With talks of the country seeking to join the BRICS economic alliance, the US has urged Saudi Arabia to continue selling its oil in Dollars. Specifically, the United States is expressing concern over the country instead of selling oil in the Chinese yuan or other BRICS currencies.

Saudi Arabia remains one of the largest distributors of oil on the planet. Moreover, their utilization of the greenback allows more than 90% of international oil sales to occur in the dollar. Subsequently, the United States is pressuring the country to continue that trend.

Also Read: Saudi Arabia is BRICS’ Greatest Threat to Western Hegemony

US Concerned Over Saudi Selling Oil in Yuan

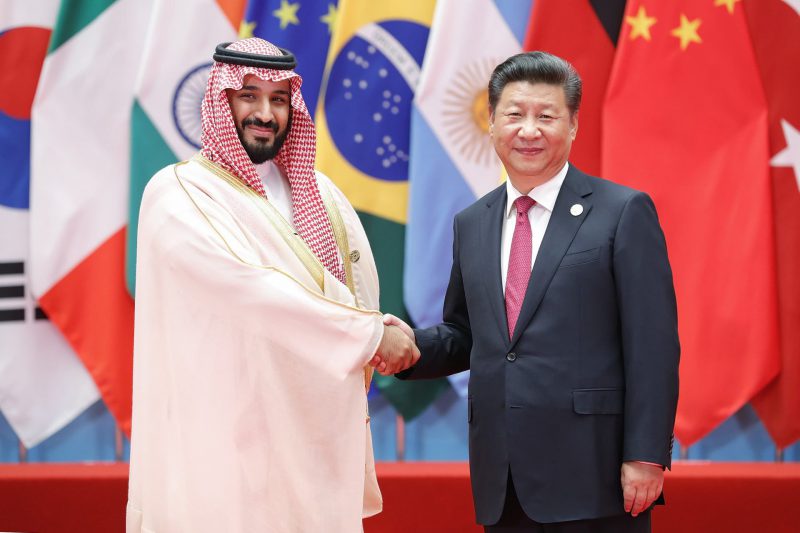

The BRICS summit is just a few days away, and the world is expecting the economic alliance to embrace expansion. Among the countries most interested in joining is Saudi Arabia, which stands a good chance of being introduced into the bloc. Subsequently, the United States is speaking out on what that could mean for its own currency.

Now, with its BRICS hopes well known, the US is urging Saudi Arabia to continue selling its oil in US dollars. Specifically, the United States has voiced its worry that the country could switch, instead selling the resource in Chinese yuan or other BRICS local currencies.

Also Read: Saudi Arabia Likely to Join BRICS Bank at August Summit

The Wall Street Journal reported on ongoing negotiations between the two countries regarding Saudi Arabia’s relations with Israel. Subsequently, the report noted that the US is using the negotiations to limit “its growing relationship with China.”

Moreover, the US has made three specific demands in this regard. Chief among them is that Riyadh will continue selling oil in dollars and not the yuan. Additionally, the two other demands are regarding the military and technological relationship between the two countries.

Also Read: BRICS Expansion Front Runners Emerge Ahead of Summit

Saudi Arabia has been selling oil in dollars since the 1970s, which has aided the dollar’s hegemony internationally. These ongoing negotiations between the two countries have seen the United States exert pressure to continue them. Understandably, the transition of oil sales to Chinese currency would have massive implications. Subsequently, that appears to fall in line with the alliance’s de-dollarization efforts over the past few months.