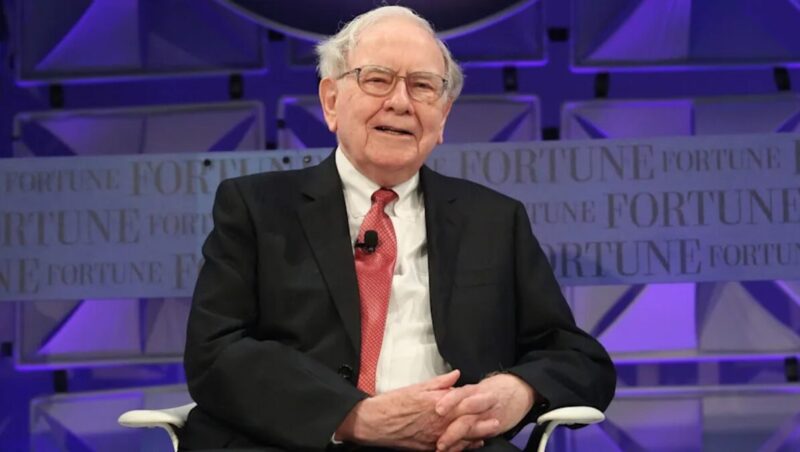

Warren Buffett’s investment empire is sounding the alarm right now, and the message is clear. Home price cuts are coming as sellers begin to panic. The legendary investor’s real estate arm, Berkshire Hathaway Home Services, has been warning that the housing market crash could force homeowners to dramatically reduce their asking prices. This marks a complete shift from the seller-dominated market we’ve seen in recent years.

Also Read: 53% of Americans Are Living Paycheck to Paycheck in Early 2025

Housing Market Crash, Seller Panic, Fed Rates And Buffett’s Signal

Market Conditions Signal Major Changes for Homeowners

The housing market crash warnings from Buffett’s team stem from some pretty dramatic changes in inventory levels. Housing inventory has reached a surplus of over 500,000 homes right now, which represents the highest level since 2013. This massive surplus happened after years of rising mortgage rates forced sellers to hold back their listings, and now we’re seeing the consequences of that artificial shortage.

Seller panic in the real estate market is becoming more evident as homeowners realize they can no longer command the high prices they once could. Many sellers who delayed listing their properties are now facing a buyer’s market. Moreover, they’re discovering that the rules have completely changed.

Price Reductions Become the New Normal

Price decreases are being experienced in all the markets as homes are spending more time on the market and sellers are being compelled to accept this new scenario. In May, the average number of days the home listing was on the market was 51 compared to in May 2024 when it was 45 days. The unsold homes have increased by 21 percent compared to the previous year and this is quite a significant move that has taken many sellers by surprise.

In March, the time of year when the spring housing market is usually kicking into full gear, 23 percent of all home listings had a price cut. The trend has been coming faster as more stock accumulates as well as sellers losing their advantage they had over years.

Interest Rate Impact Creates Perfect Storm

Fed interest rates for 2025 are approaching 7%, and this has created the perfect conditions for what Buffett’s team warned about regarding the housing market crash. These elevated mortgage rates have forced many first-time homebuyers to step back from the market entirely, and the reduced demand has shifted all the power to buyers.

Rising inventory might eventually bring buyers back, but right now the damage is done. Seller panic in real estate markets is spreading as homeowners realize they overestimated what buyers would pay in this new environment.

Berkshire Hathaway Home Services provides clear guidance for sellers navigating these challenging conditions:

“Accept the current market. Ask for an updated comparative market analysis with detailed sales trends over the last three months. Are home sales slowing or accelerating? Are home prices rising or falling? Price your home slightly under the trends.”

Strategic Response to Market Reality

The seller panic in real estate situations requires completely new strategies, and Buffett’s team isn’t sugar-coating the message. Home price cuts need to send the right signal to potential buyers about value.

Berkshire Hathaway Home Services explains their position on pricing:

“A price reduction should send the right message to the marketplace – that your home is well worth its asking price.”

Professional staging and photography have become essential as home prices continue falling across markets. The Fed interest rates in 2025 environment means sellers also need to highlight property features and neighborhood advantages more aggressively than ever before, and many are discovering that these additional costs are now necessary just to compete.

Also Read: Buffett’s $92B AI Bet, Apple WWDC, and 4 Must-Watch Stocks

This housing market crash represents a complete reversal from the Covid-era boom when mortgage rates below 3% drove unprecedented buyer demand. Back then, sellers could list properties and expect multiple offers within days, but those days are over. The current market adjustment might eventually motivate more housing activity and resolve the gridlock that’s characterized the market, but right now sellers are feeling the pain of this transition.

Buffett’s prediction about home price cuts is proving accurate as sellers across the country are discovering that their pricing expectations no longer match what buyers are willing to pay in today’s market.