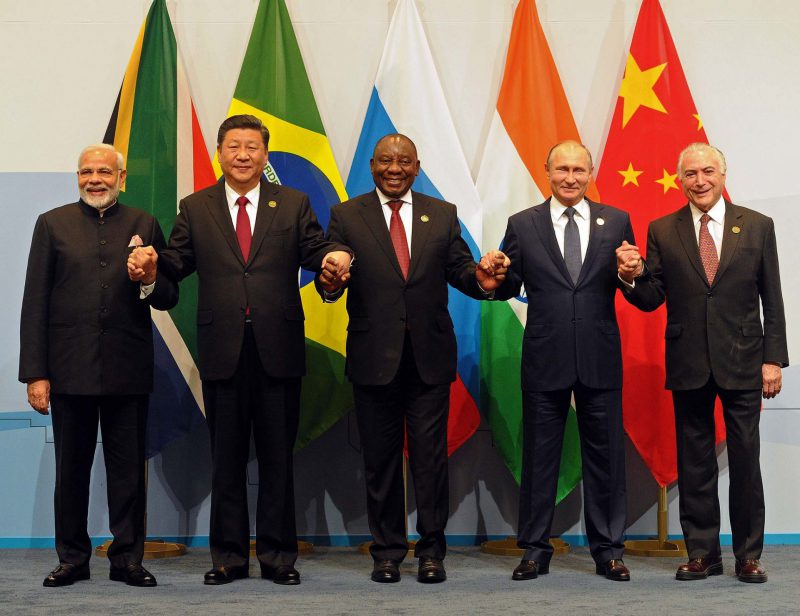

Russian President Vladimir Putin is in India, holding talks with Prime Minister Narendra Modi in New Delhi. The two-day visit will rewrite trade deals, forge new agreements, and reshape policies. Putin’s visit to India is a show of strength as the two BRICS countries are backtracking on the US dollar by using local currencies for settlements.

The 2 BRICS Nations Settle 90% Deals in Local Currencies

Putin confirmed in New Delhi on Friday that both BRICS countries, Russia and India, have settled 90% of all trade in local currencies among each other. The Russian ruble and the Indian rupee were used to settle cross-border trade and transactions. Both members are squeezing out the US dollar for more transactions.

While BRICS has not launched a new currency yet, they have begun payment settlements in local currencies. The US dollar has been put out on several occasions, contributing to its deficit. The new multipolar financial world order is unfolding in real time, diminishing Western dominance. The bloc has been steady in its agenda in sidelining the US dollar for transactions.

Also Read: BRICS: Russia Sells First Chinese Yuan Bonds, Raises $3 Billion

Local currencies are now becoming the go-to tender for BRICS members since Trump took office. The tariffs and trade wars from Trump have made developing countries come together as one. The US is now a common enemy as the policies from the White House are affecting the normal flow of trade. Goods are becoming expensive, leading to major changes in the manufacturing sector.

The import and export sector of BRICS countries has been affected, and using local currencies is the primary solution. This also helps to boost their economies and uplift their GDP, making businesses thrive. In addition, without the use of the US dollar, inflation can be brought under control. It’s a win-win situation for developing countries, but a major threat to the US economy and the dollar.