BRICS is brewing trouble for the US dollar reserves from all corners after the White House pressed sanctions on Russia in 2022. The alliance has been accumulating gold for two years and diversifying its central bank reserves with the precious metal. In the last 18 months, central banks of developing countries have combinedly brought 800 tonnes of gold. China has purchased a massive 225 tonnes of gold in the last 15 months alone.

Also Read: BRICS Prepare to Induct 10 New Countries After 2024 Summit

Russia, China, and India are among the top buyers of gold and are driving the prices of the precious metal. “On a year-to-date basis, central banks have bought an astonishing net 800 tonnes, 14% higher than the same period last year,” reported the World Gold Council. This is leading to a fall in the US dollar reserves as BRICS is replacing it with gold in their central banks.

Also Read: BRICS: 40 Countries Want To Ditch the US Dollar

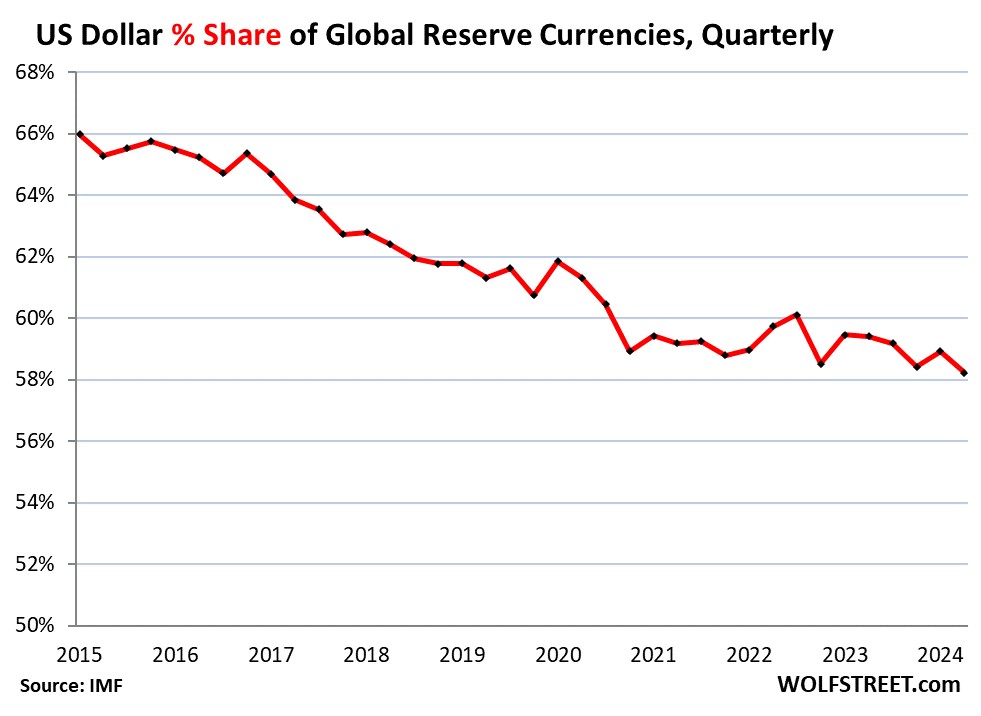

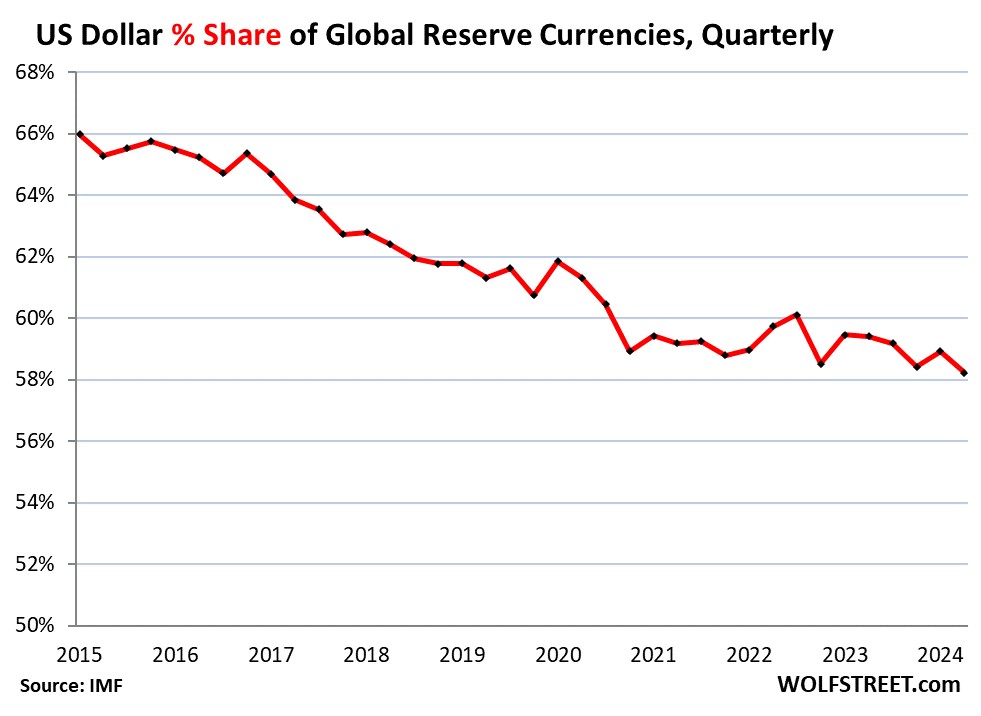

BRICS: US Dollar-Denominated Central Bank Reserves Fall to 58.2%

The latest data shows that the US dollar-denominated foreign exchange central bank reserves have fallen to 58.2% in 2024. That’s the lowest level recorded since 1995 as BRICS and other developing countries are adding gold and other local currencies to their central bank reserves.

Also Read: BRICS: Purchasing Power of the US Dollar Could Fall From 3% to Zero

Other non-traditional reserve currencies are making their way into the central bank of BRICS and developing countries. Central banks are trimming their US dollar reserves and replacing them with gold to diversify their reserves. The major alternative to the US dollar and the Euro are “non-traditional reserve currencies,” reported the IMF.

If gold gains dominance as reserves in the central bank of BRICS nations, the US dollar could face deficits. The steep dip in the reserves indicates that de-dollarization could make things worse for the USD. Emerging economies could call the shots in the global financial order leaving the US and the West in the back seat.