Multinational investment bank Morgan Stanley downgraded the outlook for the U.S. dollar from ‘Bullish’ to ‘Neutral’ on Friday. The global bank cited that the Federal Reserve initiating interest rate cuts led to the decline of U.S. Treasury yields. Morgan Stanley’s outlook for the U.S. dollar is now officially ‘Neutral’ and downgraded from its previous stance of ‘Bullish’. The downgrade comes at a time when the BRICS alliance is advancing to uproot the U.S. dollar’s global supremacy.

Also Read: BRICS: India Gets Reality Check, Ditching US Dollar Becomes Impossible

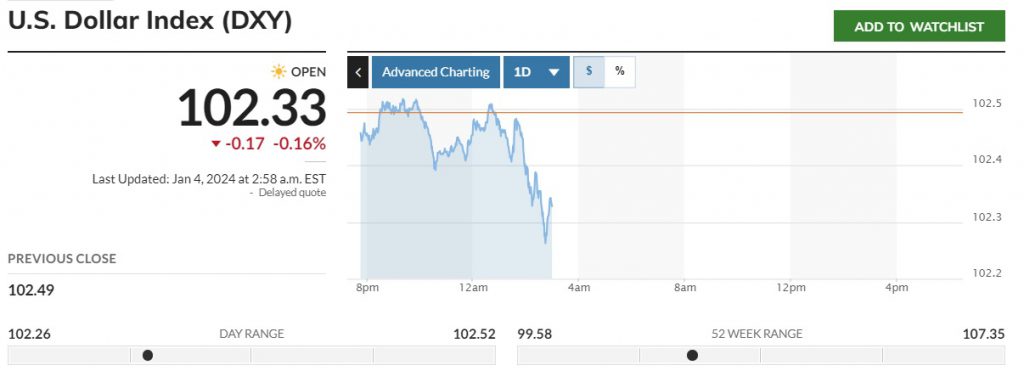

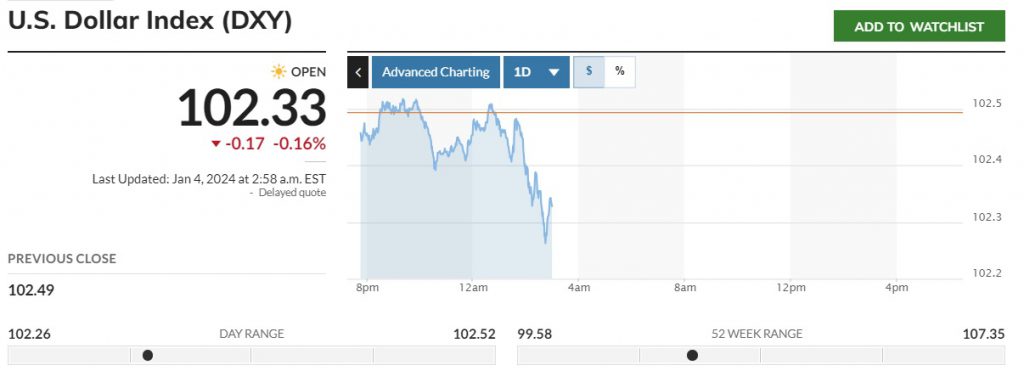

Surprisingly, Morgan Stanley was the only bank that provided fodder to the U.S. dollar terming the currency ‘Bullish’ last year. The bank has now taken a U-turn calling the U.S. dollar’s prospects ‘Neutral’ in the global markets. The U.S. dollar index is on a steady decline in the last three months and currently stands at 102 points. Goldman Sachs had already termed the U.S. dollar as ‘Bearish’ in December last year.

The U.S. dollar index might dip to $100, and if it slips to double digits, local currencies could begin to strengthen. The development coincides with the BRICS agenda of de-dollarization where they plan to get rid of the U.S. dollar for trade. Read here to know how many sectors in the U.S. will be affected if BRICS ditches the US dollar completely.

Also Read: BRICS: ‘Joint Currency’ Could Be Launched To Challenge US Dollar

“Our conviction about dollar strength has waned meaningfully,” read the Morgan Stanley report. “US data deceleration has compressed growth differentials. U.S. rates have fallen further compared with peers, and investors appear far from defensive based on equity returns.”

BRICS Vs the U.S. Dollar

BRICS is now planning the formation of a ‘joint currency’ to challenge the U.S. dollar. New BRICS member Iran has called for the creation of a joint currency within the 10-member nations and sideline the U.S. dollar. The alliance is spearheading the de-dollarization initiative and working towards making the idea a worldwide phenomenon.

Also Read: Russia Makes Huge Announcement On New BRICS Expansion

The BRICS bloc is already successful in its motives as a handful of developing countries have begun using local currencies and not the U.S. dollar for cross-border transactions. While the transactions currently are on a small scale, over time, they could eventually end reliance on the U.S. dollar.