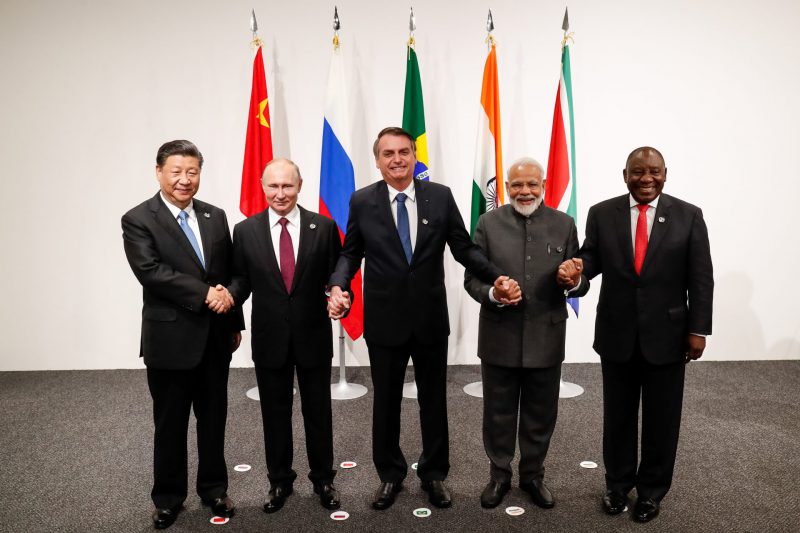

The BRICS countries initiate billions worth of trade deals in transactions for crude oil, gas, and other goods and services. Trade between BRICS members increased by 56% between 2017 to 2022 among the existing five countries. BRICS countries initiated trade deals worth $422 million in the last five years. The bloc of five nations boasts of natural resources and farm products, except for Russia. However, Russia complements the bloc by exporting crude oil to both the West and other developing nations.

Also Read: BRICS: Russia Dumps Currencies Worth $8.7 Million in Yuan & Ruble Set

Read here to know how many sectors in the US will be affected if BRICS stops using the dollar for trade. The move could put the US economy on the brink of turmoil and lead to hyperinflation in the homeland.

BRICS Trade Reaches 37% of the Global Total

According to the latest report from Bloomberg, trade between BRICS members has reached 37% of the world’s cross-border transactions. The rise in trade is what pushed the overall BRICS GDP to rise from 31.5% to 37% of the world’s economy. In comparison, the G7 nations’ GDP stands at 29.9% of the global economy. BRICS is ahead by 7.01% in terms of GDP compared to the G7 set of nations.

Also Read: BRICS Advancing To Reshuffle Global Financial Order

In addition, BRICS overtook G7 nations in global GDP of purchasing power parity (PPP) early this year. The shift in global economics is beginning to take wing and developing countries are looking to take the driver’s seat of the world’s financial order.

The power dynamics could change after the six other countries join the bloc next year in 2024. Saudi Arabia, the UAE, Argentina, Egypt, Iran, and Ethiopia, will enter the group on January 1, 2024. Five among the six new countries, except for Argentina, are leading oil-producing nations.

Also Read: BRICS Can Dethrone US Dollar Without Launching New Currency

The alliance could equip itself by trading in local currencies and put an end to the US dollar dominance. In conclusion, the traditional financial order is at risk to make way for the new world order dominated by developing countries.