In what may be considered good news for the BRICS bloc, the European Central Bank has suffered its first major loss in 20 years. The bank reported an annual loss of 1.3 billion euros ($1.4 billion) for 2023, its first loss since 2004.

The ECB had to pay out more due to higher interest rates due to global inflation. Furthermore, the Central Bank said following the posting that it expects further losses for the following few years. However, it ensures that these losses won’t affect the “ability to conduct effective monetary policy.”

Interest rates in Europe went up to a record 4% between July 2022 and September 2023. The hikes were in part due to post-COVID-19 pandemic relief as well as Russia’s invasion of Ukraine. The invasion caused a loss of energy coming from the invading country. Additionally, the ECB shared a net interest loss of 7.19 billion euros in 2023, after a 900 million euro income in 2022.

Also Read: BRICS: South Africa to Explore Stablecoin Development in 2024

“The financial strength of the ECB is further underlined by its capital and its substantial revaluation accounts, which together amounted to €46 billion at the end of 2023,” the central bank said in a statement. To combat the loss, the ECB says it will not make profit distributions to eurozone national central banks for 2023. Instead, the bank will put the loss on its balance sheet to offset future profits.

Other Banks Suffering Losses, How It Affects BRICS

The European Central Bank isn’t the first of its kind to suffer losses in the past year. Indeed, Germany’s Bundesbank and the Swiss National Bank have seen drops due to the same factors. The US, of course, also suffered from growing inflation. and steep interest rate hikes in 2023.

Also Read: Venezuela to Join BRICS in 2024?

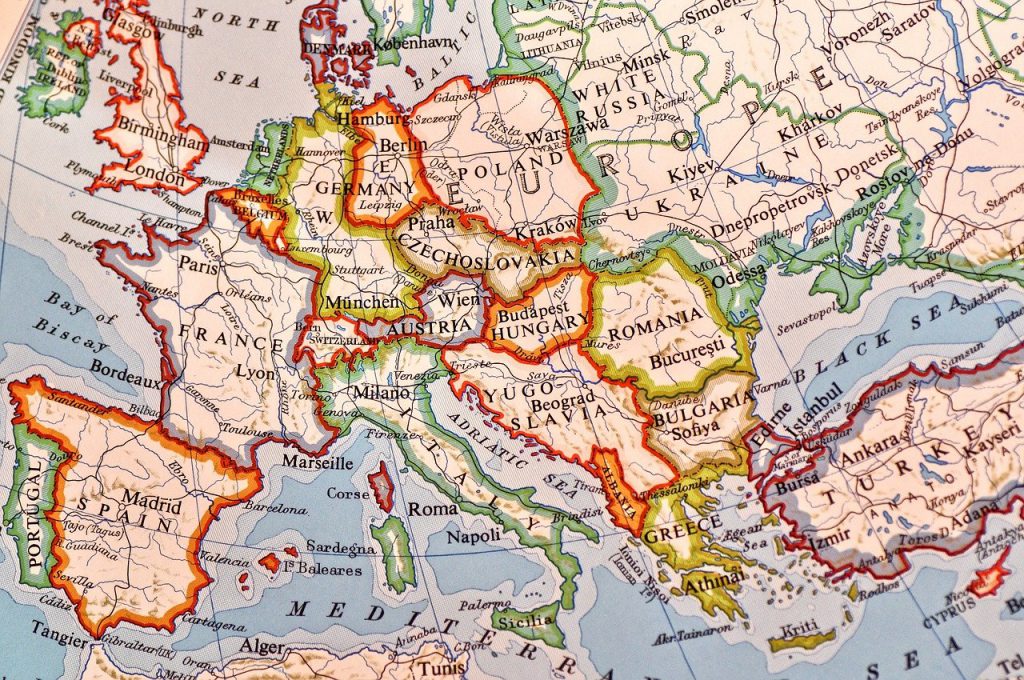

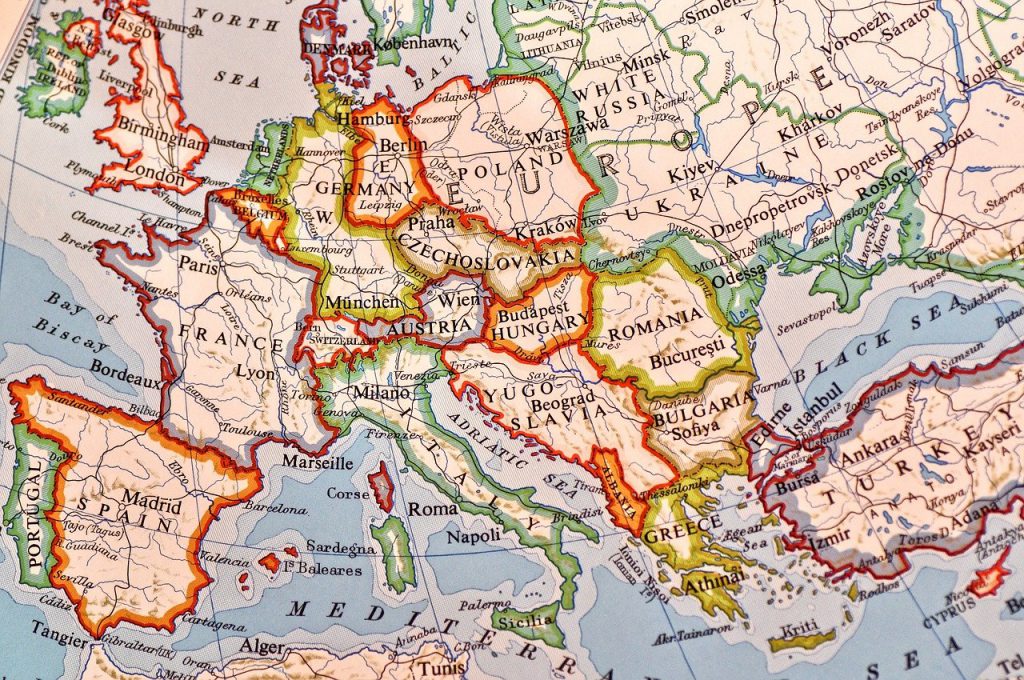

While BRICS’s primary adversary is the West, the news of a major loss by the European Central Bank may indicate potential weakness for BRICS to hit in 2024. The bloc is keen on the expansion and development of a new currency to be used globally. With the euro taking a beating due to inflation and the central bank reporting losses, BRICS may look to continue expansion as far as into Europe perhaps. Many nations have an interest in joining BRICS in 2024, and reports show that some European nations may look into joining as well.