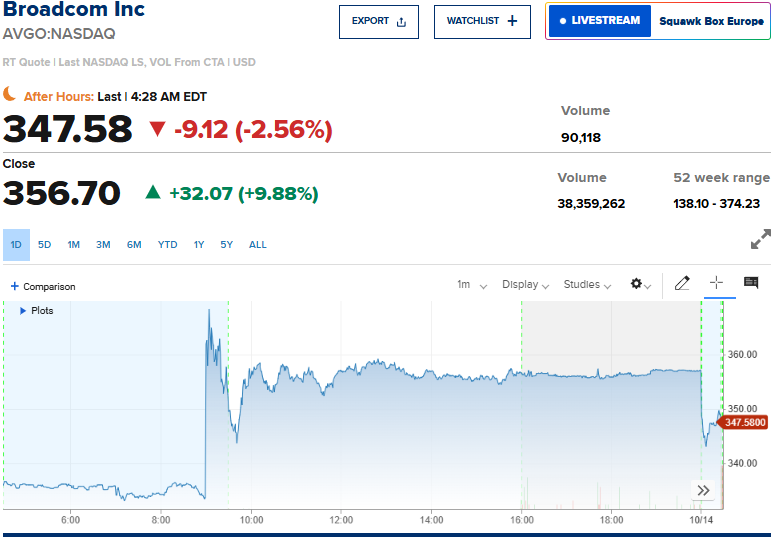

Broadcom stock jumped nearly 10% on Monday after the company confirmed a major partnership with OpenAI to develop custom AI chips. The AVGO stock surge came as investors learned that this deal could be worth up to $10 billion, marking one of the largest semiconductor agreements in recent history. Investors revealed the mystery customer and drove Broadcom stock sharply higher, sending AVGO climbing throughout the session.

Broadcom Stock Soars as OpenAI Chip Deal Lifts AVGO Price

OpenAI and Broadcom signed an agreement to build up to 10 gigawatts of AI accelerators, a massive amount of power that will consume as much electricity as a large city. This partnership marks another strategic move by OpenAI as it expands its infrastructure to support ChatGPT’s 800 million weekly users and its rapidly growing Sora video generation app.

Sam Altman, co-founder and CEO of OpenAI, stated:

“Partnering with Broadcom is a critical step in building the infrastructure needed to unlock AI’s potential and deliver real benefits for people and businesses.”

Also Read: SpaceX Starship Megarocket Launch Sends Space Stocks Soaring

AVGO Stock Price Climbs on Custom Chip Revenue

Under the terms of the deal, OpenAI will design the accelerators and systems, then develop and deploy them with Broadcom. The deployment is expected to start in the second half of 2026. The Broadcom stock price saw immediate gains as the announcement confirmed earlier speculation about a mystery customer mentioned during the company’s earnings call.

Altman also had this to say:

“Developing our own accelerators adds to the broader ecosystem of partners all building the capacity required to push the frontier of AI to provide benefits to all humanity.”

Market Impact Drives Broadcom Stock Higher

Investor confidence in the long-term value of the deal was reflected in the AVGO stock which rose 12 percent on Monday morning on the announcement. The stock of Broadcom increased sharply because analysts started to consider the possible income of this multi-year agreement. In the case of AVGO, this collaboration can help the company increase its dominance in the AI semiconductor market because the need in tailor-made silicon solutions is increasing in all technical fields.

Also Read: 3 US Stocks Deliver Above 200% Returns in a Month: Eos, Bakkt, PepGen