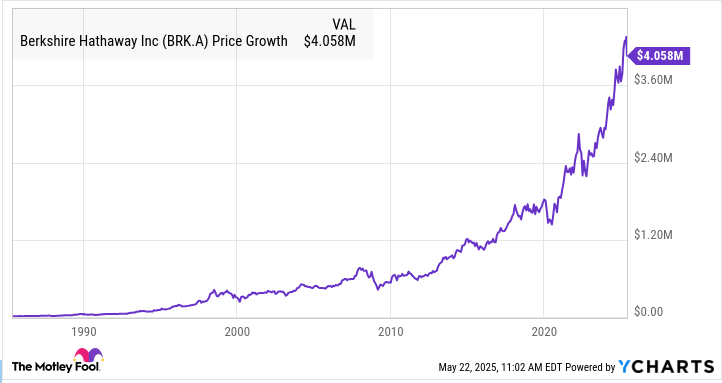

Berkshire Hathaway stocks delivered extraordinary returns for early investors, and also a $10,000 investment from 1985 would be worth nearly $4.1 million today, which is quite remarkable. Right now, three companies present similar opportunities to capture the Berkshire formula: Markel stock analysis reveals a mini-Berkshire structure, and also Howard Hughes Holdings investment offers conglomerate potential under billionaire leadership, while Kinsale Capital profitability demonstrates the insurance margins that fuel conglomerate growth stocks.

Why These 3 Stocks Could Become the Next Berkshire Hathaway

Finding the next Berkshire Hathaway stocks requires identifying companies with similar fundamentals before the market recognizes their potential. Just as Berkshire Hathaway stocks were overlooked in the 1980s, these three companies also trade at reasonable valuations despite having strong business models and solid fundamentals.

Warren Buffett said the following in his 2025 shareholder meeting:

“We will make our best deals when people are the most pessimistic.”

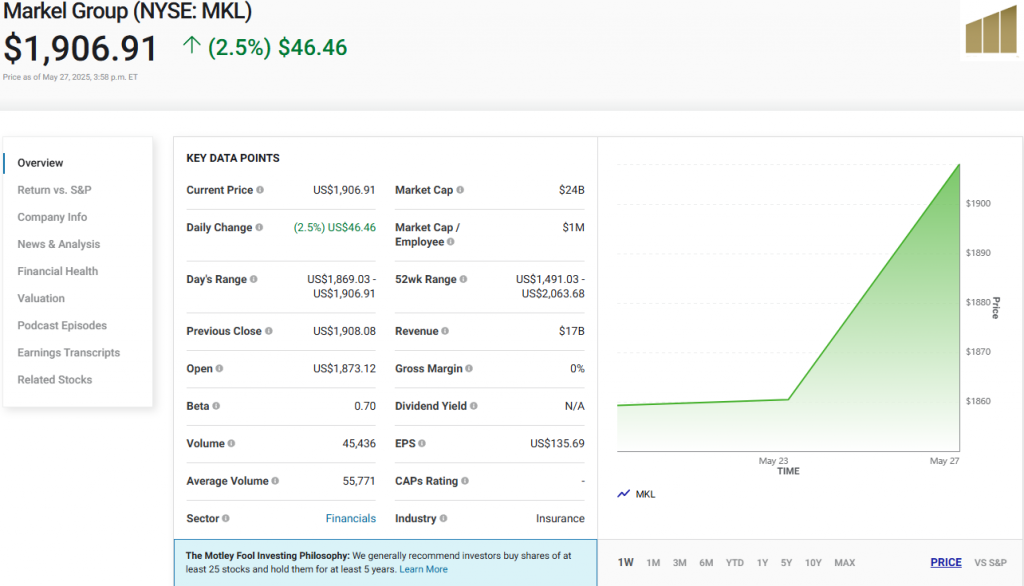

1. Markel – The Berkshire Clone

Markel stock analysis shows striking similarities to early Berkshire Hathaway stocks, which is interesting. The company operates three business segments identical to Berkshire’s structure: specialty insurance, and also wholly-owned subsidiaries, and investment portfolio management too.

The specialty insurance focus delivers superior margins compared to commodity insurers, and this is important. Markel Ventures acquires entire businesses, similar to Berkshire’s subsidiary strategy but at a more manageable scale. The investment portfolio also includes Berkshire Hathaway stocks as its top holding, creating additional alignment between the companies.

At the time of writing, management’s strategic review aims to unlock value, with intrinsic worth growing 130% over five years while the stock advanced less than half that amount. This disconnect suggests significant undervaluation for patient investors seeking conglomerate growth stocks right now.

Also Read: Warren Buffett’s $330B Portfolio Holds 58% in Just 4 Power Stocks

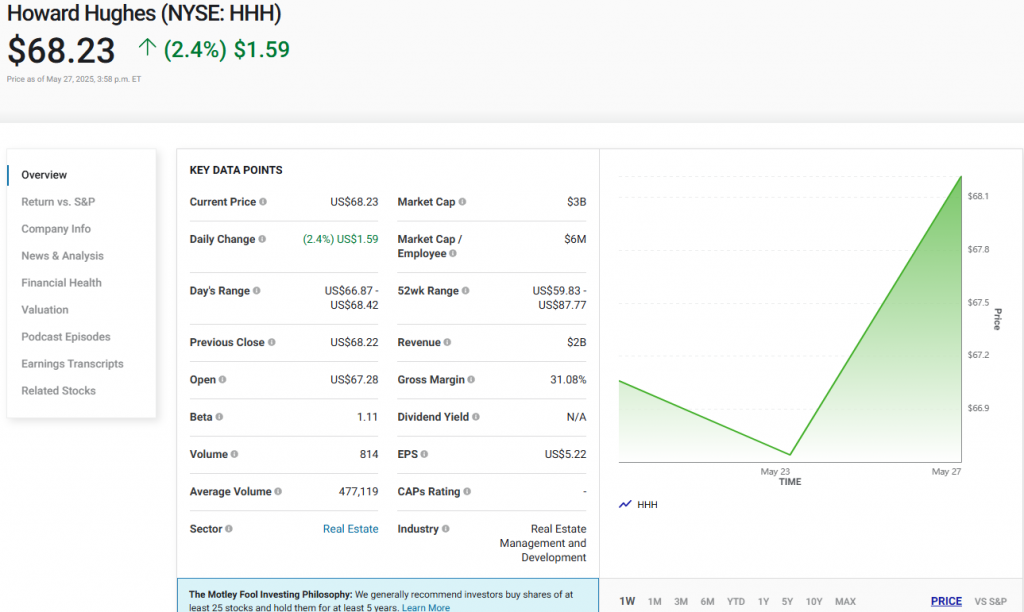

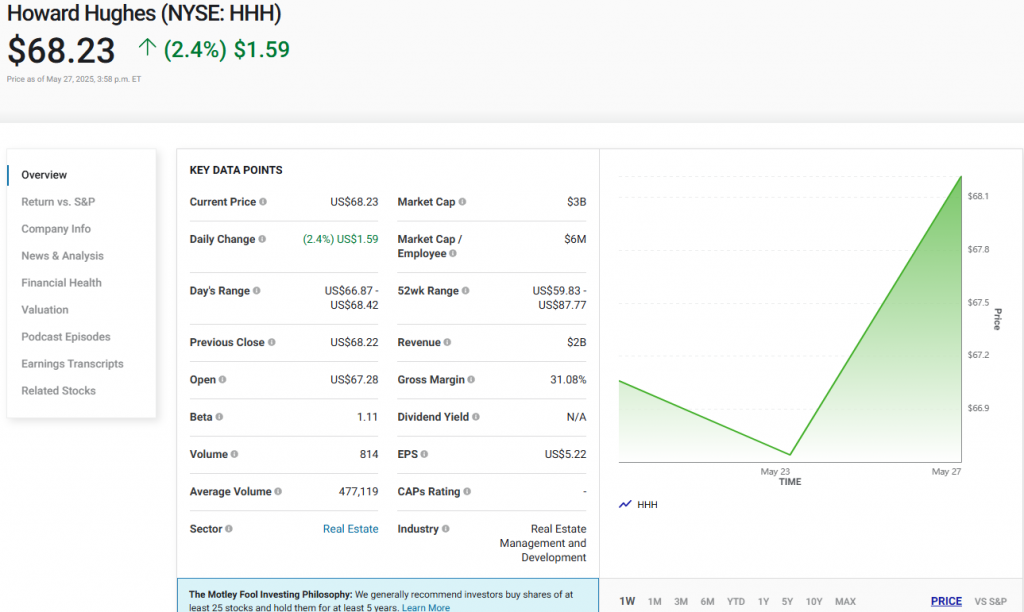

2. Howard Hughes Holdings – Billionaire’s Vision

Howard Hughes Holdings investment transformed dramatically when Bill Ackman invested $900 million and became executive chairman. His stated goal is building a modern-day Berkshire Hathaway using the master-planned community business as a foundation, and this is quite ambitious.

The existing MPC business develops city-sized projects like The Woodlands and also Summerlin, providing steady cash flow. Ackman’s war chest enables acquisitions to build a true conglomerate, and insurance will likely play a major role following the Berkshire playbook approach.

Right now, retail investors can purchase shares at approximately 35% below Ackman’s recent investment price, creating an attractive entry point for this Berkshire Hathaway stocks alternative.

Also Read: Top 5 Defense Stocks to Buy as U.S. Approves $150B Military Budget

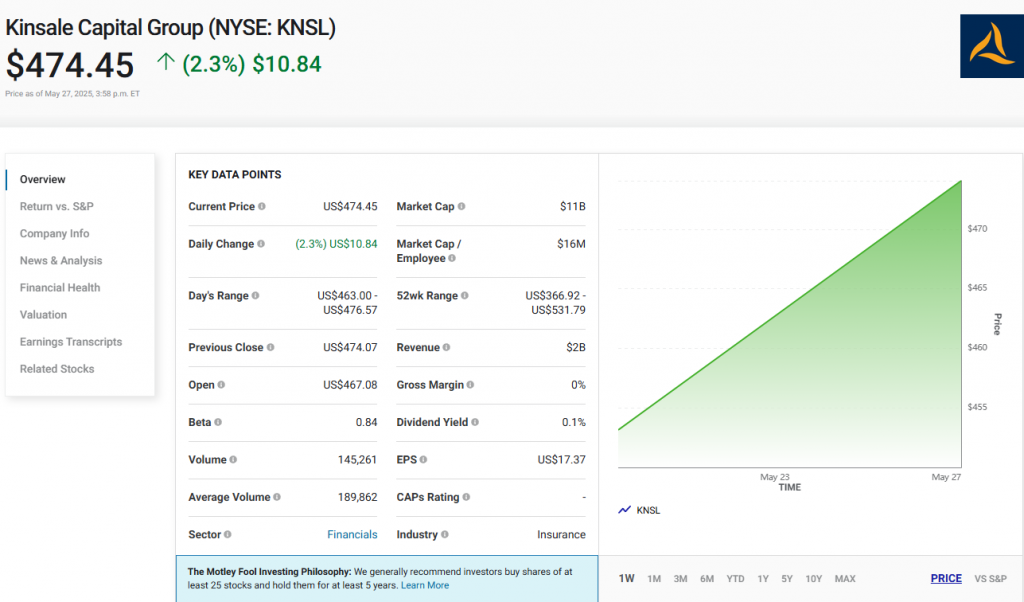

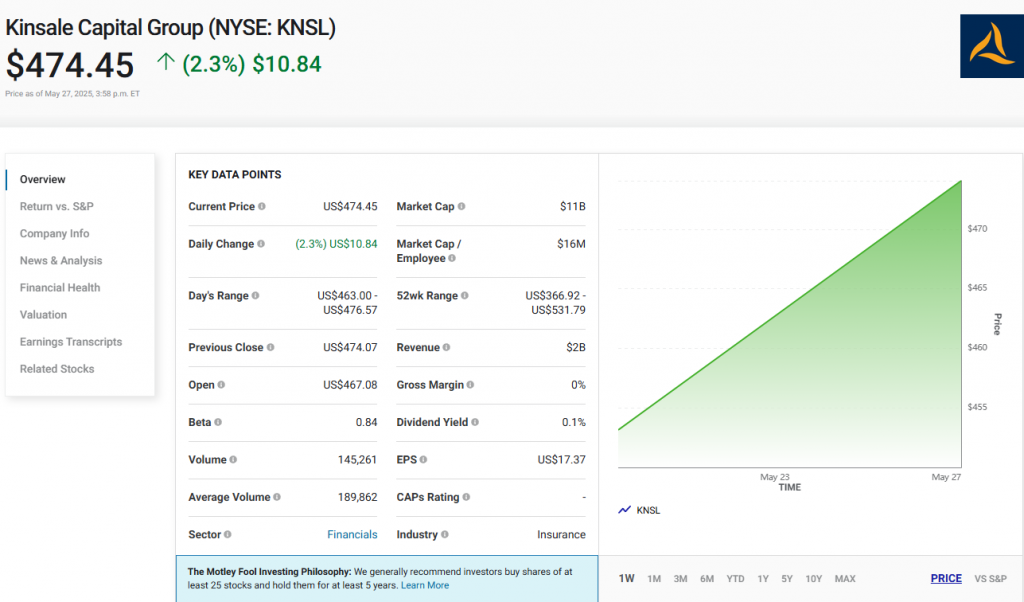

3. Kinsale Capital – The Profit Machine

Kinsale Capital‘s margins are so high that Berkshire could use them to pursue the expansion it is known for and these margins are truly impressive. Achieving a combined ratio of 76.4% allowed the company to report nearly 24% profit from underwriting which is much higher than the 1-2 percent profits that most competitors report.

This superior profitability provides flexibility for aggressive investment strategies as the portfolio grows. Management expressed comfort with increasing equity exposure, potentially evolving toward the Berkshire model of using insurance float for long-term investments.

Warren Buffett emphasized the importance of profitable operations by saying that:

“Berkshire will increase its earning power over time as we retain money. We are doing things, making decisions every day… We will build the earnings power.”

Kinsale hasn’t yet said it wants to expand into conglomerates, but the company’s top margins indicate it has many opportunities to grow which makes it an exciting option for investors interested in growth stocks.

You can gain exposure to the Berkshire formula with these firms before their reputations in the market cause their stock prices to rise. Investing in Berkshire Hathaway stocks during the 1980s was successful if you believed in their business plan and waited.