How the BRICS Currency is Poised to Disrupt the Global Financial System

Before we delve into the concept of the BRICS currency, it’s essential to understand the significance of the BRICS nations themselves.

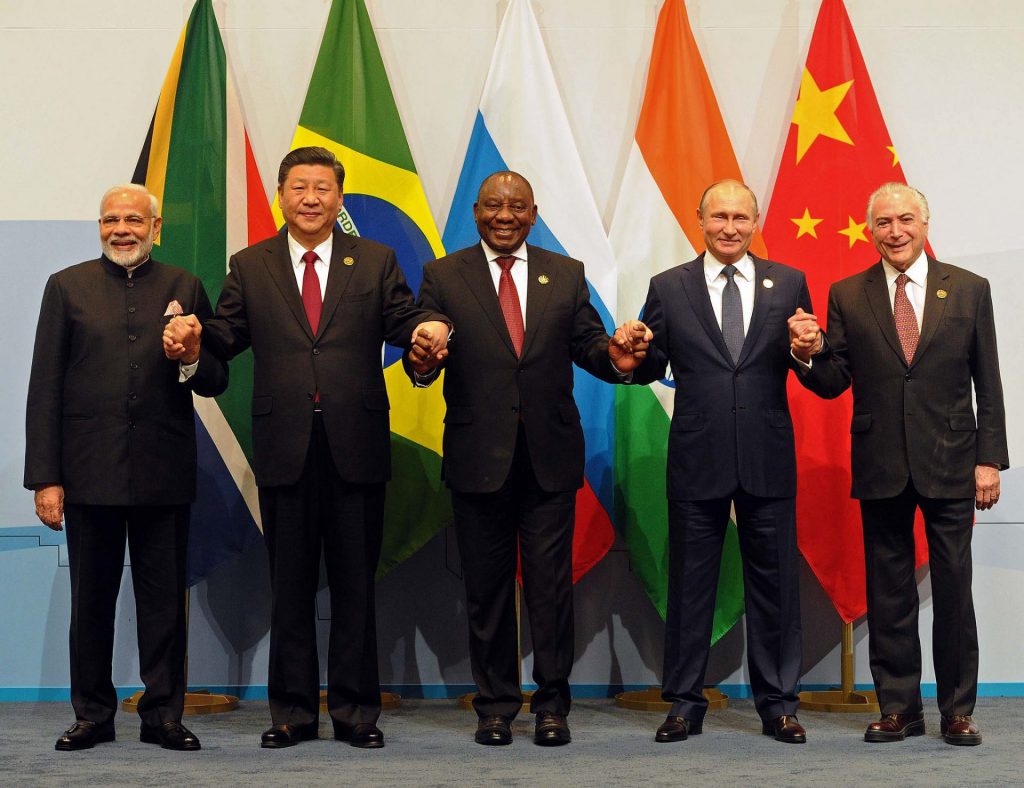

BRICS stands for Brazil, Russia, India, China, and South Africa. These countries share several characteristics that make them crucial players in global affairs.

Read our previous article titled “What Countries Are Trying to Join BRICS?” here.

How Did the BRICS Alliance Form?

First, it might be helpful to understand how this alliance was created before understanding what currency they might use.

The nations mentioned above have experienced rapid economic growth in recent years.

Their combined GDP accounts for over 20% of the global total.

This has led to a shift in economic power from traditional Western economies to emerging markets.

Second, the BRICS countries have a massive consumer base.

They have a combined population of nearly 3.2 billion people. This represents a significant portion of the global market, creating immense opportunities for businesses and investors.

Moreover, the BRICS nations have increasingly asserted their political influence on the world stage.

They have formed various alliances and organizations, such as the BRICS Development Bank and the Shanghai Cooperation Organization. These are formed to promote their interests and foster cooperation among member countries.

Given their economic and political clout, it’s only natural that the idea of a common currency among these nations has been proposed to solidify their position in global affairs further.

What is the BRICS currency?

Although there is no official BRICS currency in circulation at the moment, the term refers to the concept of a shared currency among the BRICS nations. Various policymakers, economists, and scholars have discussed and debated this idea over the years. Some advocate for its creation to strengthen the economic ties among these nations and challenge the dominance of traditional global currencies.

The concept of a BRICS currency is essentially a shared medium of exchange that would facilitate trade.

Proponents of the idea argue that it would increase the efficiency of cross-border transactions, reduce currency risks, and promote economic integration among the BRICS nations.

Some have even suggested that a BRICS currency could eventually become a global reserve currency, serving as an alternative to the US dollar, euro, and Japanese yen.

However, implementing a common currency among these diverse economies remains a subject of intense debate.

BRICS Currency vs. Traditional Global Currencies

Comparing a BRICS currency with traditional global currencies can help us to understand its potential. These traditional currencies are currently dominating the international financial system.

The US dollar, euro, and Japanese yen are the most widely used global currencies. They typically serve as the primary medium of exchange for international trade and investment.

They also serve as the principal reserve currencies held by central banks worldwide.

One can attribute the dominance of these traditional currencies to several factors, including:

- stability

- liquidity

- the economic strength of the issuing countries

The supremacy of certain currencies is declining. Emerging markets like the Chinese renminbi have gained more global recognition in recent years. This has created a challenge to their supremacy.

A BRICS currency could disrupt the established order by providing an alternative medium of exchange and a reserve currency option for central banks.

This could lead to a more diversified global currency landscape, with the BRICS currency playing a prominent role alongside the traditional global currencies.

Impact of BRICS currencies on the global financial system

Introducing a BRICS currency could have far-reaching implications for the global financial system.

One of the most significant impacts would be the potential to reduce reliance on the US dollar. The US dollar is currently the world’s primary reserve currency.

This could lead to a more balanced and diversified global currency system, with various currencies sharing reserve currency status.

A BRICS currency could facilitate greater economic integration among the member countries. This would promote trade and investment by reducing transaction costs and currency risks. This could result in even stronger economic growth for the BRICS nations, further enhancing their influence on the global stage.

On the flip side, implementing a common currency among these diverse economies could also pose several challenges.

For instance, coordinating monetary policy among the BRICS countries could prove difficult, given their differing economic structures and policy priorities.

Additionally, a BRICS currency could potentially give rise to financial instability if not properly managed.

The future of BRICS currency

While the idea of a BRICS currency remains debatable, several factors could influence its prospects.

One key factor is the degree of political and economic cooperation among the BRICS nations.

Greater collaboration and consensus on key issues could pave the way for implementing a common currency.

Another crucial factor is the evolution of the global financial landscape. As emerging market currencies gain prominence and the dominance of traditional global currencies wanes, the demand for a BRICS currency could grow stronger.

Implementing a BRICS currency has hurdles, including technical and logistical challenges and agreement on monetary policy and currency management.

Conclusion

In conclusion, the BRICS currency is an intriguing concept with the potential to disrupt the global financial system.

While the feasibility of implementing a common currency remains debatable, the evolving global financial landscape will shape the prospects of a BRICS currency. Not to mention the degree of political and economic cooperation among the member countries.

As you ponder the potential implications of a BRICS currency, remember that the world of global finance is constantly evolving.

The rise of new economic powers, such as the BRICS nations, can reshape the current world order.

By staying informed and engaged with these developments, you’ll be better prepared to navigate the ever-changing world of global finance and seize the opportunities that lie ahead.