Nvidia and Palantir are two emerging crowning jewels of the stock world. These stocks have shaken the market with their successful performances and have built a solid reputation for themselves in the seasoned stock market world. However, as markets continue to evolve, a new competitor has emerged from the shadows —a capable AI stock that has the power to rival and ultimately overtake Nvidia and Palantir, becoming “the” stock of the decade. Should you consider exploring this stock before it experiences a significant surge? Let’s find out why this AI stock needs to be on your radar.

Also Read: Uber to Fund Robotaxi Expansion Through Banks: Stock Responds

Emerging AI Stock You Should Know About

Meta Platform is the next emerging company, an AI-focused firm that is putting its foot forward in all domains, exploring the realm to the fullest. Per a recent Motley Fool stocks report, Nvidia and Palantir are collectively worth $4.6 trillion. Meta Platforms, on the other hand, has the power to overtake Nvidia and Palantir in the coming years only if it can emerge victorious in the competitive AI sector.

Meta Platforms is an early contender in the smart glasses domain, a sector that is largely untouched by the majority of tech giants. If deemed successful by the masses, this arena can help transform Meta’s earnings, helping the firm accumulate massive profits in the years to come.

Moreover, the company is also using AI to strengthen its ad business. With four leading apps like Facebook, Instagram, Threads, and WhatsApp under its wings, the company is exploring ways to revolutionize its ad business through AI, which, if integrated right, could turn the fortune around for its stock.

“AI is significantly improving our ability to show people content that they’re going to find interesting and useful.” Improved recommendations led to a 5% increase in time spent on Facebook and a 6% increase in time spent on Instagram in the second quarter. Also, more brands used Meta’s AI creative tools, leading to 3% more ad conversions on Facebook and 5% more on Instagram.” CEO Mark Zuckerberg told analysts

Buy Signal On: Key Metrics To Watch

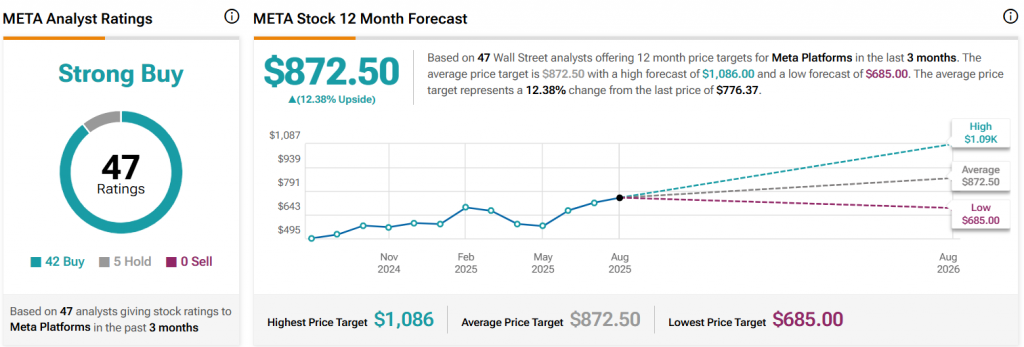

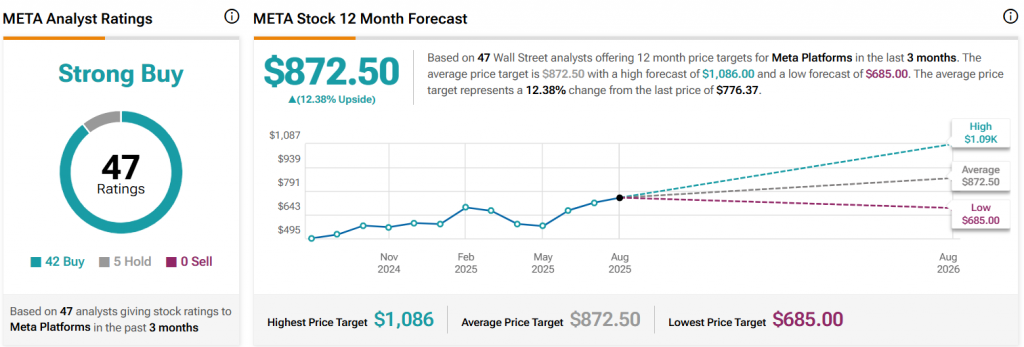

According to TipRanks meta stock data, analysts have issued a “strong buy signal for META.”

“Meta Platforms, Inc.’s analyst rating consensus is a Strong Buy. This is based on the ratings of 47 Wall Street analysts.”

The platform predicts the AI stock to hit the $1000 mark in the next 12 months.

“The average price target for Meta Platforms, Inc. is 872.50. This is based on 47 Wall Street analysts 12-month price targets, issued in the past 3 months. The highest analyst price target is $1,086.00, and the lowest forecast is $685.00. The average price target represents a 13.02% increase from the current price of $771.99.”

Also Read: American Eagle Stock (AEO) Is Trending Again Thanks to Donald Trump