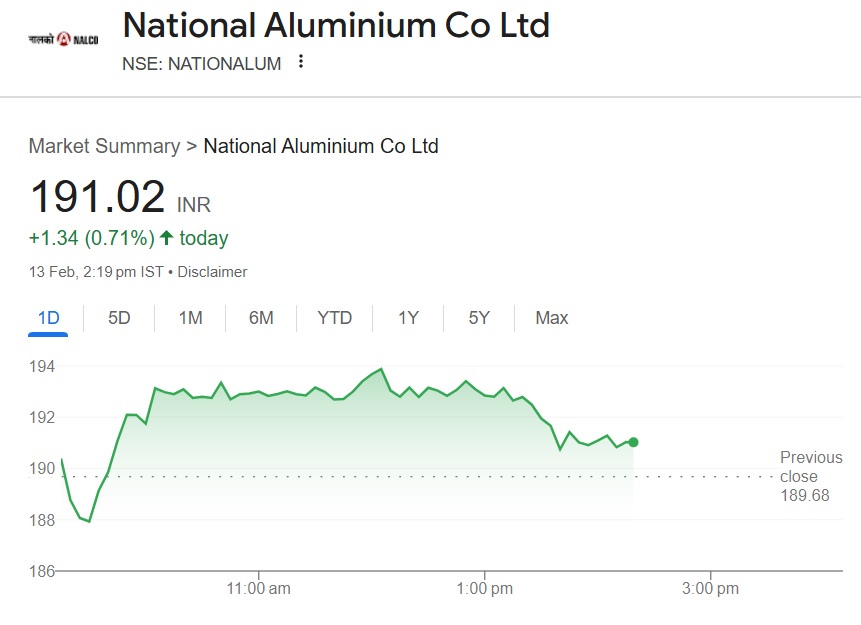

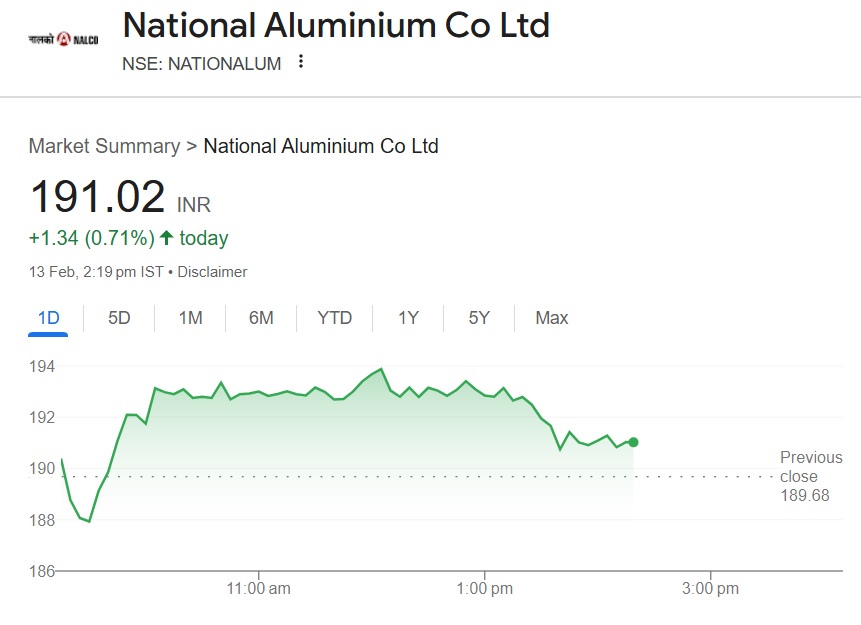

National Aluminium Co Ltd (NALCO) shares are currently trading at the Rs 191 mark on Thursday. The stock has relatively remained stable despite Sensex dipping by 3,000 points this month. Even after the market dip, the stock has maintained 12% profits in the last six months. It had reached a high of Rs 256 in November but dipped to 191 level in February.

Also Read: IRFC & Jio Financial Shares Price Prediction

The recent price prediction for NALCO shares remains bullish amid the market downturn. The net profits for the company have zoomed 3x and its margins have doubled, reported CNBC. The company will also soon declare dividends to its investors and reward them with additional income. In this article, we will highlight the latest bullish price prediction for NALCO shares.

Also Read: Warren Buffett Buys $35 Million Worth Occidental Petroleum (OXY) Stock

NALCO Shares Get ‘Buy’ Call: New Price Target Rs 255, Profit 33%

Consensus has estimated that NALCO shares could surge in price and reclaim its November 2024 level. The latest price prediction indicates that the stock could spike to the Rs 255 level next. That’s an uptick and return on investment (ROI) of approximately 33% from its current price of Rs 191. Therefore, an investment of Rs 10,000 could turn into Rs 13,300 if the forecast turns out to be accurate.

Also Read: Netflix Stock Gets $1,200 Target as NFLX Continues Climb

In addition, the company announced that it will provide details of the dividends on February 14, 2025. The payouts to investors will be completed before March 10 this year. Reports indicate that the board will pay Rs 4 as dividends per NALCO share to investors. However, we will have to wait for the official report on the dividends on Friday.

NALCO shares have spiked close to 370% in the last five years and are among the top performers. It was trading at around Rs 30 during the Covid-19 lockdowns in 2020 and sustainably scaled up in the indices.