Microsoft (NASDAQ: MSFT) signed a $750 million cloud deal with an AI search startup, Perplexity. Despite the new partnership, investors aren’t excited about the prospects as Microsoft’s stock is on a steady decline. It reached a low of $411 on Tuesday, closing the day by falling close to 3%. In the last six months, the tech giant plummeted 24% in the charts and is displaying extreme weakness.

But Microsoft’s stock had a grey cloud hanging above due to its missed earnings last week. Azure cloud revenue growth of 39% fell short of the overall consensus forecast. Even the personal computing segment, which analysts expected to be at $13.7 billion, fell to $12.6 billion. All of these added to MSFT’s woes, making its growth stall in the indices.

Also Read: Intel (INTC) Closes in on Nvidia, Announces GPU Development

Buy or Sell Microsoft Stock After Perplexity Deal?

Microsoft’s Perplexity deal could be the key driver for its Azure cloud business. The $750 million partnership allows the startup to deploy models from OpenAI, Anthropic, and xAI through Microsoft’s Foundry service. Analysts from Barchart remain positive with the partnership, calling it a “winning business.”

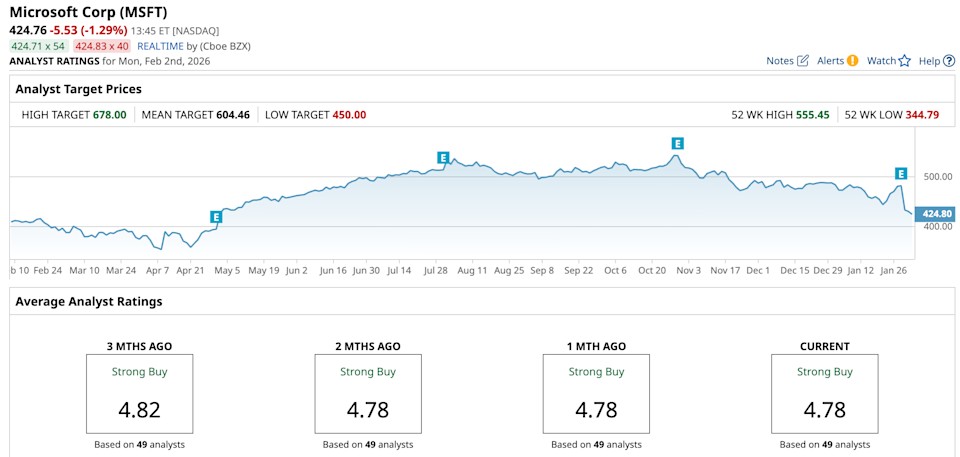

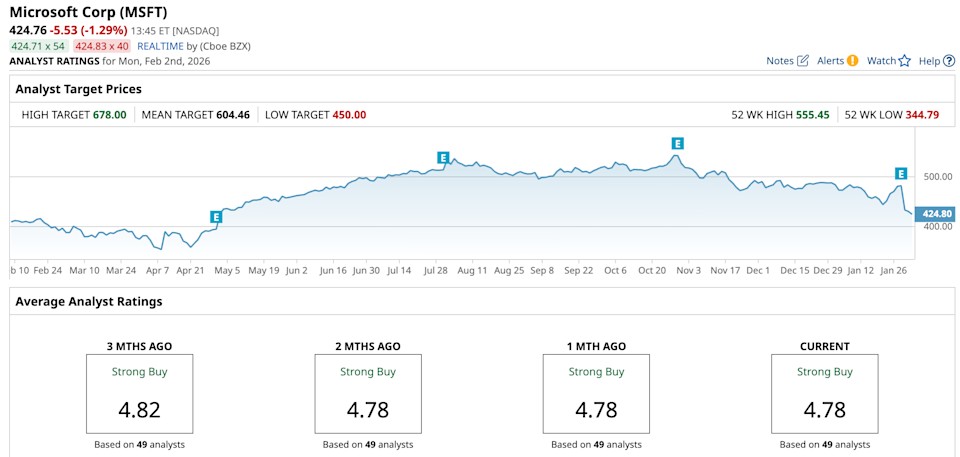

Out of the 49 analysts, 41 of them gave out a “strong buy” call, while five others called for a “moderate buy.” Three others recommended “hold” while revising their price prediction for Microsoft stock. The analysts predict that MSFT could gain from the Perplexity deal and boost its Azure cloud business.

Microsoft’s CFO Amy Hood acknowledged in the earnings call that Azure’s numbers could have been higher if the focus had been on external customers rather than internal needs. “If I had taken the GPUs that just came online in Q1 and Q2 and allocated them all to Azure, the KPI would have been over 40%,” she said. MSFT could now get a breath of fresh life with the Perplexity deal, giving it a chance to scale up.