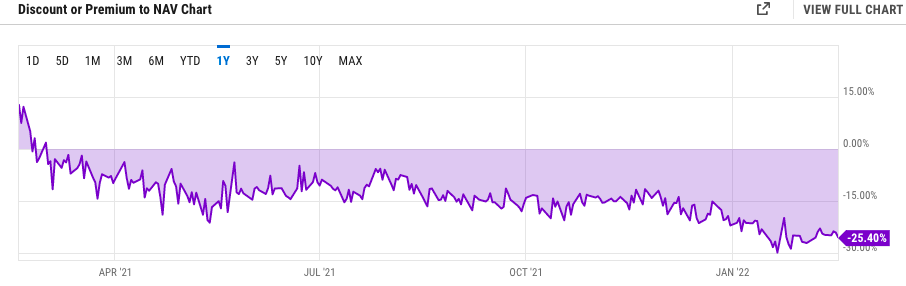

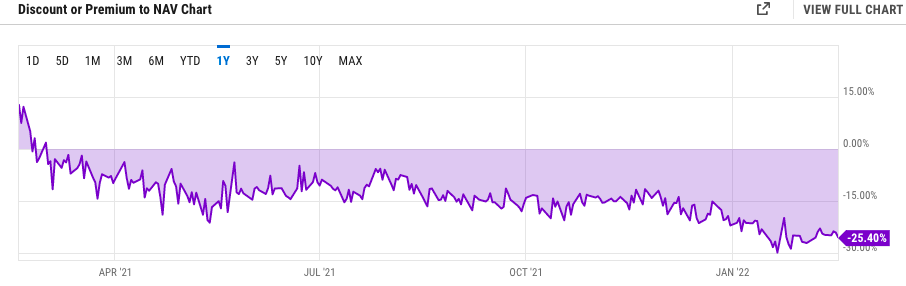

Grayscale’s flagship trust, GBTC, has been in dire straits for almost a year now. Towards the end of January, the fund’s shares were trading at merely two-thirds of their value, for GBTC’s discount had extended to almost 30%.

Even though Bitcoin has been able to shrug off January’s bitter bearishness and climb back above $40k, GBTC’s discount numbers have hardly narrowed down.

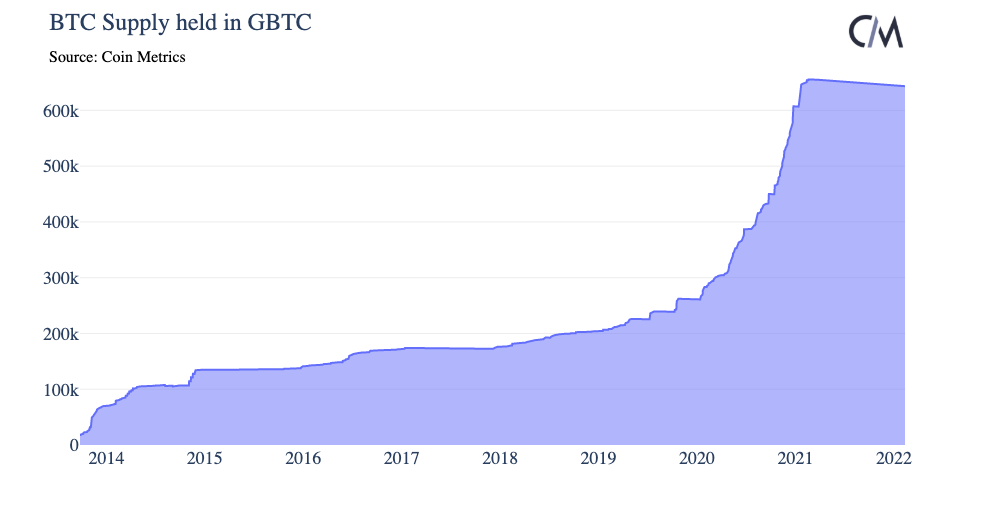

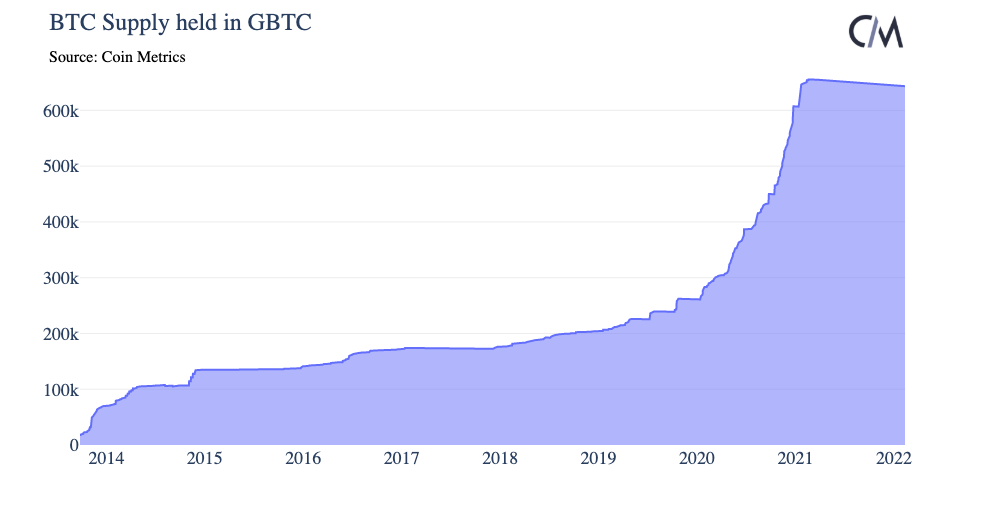

Institutions usually prefer to access crypto exposure through Trusts, and Grayscale’s GBTC is the largest by net asset value (NAV). It currently holds around 643k BTC cumulatively worth around $27 billion. However, Grayscale’s grasp on the game has started dwindling with other players coming into the foray. Now, the organization is urging the SEC to allow its GBTC to transition into a Bitcoin Spot ETF. Considering they get the green light, does it push Grayscale at the top of the institutional apex yet again?

The flies in Grayscale’s ointment

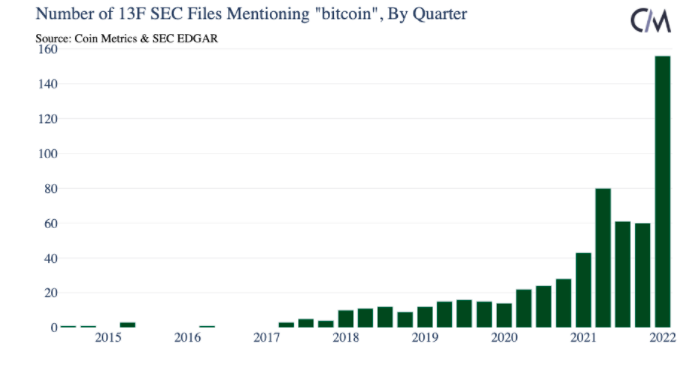

The latest 13F filing numbers brought quite a few interesting investing attributes to light. As such, form 13F is a quarterly report filed by institutional investment managers with control over $100M in assets to the SEC, listing all equity assets under management.

GBTC’s Bitcoin HODLings increased consistently alongside the number of investment funds mentioning BTC in their 13F filings during 2020 and the initial few months of 2021. The same has, however, remained flatlined for almost a year now, despite the 13F filings mentioning Bitcoin accelerating towards the end of last year.

At this stage, it is worth recalling that the US saw its first futures-based exchange-traded BTC products [ProShares’ Bitcoin Strategy ETF (BITO) and Valkyrie’s Bitcoin Strategy ETF (BTF)] launch towards the end of last year. And as per CoinMetrics, the said funds are now being reported on 13F filings, accounting partially for the increase in unique entities.

When viewed in conjunction, the following can be deduced:

- Institutions have started steering away from GBTC and have now gradually begun hopping towards new investment vehicles that provide them indirect exposure to Bitcoin

- The not so appealing state of GBTC shares over the past year could possibly be one of the main reasons why we’re witnessing the shift

- Institutional funds migrating towards other Bitcoin investment vehicles obliquely hints towards the dip in GBTC’s demand and that could possibly be one of the main reasons why the flagship crypto management company hasn’t added more BTC to its reserves

Can its conversion to an ETF do the trick?

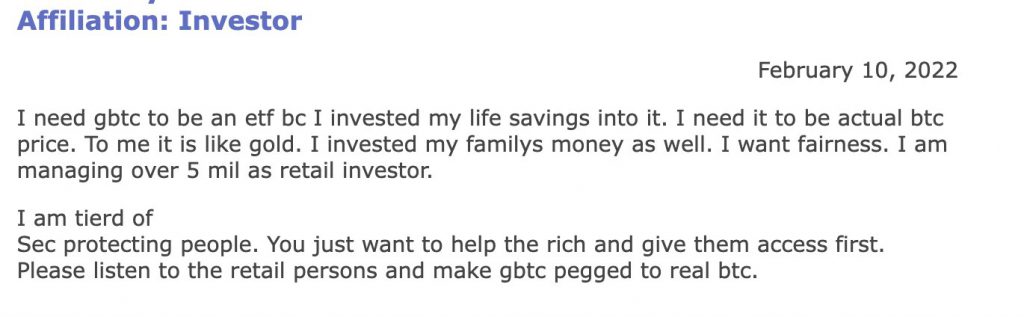

Well, back in October last year, Grayscale had filed its papers with the SEC to convert its GBTC into an ETF. Quite recently, the regulatory agency opened its doors for community comments and feedback on the same. Unsurprisingly, a majority of them [close to 95%] are in favor of Grayscale’s proposal. Bloomberg’s senior ETF analyst Eric Balchunas took Twitter to proclaim the same.

One investor explicitly went on to state that he had invested his life savings into the fund and was “tired” of the SEC trying to protect people. The investor also added that the regulator was out just to “help the rich.”

Now, if the SEC indeed ends up lending its ears to the investor community and gives Grayscale a green flag to proceed with the conversion, all parties across the spectrum would benefit from the same.

- The SEC would get a chance to efface the ‘adamant’ tag associated with it

- Investors’ demand would be catered to, for they’ll be presented with an investment vehicle that they want

- In effect, Grayscale’s transformed product would be able to garner renewed interest, and if things go well thereon, it might also be able to make up for all the fund haircuts, that investors faced while HODLing the trust’s shares, over the long term

Well, the process isn’t going to be simple and straightforward. There will be unanticipated twists and turns all across the path, but if Grayscale manages to reach the finish line before its direct competitors like BITO and BTF carve a niche for themselves in the ETF space, it would likely be able to retain its reigns in the institutional investment kingdom.