specifically, it joined the United Arab Emirates (UAE), Egypt, Iran, and Ethiopia. However, the nation is poised to be of massive importance to the bloc’s efforts against the dollar. Subsequently, even a former US official has warned of what its cooperation with the initiatives could mean.

Also Read: 5 New Arab Countries Look To Join BRICS Alliance

China and Saudi Arabia To Have Massive Impact on BRICS De-Dollarization

Throughout 2023, the BRICS alliance has shaken up the geopolitical sector. Indeed, the bloc has consistently challenged the status quo of the global order. Subsequently, they have driven their own goal of multipolarity in the current international landscape. Now, those two things could see continued evolution through the coming year, thanks to recent cooperation.

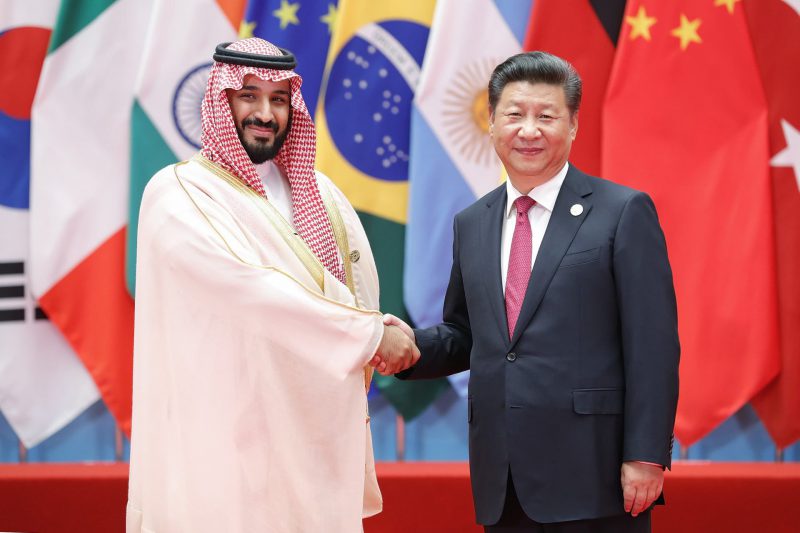

Specifically, the BRICS bloc is set to see both China and Saudi Arabia drive the global end to the US dollar. Indeed, the two nations have agreed to a landmark currency swap that will continue to push Saudi Arabia’s embrace of BRICS local currencies. Therefore, it will only decrease its use of the US dollar.

Also Read: BRICS: Brazil Calls for Digital Revolution in New World Order

Since its inception in the BRICS bloc, Saudi Arabia’s ties to the United States have been a massive talking point. However, the geopolitical implications of its association with the bloc’s de-dollarization could be astronomical. Currency swap agreements between the nation and BRICS affiliates could only further that mission.

Both Saudi Arabia and the People’s Bank of China agreed to a three-year currency swap agreement worth $6.93 billion. Moreover, that is all in Chinese currency, aiding the two nations and increasing the amount of local currency that the Middle Eastern nation has access to. Ultimately, it could have massive repercussions on the global market and the US dollar’s place within it.