Africa is taking a bold economic U-turn by following the footsteps of BRICS and challenging the US dollar by settling trade in a homegrown payment system. The Continent accelerated the launch of a local currency payment system that does not rely on the US dollar. The homegrown payment system is called the ‘Pan-African Payments and Settlements System‘ (PAPSS) and remains at the forefront of the de-dollarization agenda in the Sub-Saharan Continent.

Also Read: India Reveals New Details About BRICS Currency

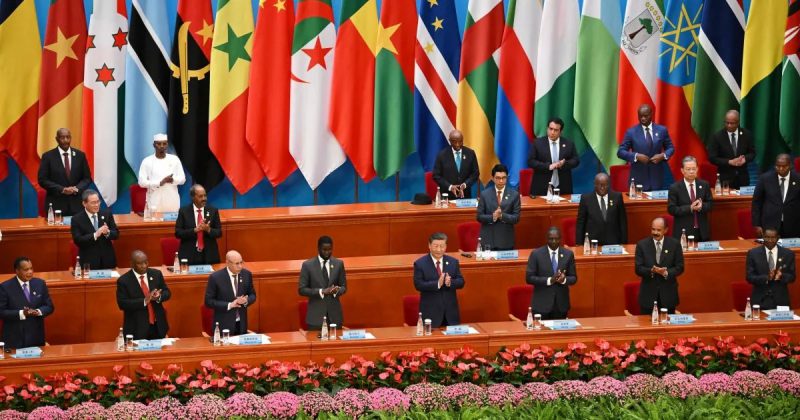

BRICS Inspires 15 Countries in Africa To Settle Trade in the Homegrown Payment System

Taking a leaf from the BRICS bloc, 15 African countries have used the homegrown payment system PAPSS for trade. As of June 2025, over 150 commercial banks in Africa settled the payments in local currencies bypassing the US dollar. The 15 countries that used the PAPSS include Kenya, Malawi, Tunisia, and Zambia, among many others.

PAPSS saves African countries more money in foreign exchange as it does not have to deal with the US dollar. Internal estimates suggest that a trade worth $200 million in the USD would cost 10% to 30% in foreign exchange. The entire load gets reduced to just 1% while using the PAPSS homegrown payment system. BRICS is inspiring several countries to use local currencies through the homegrown payment system.

Also Read: Payments in National Currencies To Increase After BRICS 2025 Summit

The PAPSS payment system inspired by BRICS uses local currencies like the Nigerian naira, Ghanaian cedi, and South African rand. It potentially saves African countries close to $5 billion in foreign exchange by simply sidelining the US dollar. If many more African countries start using PAPSS, the USD will remain under tremendous pressure.

BRICS is also looking to launch a homegrown payment system similar to PAPSS and challenge the US dollar. The next few decades could change the course of global finances making the USD take the back seat. Local currencies could be seated in the driver’s seat leading to a multipolar world.