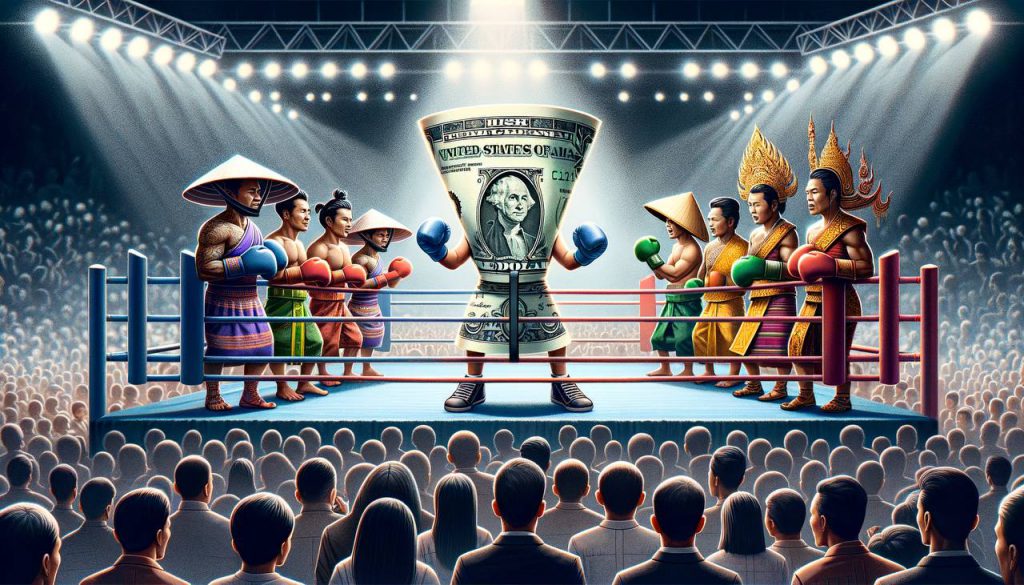

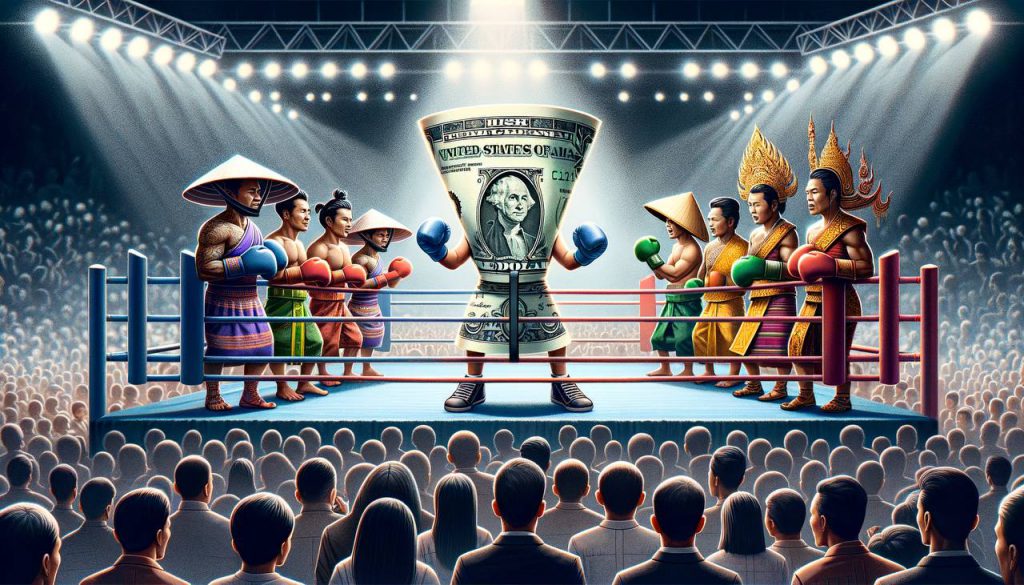

The US dollar is once again in the news, primarily because it continues to fuel speculation about whether it will be able to keep up with the current multipolar world order. As the majority of countries vow to promote their local currencies, the US dollar is now standing at a very precarious threshold.

In addition to this, at the recent BRICS summit, a mockup banknote of the special BRICS currency was introduced to Vladimir Putin, sparking debates on whether the end of the dollar is truly near.

Also Read: Microsoft Shareholders to Vote on Bitcoin Investment Despite Board’s Warning

A New Challenge To The US Dollar Emerges

The recent BRICS Summit, held in Kazan, Russia, was the epitome of power and prestige. With all leading global leaders sitting at the grand round table discussing world politics, the development exuded power at its best.

Amid it, a new contender challenging the US dollar also made its first official appearance. The BRICS banknote, dubbed the “mockup currency note,” was presented to Russia’s President Vladimir Putin. The gesture sparked wild speculations about the BRICS payment system finally being unveiled to the world.

The BRICS bill, reportedly a mockup currency, boasts five flags of the leading founding BRICS nations. The list includes flags of Brazil, Russia, India, China, and South Africa connected via a circle. The bill’s reverse side consists of the flags of all countries expressing their desire to join the bloc.

The bill has sparked widespread discussions across all major social media platforms, speculating whether the BRICS’s vision to derail the US dollar has finally begun in all its glory. The banknote also bore an inscription that read “BRICS New Development Bank,” adding more heat to the overall development.

Several commentators were seen posting anti-dollar comments on X, adding how this mockup, if materialized, could derail the US dollar in the long haul.

Also Read: US Stocks: Meta May Report New Surge, Targets $627 In The Long Run

Can the American Currency Be Truly Derailed?

The fact that the US dollar has garnered significant notoriety in the past is not a new development. The ballooning US debt metrics and currency weaponization have eroded the USD’s prestige and power. However, the derailment of the US dollar is a sensitive topic, and to topple the US dollar, the alternate currency will have to gain a wider adoption base and acceptance to gain further momentum.

While the multipolar currency agenda runs in full swing, Morgan Stanley analysts have devised a unique explanation. The analysts quipped how USD is the ultimate currency that will continue to reprise its role as the king currency in the long run.

“Which currency would you want to own when global stock markets start to fall. And the global economy tends to head into recession? You want the positioning in US dollars. You want to be positioning in US dollars. Because that has historically been the exchange rate reaction to those kinds of events,” he answered. The firm’s head of US public policy research, Michael Zezas, agreed. “‘Bottom line, King Dollar doesn’t really have any challengers,” he said.

Also Read: SEC Can’t Stop It: Ripple CEO Predicts Inevitable XRP ETF Approval