According to a top Russian official, a BRICS currency agreement is expected at some point this year. Specifically, the chairman of the State Duma Committee on the Financial Market ensured that an alternative currency to the US dollar would be agreed upon at some point in 2023.

The BRICS nations have been at the forefront of de-dollarization efforts, following Russian sanctions imposed after the invasion of Ukraine. Moreover, the collective has sought alternatives to the United States currency for international settlements.

BRICS Currency Set for 2023 Debut?

According to Anatoly Aksakov, Chairman of the State Duma Committee on the Financial Market, a BRICS currency agreement is expected this year. Additionally, Aksakov discussed de-dollarization with the Federal Assembly of the Russian Federation’s Parliamentary Newspaper, according to Bitcoin News.

“By tying its economy and currency to politics, the US is practically undermining the foundations of its dominance.” Aksakov additionally stated, “I am sure that the share of the dollar in world trade will readily decline.” However, the fading relevance of the US dollar has already been a headline throughout the year thus far.

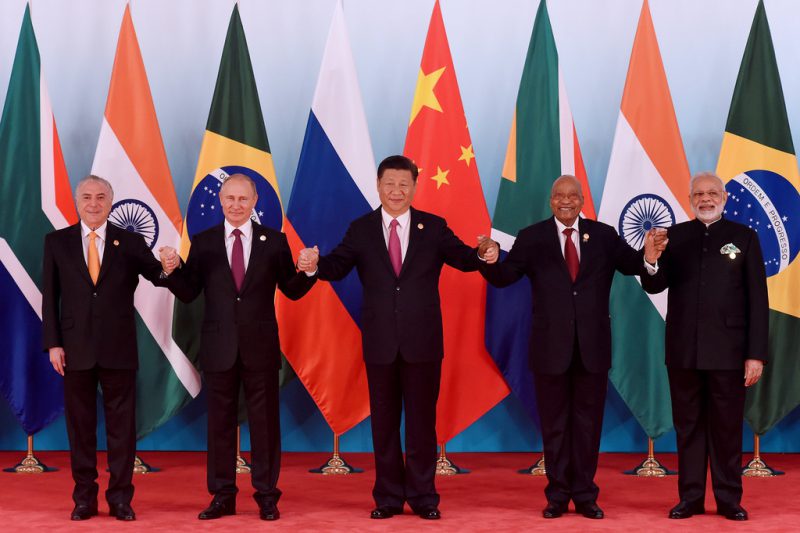

Aksakov assured that the development of a BRICS currency has already been discussed by Brazil, Russia, India, China, and South Africa. Subsequently, although negotiations remain quite early, an agreement is expected in 2023. A development that should concern those hopeful for the US dollar.

Additionally, the collective is seeking to expand its member states. Specifically, it was reported that more than 19 nations have submitted membership requests to join the bloc. It appears that expansion is set to be one of the talking points for the upcoming BRICS summit this summer. A summit that appears to be vitally important.

Alternatively, how negotiations surrounding an alternative currency commence will be crucial. The US dollar has seen its relevancy fade in recent months, as macroeconomic factors have run rampant. Moreover, with the Chinese yuan already gaining popularity, the speed of those negotiations will likely depend on the nations’ ability to unify.