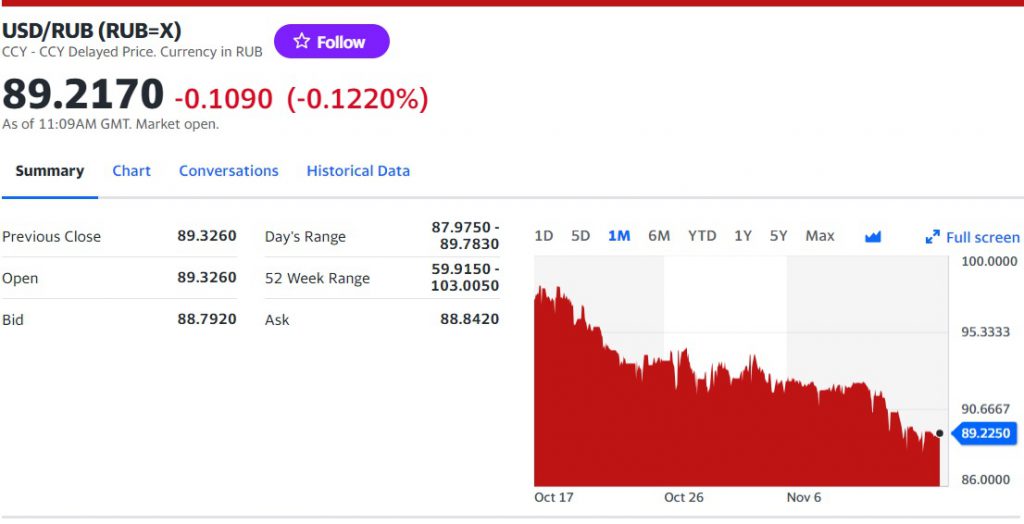

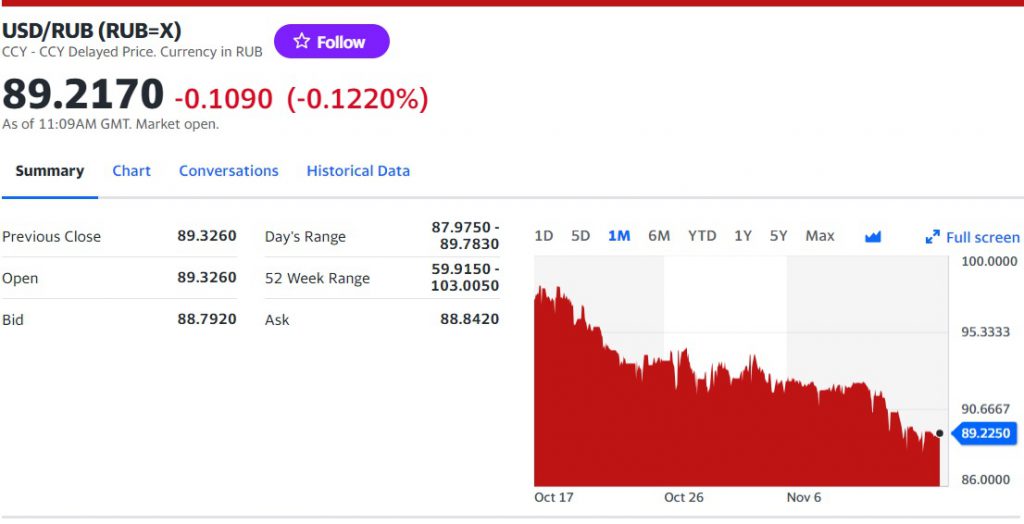

The Russian ruble is outperforming the US dollar in November this month despite facing economic sanctions from the White House. The BRICS nation’s local currency, the Russian ruble, surged by a massive 12% in two weeks against the US dollar. While the US dollar performed better against other BRICS nations’ currencies, it failed to contain the Russian ruble in November.

Also Read: BRICS: 155 Countries Sign Belt & Road Initiative With China For Trade

The ruble had reached a low of 100.50 last month as the US dollar surged against all currencies, commodities, and gold. However, the US dollar weakened in November as the Fed’s rate cut remain unclear. The dollar also dipped after the jobs report came out showing unemployment rising from its previous monthly high.

So how is BRICS country Russia managing to keep its local currency, the ruble, on top of the US dollar? In this article, we will highlight what made the ruble outperform the US dollar in the last two weeks.

Also Read: BRICS: Iraq to Ditch US Dollar for Imported Goods

BRICS: How is The Russian Currency Beating the US Dollar?

BRICS member Russia is using various methods to keep its currency from falling to a new low against the US dollar. The methods include interfering in the global currency and foreign exchange markets to favor the ruble. The Central Bank of Russia had paused the US dollar exchange in foreign currency across the country. The move made the Russian ruble trade more in the currency exchange market than the US dollar.

Also Read: BRICS: ING Bank Predicts Future of the U.S. Dollar

In addition, Russia also initiated currency trades in the foreign exchange market in the ruble and Chinese yuan sets. Russia dumped 0.8 billion rubles, equivalent to $8.7 million in the currency market on November 3. Reports state that Russia then initiated large amounts of ‘buy’ and ‘sell’ of their own currency to keep the ruble on top.

In conclusion, BRICS member Russia made the ruble recover from its low to reach a comfortable position against the US dollar. However, the means used to safeguard the ruble currency might not last forever as the US dollar could certainly come back.

Also Read: Gold To Become Expensive & Reach $3,000: Best Time To Invest?