Russia has been indicating that the BRICS currency is in the pipeline, but has kept all details under wraps. It is touted as a tender that could challenge the US dollar’s supremacy in the global markets. Many even went a step forward, claiming BRICS currency could gain reserve status. All these wild statements are made even before the tender is launched and tested in the market.

However, for the BRICS currency to gain reserve status, it needs to meet several parameters. They include the domestic economic strength of the countries that formed it, and also how it performs in international trade. Most importantly, the trust level needs to be maintained, as without it, the tender falls flat. The US dollar, on the other hand, has gained trust and has withstood the whiplashes of the forex markets for decades.

Also Read: BRICS Tests Digital Currency Bridge, Settles Payments in 7 Seconds

Here’s What It Takes For BRICS Currency To Gain Reserve Status

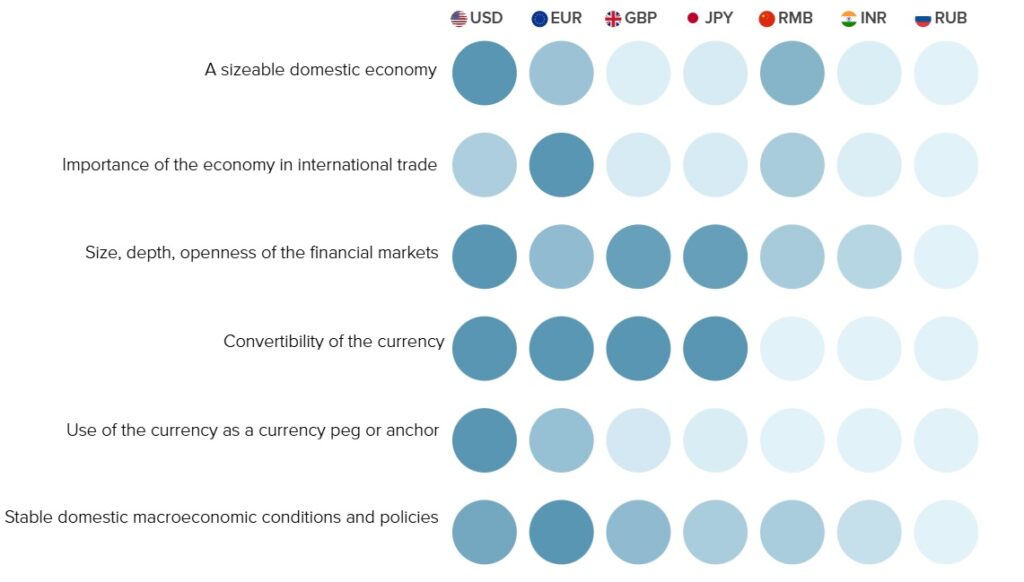

For the BRICS currency to gain reserve status, it needs to tick all the boxes of the International Monetary Fund’s (IMF) Special Drawing Rights. The indicators include a sizeable domestic economy, the importance of the economy in international trade, size, depth, openness of the financial markets, convertibility of the currency, use of the currency as a currency peg or anchor, and stable domestic macroeconomic conditions and policies.

Also Read: BRICS Capitals Sign Moscow Pact, Mark New Phase of De-Dollarization

The chart above shows that the US dollar ticks almost all the boxes here. The euro ticks more than half of them while the pound stands at the center. All of these currencies have been in the market for more than a century and have experienced the worst crisis and bounced back. They have a weightage in the market and are among the most-used tenders. It is practically impossible for the BRICS currency to meet all these parameters. It takes years, if not decades, to just stabilize in the forex market, let alone to become the global reserve.