In what is certainly a landmark development for the BRICS alliance, China and the United Arab Emirates (UAE) have completed the first cross-border Central Bank Digital Currency (CBDC) transaction worth more than $13 million. Both countries moved 50 million dirhams across the mBridge network, according to reports.

Indeed, the aforementioned mBridge network links the central banks of Hong Kong, Thailand, the UAE, and China. Moreover, its presence is a key part of those nations’ attempts for greater de-dollarization. Subsequently, the move certainly creates another avenue to lessen global reliance on the greenback.

Also Read: BRICS: No Demand For US Dollar Bonds, Sales Get Worst Start Since 2016

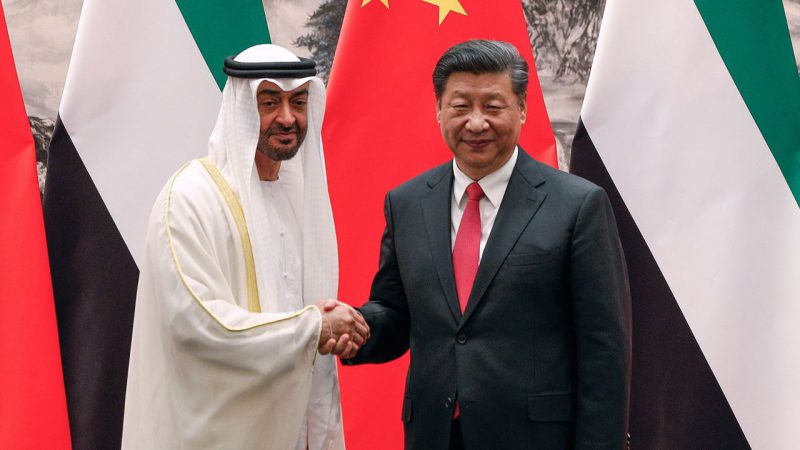

China and UAE Complete Inagural Cross-Border CBDC Transaction

Over the past year, the BRICS economic alliance integrated initiatives that were vital to its overall growth. Alongside the adoption of prevalent De-dollarization plans, the alliance has also expanded for the first time since 2001. Subsequently, those two things aligned in what could be a landmark for digital assets and the economic alliance.

Indeed, the BRICS nations of China and the UAE have completed the first cross-border CBDC transaction worth more than $13 million. Moreover, the completed transaction was worth 50 million dirhams and is the first real-time payment to ever take place on the mBridge.

Also Read: 34 Countries Look to Join BRICS Alliance After Saudi Arabia’s Entry

The network that links the central banks of Hong Kong, China, the UAE, and Thailand was first piloted in 2014. Additionally, the report noted that there were two critical payments. Firstly, Saudi Prince Mansour and Chinese ambassador Yiming Zhang set the 50 million dirhams jointly. While that was taking place, the Chinese central bank had paid a remittance payment in the digital RM.

However, the mBridge network is not yet fully active. The Bank of International SEttlemtns notes that the project is still too early to predict a launch date. However, it does have plans to roll out in mid-2024. Its presence should provide another key challenger to the US dollar’s usage on a global scale. Specifically within BRICS and alliance countries.