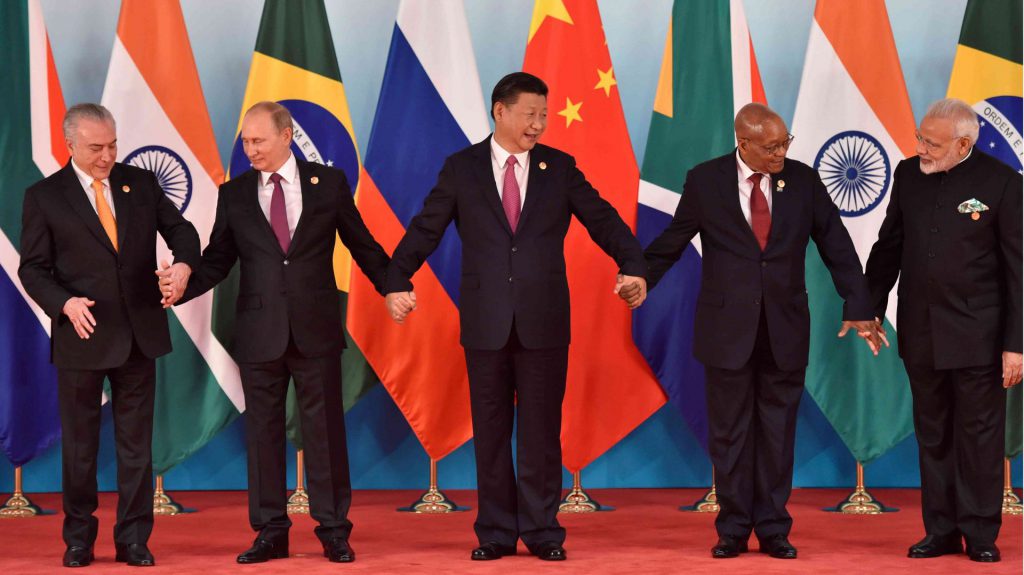

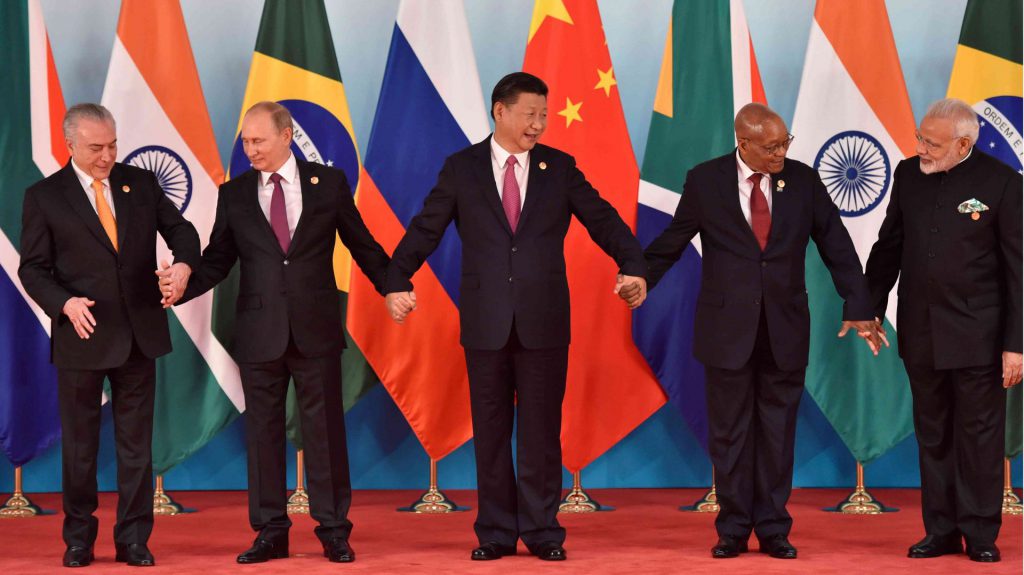

Despite the rapid growth experienced by the bloc in recent months, new projects have altered its course. Specifically, it has been reported that the BRICS economic bloc may no longer be on track to outpace the G7 economy.

Indeed, reported data from Stonybrook Capital stated that the global property and casualty (P&C) market is set to grow. Moreover, that growth is projected to surpass $3.3 trillion in gross written premiums (GWP) at the conclusion of the 2020s. Thus, offsetting previous notions that the BRICS could grow larger than the G7 countries.

BRICS Growth No Longer Set to Exceed G7?

The rise of the BRICS bloc has been a dominant headline thus far in 2023. Subsequently, one of the prominent data points is the economic blocs surpassing the G7 global GDP (PPP). This revelation noted that the bloc was set to continue its growth in the future and already presented strong competition to the West.

However, it appears as though that growth may not be set in stone. Specifically, a recent report suggests that the BRICS nations may no longer be projected to outpace the G7 economies. Specifically, the report referenced insurance market data revealed by Stonybrook Capital.

Now, the data shows that the projections and expectations have altered significantly. Stating that, a decade ago, RBICS was widely believed to be on track to surpass the G7 economy in size. Then, it was a mere 56% of G7 economies, with a total GDP of $14 trillion. Comparatively, it was significantly smaller than the G7’s $25 trillion.

Declining Growth Rates for the Bloc?

Alternatively, the growth rates between both blocs were significantly different. The report notes that the BRICS bloc was growing three times faster than the G7 economy. Thus, leading many to expect the former to surpass its Western counterparts.

Conversely, the global economy has changed since those projections first took place. Specifically, both the G7 nations and the EU were navigating a downturn in the housing market. Meanwhile, BRICS had seen a slowdown in its rapid growth figures.

Subsequently, the report notes that current projections have observed a strong deviation from those growth numbers. Stonybrook data was reported as noting global P&C insurance market growth expected at more than $800 billion at the end of the decade.

Additionally, much of the growth is expected in developing nations. However, limited access and barriers to entry limit the accessibility of the market to the Western World. With a figure of around $400 billion.

Thus, nearly three-quarters of that expected growth is set to be concentrated in the West. Moreover, they maintain the most ability to take advantage of the growth and change the current trajectory of both economies.