BRICS members Russia and China are looking to ditch the US dollar for loans and use the Chinese Yuan for disbursement. Russia’s Finance Minister Anton Siluanov said that the country is considering discussions with China for the possibility of getting loans in the Chinese Yuan and not the US dollar.

Also Read: BRICS: 30 New Countries Prepare To Join Alliance in 2024

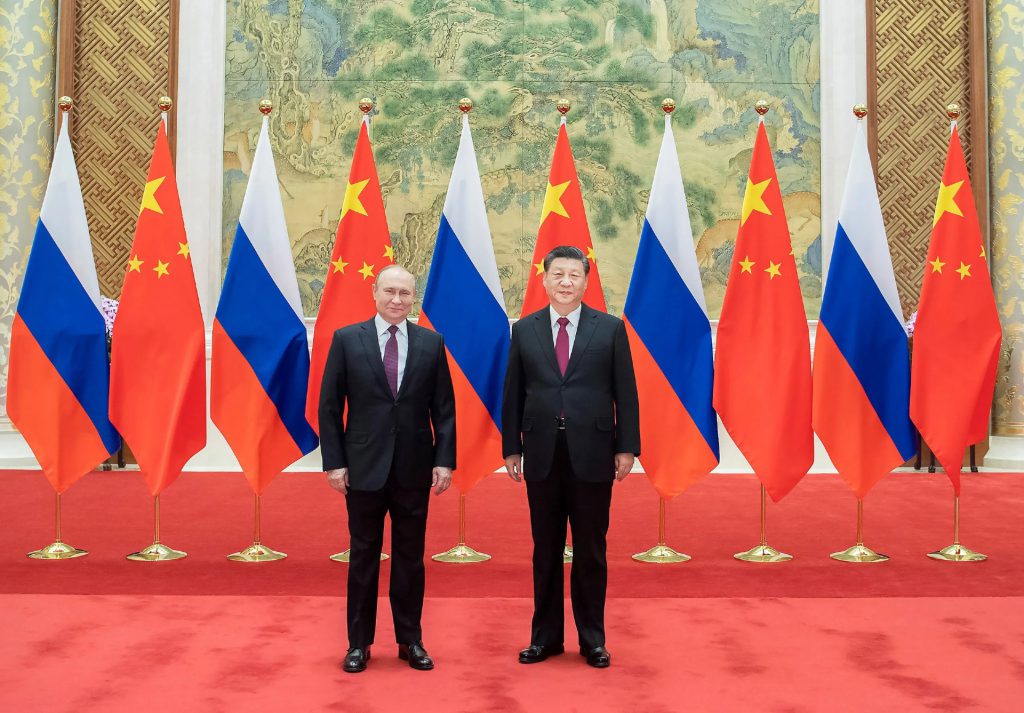

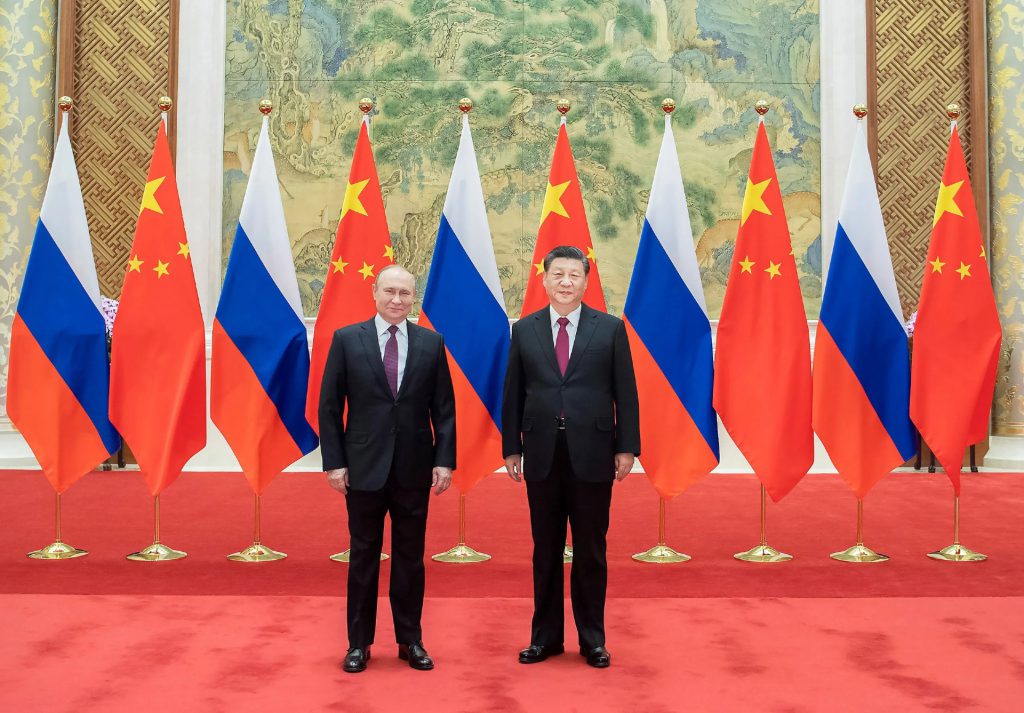

The BRICS alliance is looking at several options to reduce dependency on the US dollar and promote local currencies instead. China and Russia are the flag bearers of the de-dollarization initiates and are convincing other nations to cut ties with the US dollar. Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade.

BRICS: Russia Wants Loans in Chinese Yuan, Not the US Dollar

Siluanov confirmed that Russia is ready to accept loans in the Chinese Yuan and not the US dollar. However, he revealed that Moscow is awaiting the nod from Beijing as discussions continue with the matter. Considering both are BRICS members, the deal might go through and loans could be disbursed in the Chinese Yuan.

Also Read: BRICS: Iran Explains Why It Joined The Alliance

If China agrees to disburse loans in the Chinese Yuan, billions of US dollars will not exchange hands on the global stage. BRICS aims to put pressure on the US dollar giving more mileage to the Chinese Yuan and other local currencies.

However, Siluanov explained that the loan deal is yet to materialize as no decision has been taken yet. “Negotiations with Chinese partners have been going on for a long time. So far there is no decision. We discussed this topic at the end of last year at the inter-ministerial dialogue,” he said to RIA.

Also Read: BRICS to Launch a Single Currency Similar to Euro?

The BRICS bloc is exploring several proposals to end dependency on the US dollar. If the trend continues for a decade, the US dollar will be the hardest-hit currency in the global financial markets.