Amid talk of the BRICS nations creating an alternative currency, international interest in Bitcoin has surged amid the US dollar’s falling usage. Specifically, the Bitcoin 2023 conference that took place in Miami saw Marathon Digital Holdings, a massive Bitcoin mining firm, announce its hopeful expansion into the United Arab Emirates (UAE).

The announcement arrived as the company noted its construction of a new mining plant in the UAE. Additionally, a Bitcoin mining equipment company, MicroBT, announced its expansion to more than 65 countries. Proving the fruit of international interest in digital assets.

BRICS Nations Driving Bitcoin Interest?

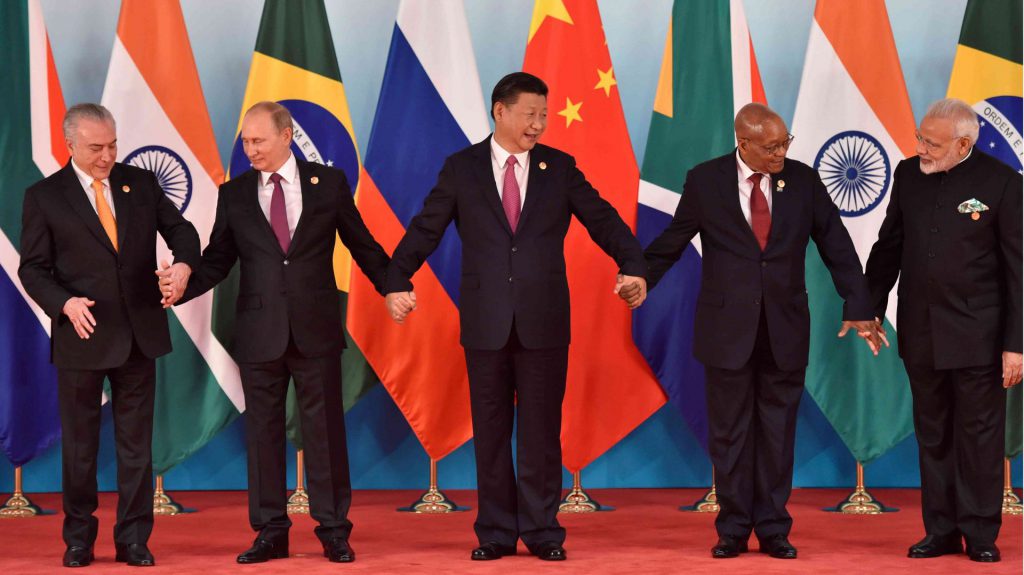

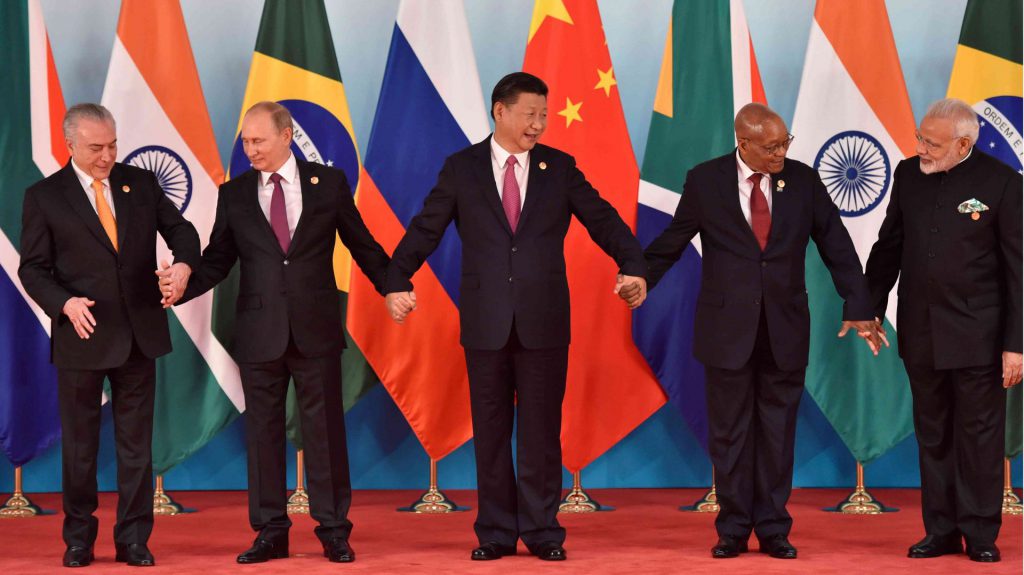

The last few weeks have seen a stark increase in the discussion surrounding the creation of an alternative currency. Moreover, Telesur reported that the BRICS bloc is developing its currency amidst a massive influx of submission requests.

Now, it appears as though the actions of the BRICS nations have driven international interest in Bitcoin, as the US dollar has seen its relevance fade. Subsequently, the expansion of several mining companies has shown that there is a strong drive for Bitcoin adoption internationally.

De-dollarization has seemingly been a byproduct of the BRICS bloc’s establishment of a new currency. Consequently, Bitcoin has seen a beneficial response amid the growing call for an alternate trade currency. Nevertheless, that interest is beginning to intensify as BRICS seeks to create guidelines for an ongoing expansion plan.

With the bloc’s annual summit arriving this summer, both of these ideas are on the table. Moreover, a host of nations have already initiated the process for membership, thus driving de-dollarization with speculation of the currency being used by more nations.

South Africa’s Minister of International Relations and Cooperation, Naledi Pandor, discussed the vital role BRICS can play internationally. The economic bloc, and its New Development Bank, are assisting its members in the development of economic facets while providing necessary funding for their infrastructure needs.

The development of a BRICS currency will benefit from these factors. Then, through the inherent de-dollarization of the process, assets like Bitcoin could continue to see an increase in interest. Followed closely by an increase in adoption.