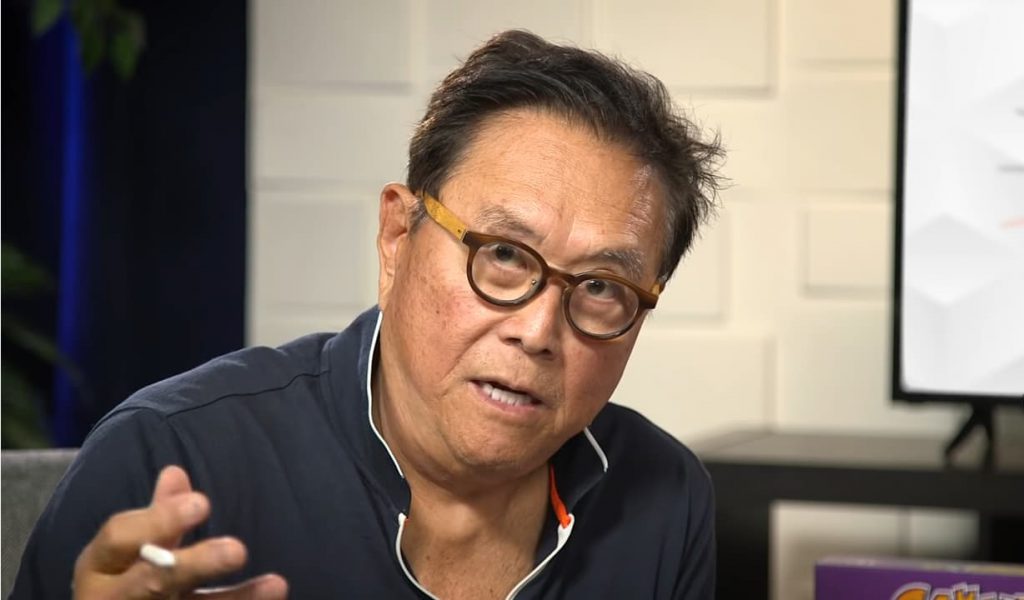

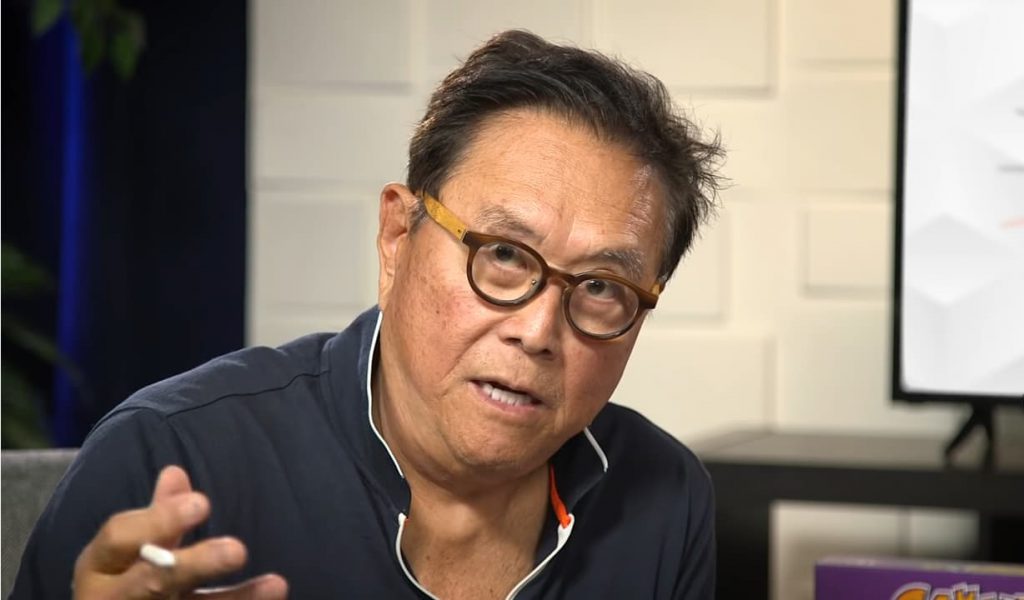

As the BRICS bloc seeks to lessen international reliance on the greenback, one US economy has anticipated bankruptcy for the United States along with an overarching market crash. Indeed, Robert Kiyosaki took to X (formerly Twitter) to share the rather concerning prognosis.

Kiyosaki is well known as the author of the Rich Dad, Poor Dad book series. The American businessman recently shared his perspective on the United States’ worrying direction. Specifically, he noted the increasing US debt as the reasoning behind what could be a horrendous crash for the country’s economy.

Also Read: BRICS: China Makes Major Financial Announcement

Robert Kiyosaki Predicts US Bankruptcy and Market Crash

Throughout the last year, the global economic perspective has greatly shifted. As the BRCIS economic alliance has increased in prevalence, a host of countries have sought to lessen their reliance on the US dollar. Moreover, this decision has occurred as the currency has been in a fragile state amid macroeconomic deterioration.

Now, one prominent American voice has shared his rather harrowing expectations for the economy. Indeed, as the BRICS bloc has driven global economic diversification, one US economist has predicted bankruptcy and an overarching market crash. Ultimately, he forecasted a massive collapse for the US dollar.

Robert Kiyosaki took to X to predict that “everything bubble, stocks, bonds, and real estate is set to crash.” Additionally, he observed the fragility of the debt crisis in the United States. Indeed, he noted that “US debt [is] increasing by $1 trillion every 90 days.”

Also Read: BRICS: China Dumping US Dollars To Keep Yuan on Top?

Moreover, Kiyosaki then stated that the country would be bankrupt from those developments. Furthermore, he noted the asset classes that could be the most important in protecting citizens from this potential occurrence. Specifically, he pointed out gold, silver, and bitcoin as the most important haven assets to save.

Throughout the year, BRICS has driven a global shift to increase gold acquisition. Many countries, fearing for the eventual fate of the US economy and its dollar, have sought to diversify their holdings. Subsequently, central banks have followed the economic alliance in acquiring precious metals to fortify their reserves.

Alternatively, a host of countries throughout the world have turned to the research and development of digital currency solutions. Many have embraced Bitcoin, while many others have observed how to infuse their economies with this promising technology.