The global oil supply of the BRICS alliance has been experiencing a sharp rise in 2023. The BRICS alliance inducted six new countries into the bloc and five of them are oil-producing nations. Saudi Arabia, the UAE, Egypt, Iran, and Ethiopia export millions of barrels of oil around the world every year. Argentina is the only new member that does not produce oil. However, it is looking to bring down its dependence on the U.S. dollar. Therefore, the BRICS bloc now controls a major portion of the global oil exports and could challenge the Western hegemony.

Also Read: South African President Makes Huge Announcement on BRICS Expansion

Read here to know how many sectors in the U.S. will be affected if BRICS stops using the dollar for trade.

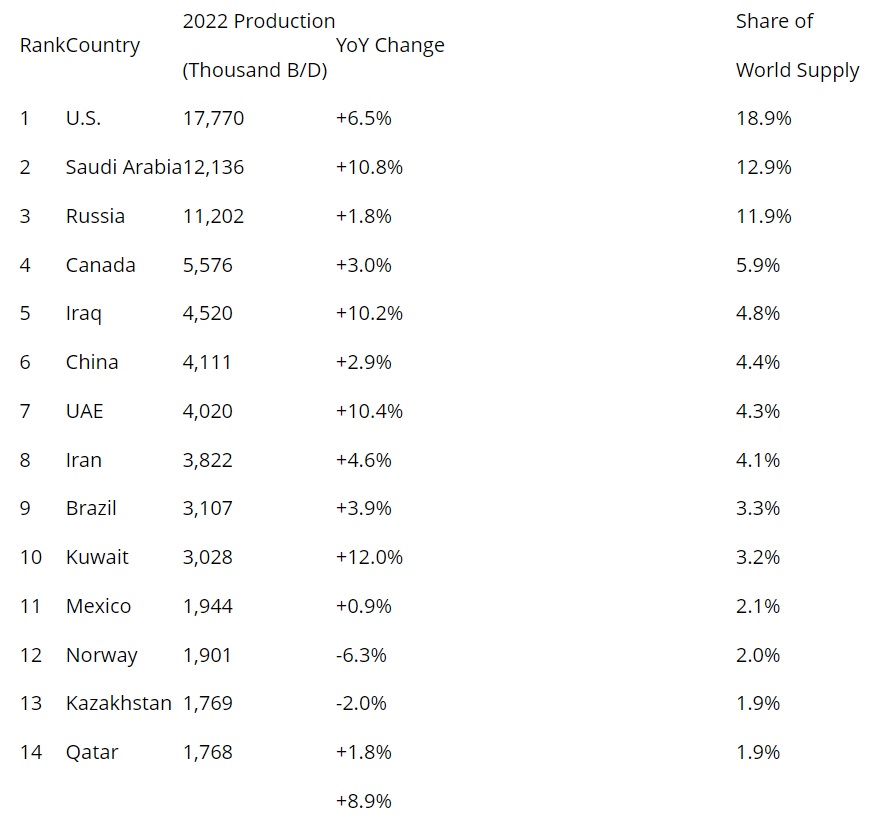

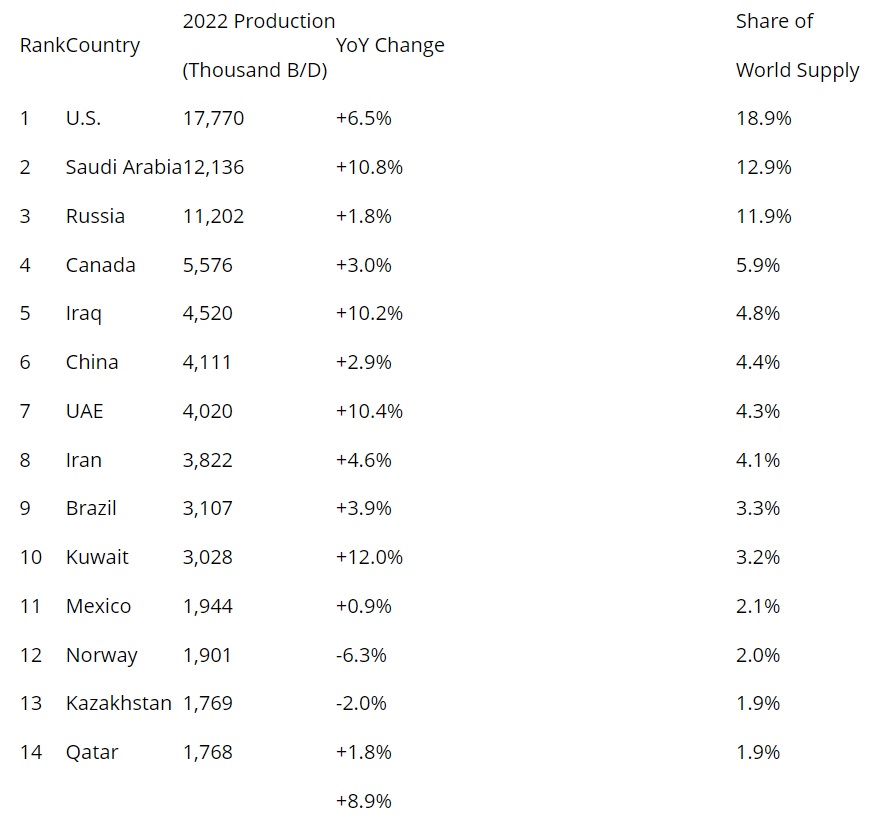

BRICS Now Control 40.9% of Global Oil Supply, Up 10.9% YoY

The newly expanded bloc has seen the share of its global oil supply rise year-on-year (YoY). BRICS now control 40.9% of the world’s oil supply, exporting millions of barrels to other countries every year, according to the latest estimates from OilPrice. Russia’s oil production has increased by 1.8% this year, despite U.S. sanctions.

Also Read: The U.S. Dollar Overtakes All BRICS Currencies & Gold

Saudi Arabia’s oil production increased by 10.8%, while China’s spiked by 2.9% in the same year. The UAE and Iran also increased their production by 10.4% and 4.6% respectively. These statistics evidently point out that BRICS could dominate the oil sector in the coming years. In retrospect, power could be tilted from the West to the East.

Below is the list of the global oil supply from BRICS members between FY 2022-2023:

Saudi Arabia – 12.9%

Russia – 11.9%

China – 4.4%

UAE – 4.3%

Iran – 4.1%

Brazil – 3.3%

Also Read: BRICS: Former Treasury Secretary Predicts Future of the US Dollar

If BRICS countries decide to ditch the US dollar and accept local currencies for oil trade, the U.S. dollar will be hit the hardest. The U.S. dollar could lose its demand in the international markets and find lesser means to fund its deficit.

The development would directly impact the U.S. economy which could eventually lead to inflation and job cuts. In conclusion, BRICS taking over the oil sector could spell doom to the dollar and the U.S. economy over the long run.