BRICS member China’s largest real estate developer Evergrande has been ordered to liquidate $300 billion in assets by a Hong Kong court on Monday. The property giant Evergrande was unable to offer a concrete restructuring plan becoming the world’s most indebted real estate developer. Evergrande failed to provide restructuring plans despite months of delay in several court hearings.

Also Read: BRICS: Morgan Stanley Predicts Future of the U.S. Dollar

However, Justice Linda Chan ordered to liquidate more than $300 billion in liabilities after noting Evergrande’s lapses in restructuring plans. “It is time for the court to say enough is enough,” said Justice Chan during her final court verdict.

Evergrande’s business operations will now make it harder to focus on its revival. “It is not an end but the beginning of the prolonged process of liquidation, which will make Evergrande’s daily operations even harder,” said Gary Ng, Senior Economist at Natixis.

Also Read: BRICS Expansion a Threat To SWIFT Payment System & US Dollar

“As most of Evergrande’s assets are in mainland China, there are uncertainties about how the creditors can seize the assets and the repayment rank of offshore bondholders, and the situation can be even worse for shareholders,” he said to Reuters.

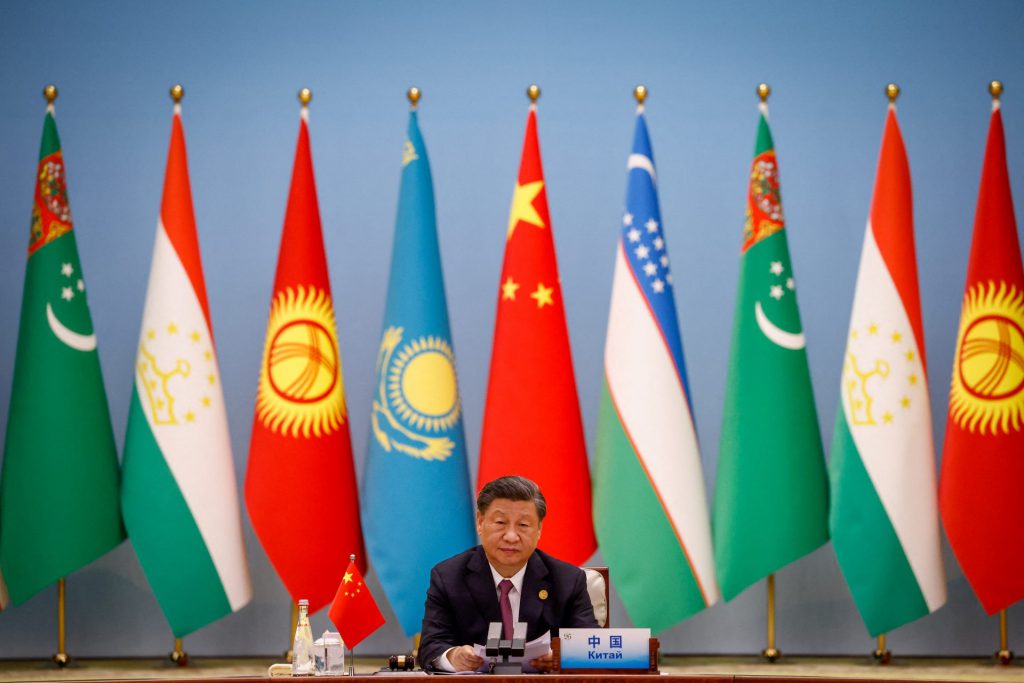

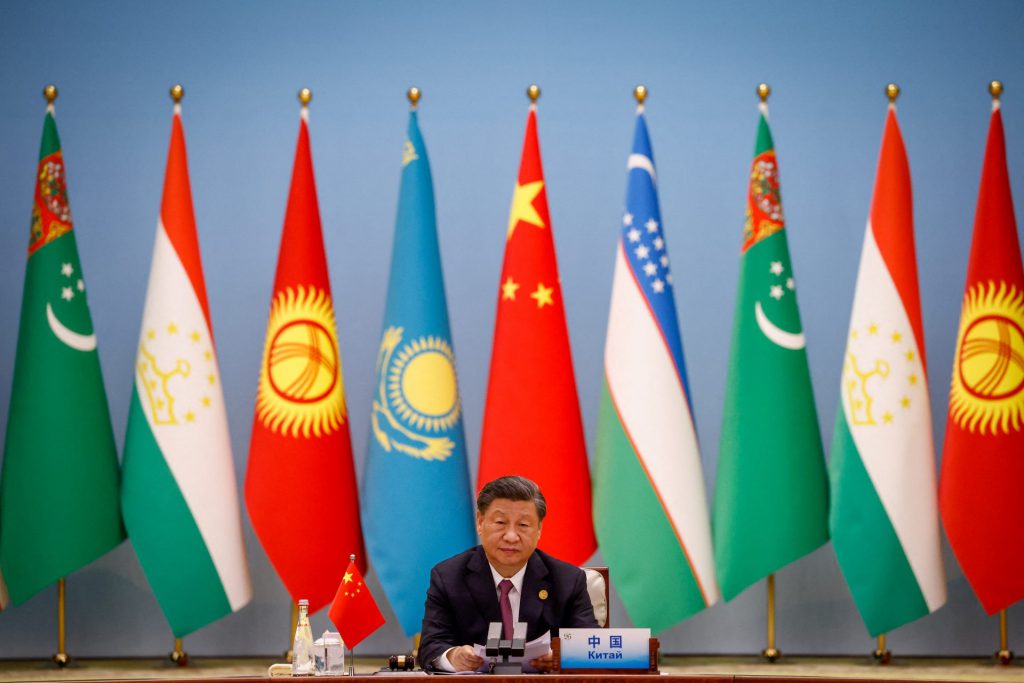

BRICS: China’s Economy Takes a Beating in 2024

BRICS country China’s economy is not in the right shape in 2024 as top business giants are facing bankruptcy. The Chinese Yuan along with the economy is moving downhill with growth remaining stagnant for three years. The tailspin could continue and send ripples across the other sectors of the Chinese economy.

Also Read: BRICS: Africa to Ditch US Dollar as World Bank Fails To Provide Funds?

This puts BRICS in a spot as China was spearheading the de-dollarization efforts across the globe. If the BRICS country China cannot save its billion-dollar real estate giant, other developing nations might not join the de-dollarization bandwagon.

The stakes are high for BRICS and ditching the US dollar is not as easy as they think. The US economy is slowly coming out of a crisis while BRICS nation China is slipping into a crisis.