Russia is reaching out to Myanmar to advance and strengthen the de-dollarization agenda in 2025. BRICS member Russia is in discussions with Myanmar to conduct trade in local currencies and ditch the US dollar. The Putin administration is looking to launch a direct payment system with their respective local currencies, the kyat and ruble. The goal is to significantly reduce the usage of the US dollar and bolster local currencies for cross-border transactions.

Also Read: Analysts Predict the Future of BRICS Currency

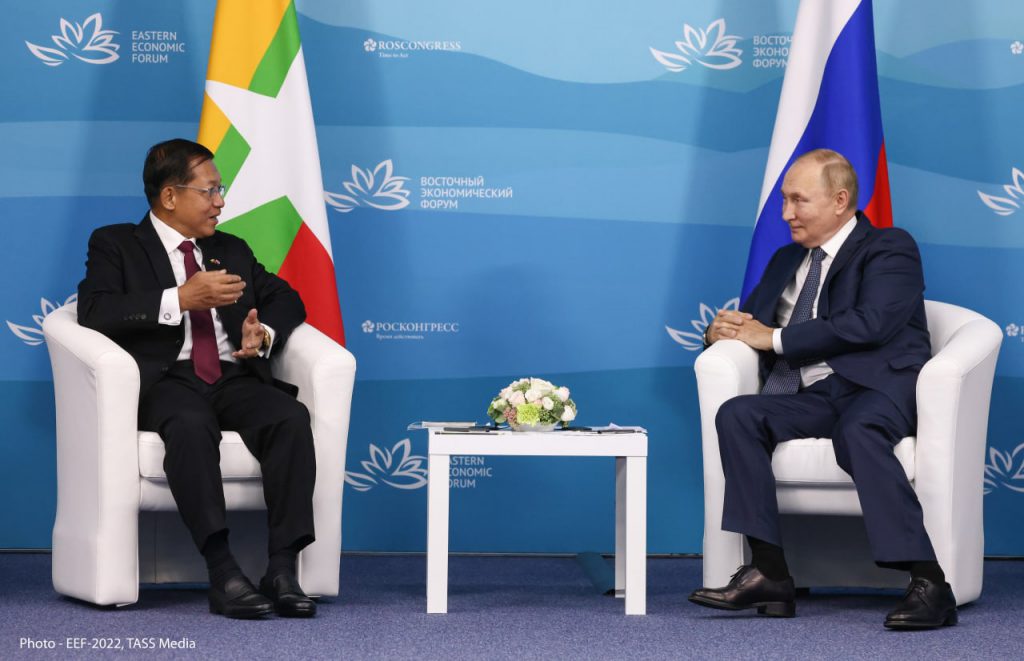

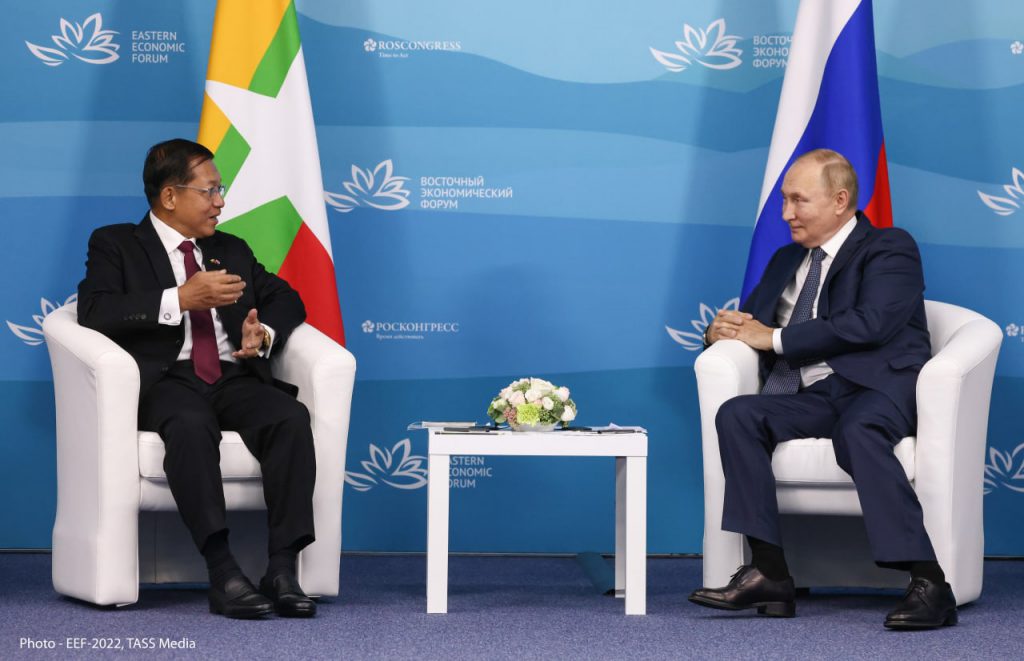

BRICS: Russia & Myanmar Look to End US Dollar Reliance, Promote Local Currency

Myanmar’s Foreign Economic Relations Minister, Kan Zaw revealed that they are negotiating a local currency payment system with Russia. “We have been negotiating the kyat-ruble payment system to facilitate the bilateral trade. However, the central banks of the two countries have been keeping the current series of discussions at a very low profile,” he said. The discussions will only benefit the BRICS bloc and add another feather to its de-dollarization agenda.

Also Read: De-Dollarization: 12 Countries Officially Abandon the US Dollar

“Bilateral trade between the two countries will be increased through constructive dialogues at the national level by exchanging views on the potential of being able to connect with each other based on the needs of the market, resolving the difficulties encountered, and finding collaborative ways,” said Myanmar’s minister. The initiative aligns with the BRICS ideals of reducing the supply of the US dollar for global trade and transactions.

Also Read: BRICS: Goldman Sachs Predicts Major US Market Correction

In addition, BRICS members Russia and Iran will soon sign a defense deal without incorporating the US dollar. Both countries aim to use their local currencies, the rial and ruble, and not the US dollar. Read here to know more details about the upcoming defense partnership between Russia and Iran. BRICS is advancing the de-dollarization initiative and is threatening the future prospects of the US dollar. Local currencies could take center stage in the next decade and begin to shake the roots of the US dollar.