LooksRare’s native LOOKS token has substantially rallied over the past few weeks. In the mid-March period, this token was priced under $1, but yesterday, it went on to establish a local peak at $2.829.

Friday’s broader market dump, however, dented the token’s upswing spree. After shedding more than 10% of its value in a single day, LOOKS was trading at $2.48 at the time of press.

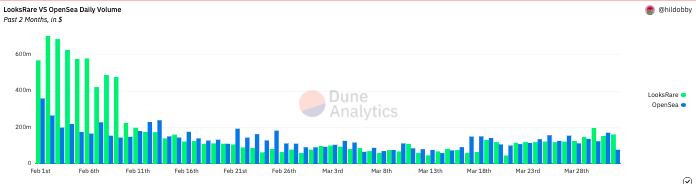

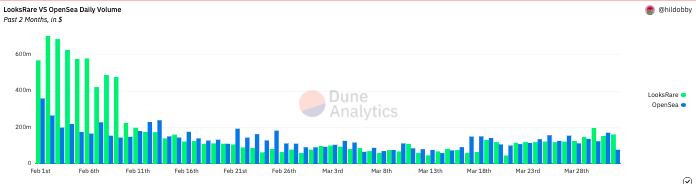

Post the launch hype, the volume of NFTs sold on LooksRares’ had notably compressed. However, as can be seen towards the right side of the chart attached, the same has now started rising and remains to be higher than its apex competitor Opensea. By and large, this brings to light the renewed interest w.r.t. the platform amongst the NFT community members.

Outlining LOOKS’ organic growth

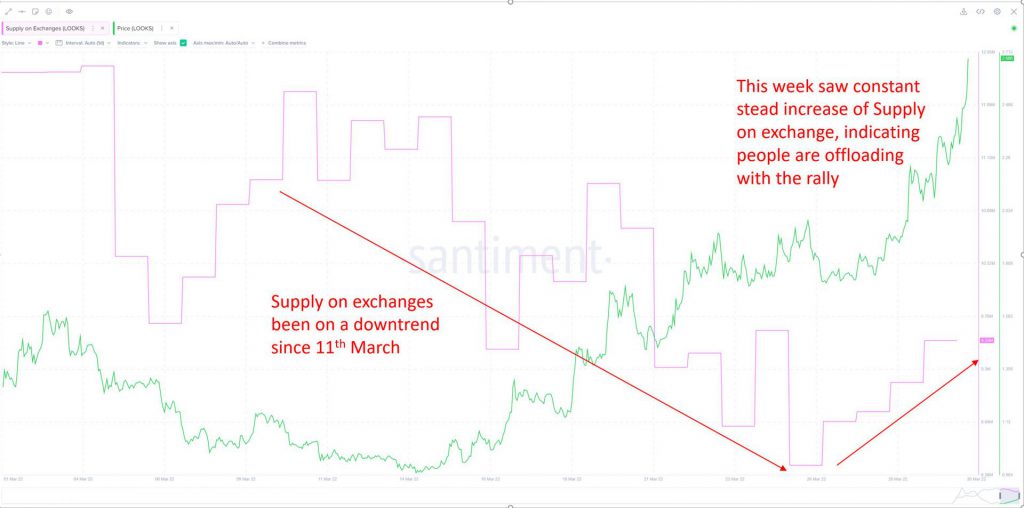

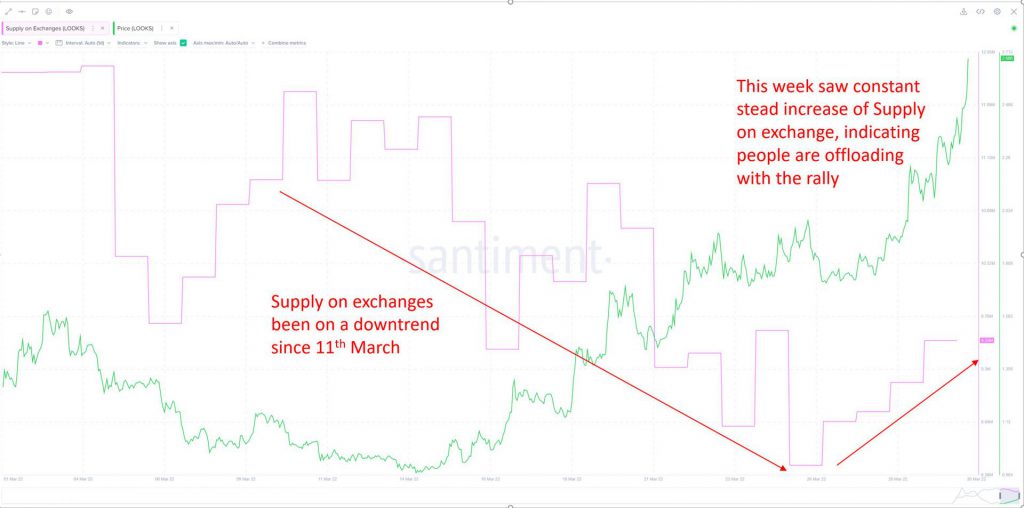

LOOKS’ 200%+ rally to its local peak was accompanied by consistent buy-side transactions. The supply on exchanges witnessed substantial inflows from 7 March until 15 March.

Since then, however, the outflows spiked up and naturally pulled up the price of the token.

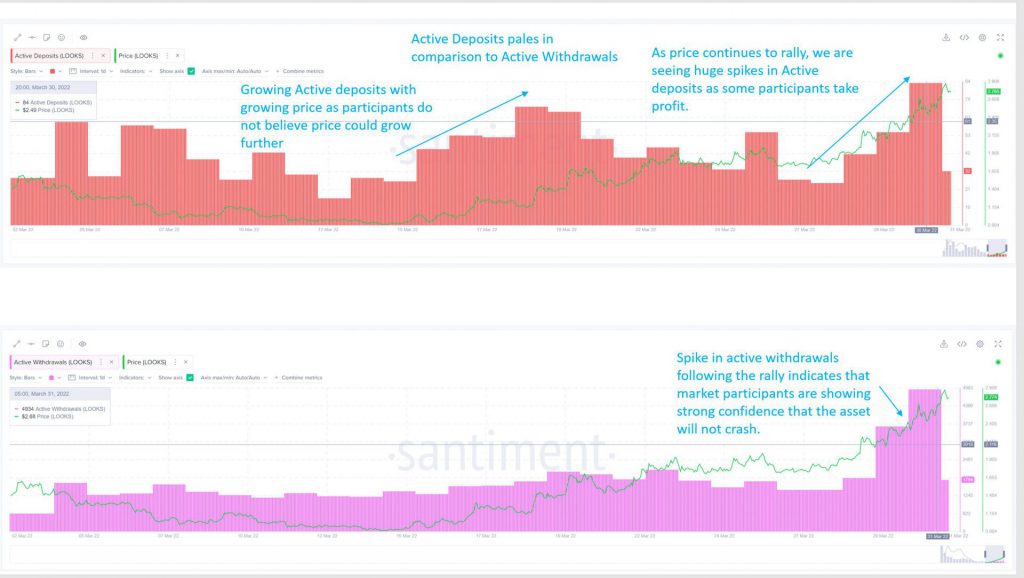

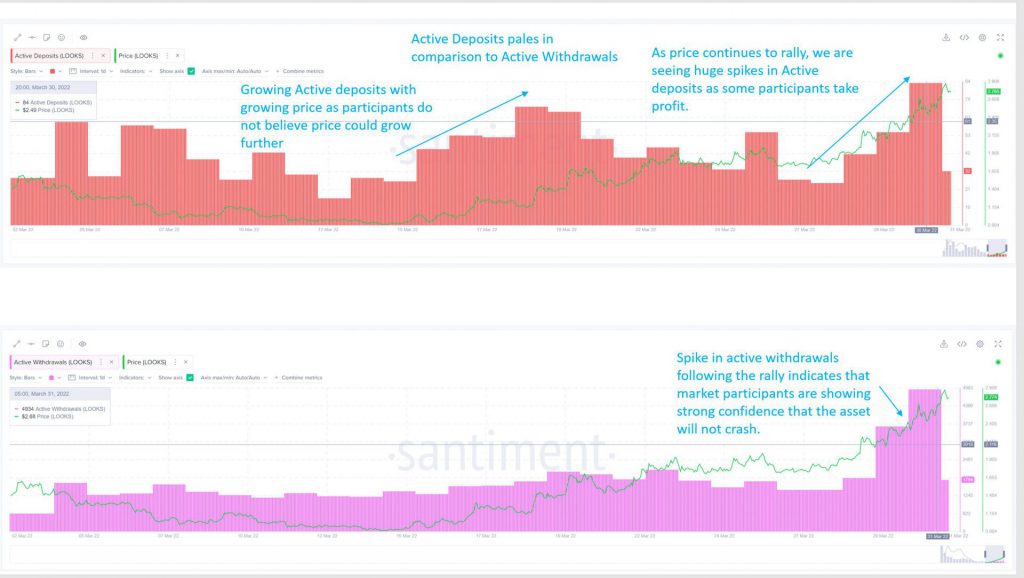

A LOOKS token HODLer is highly incentivized to stake LOOKS for rewards. Thus, having a look at how deposits and withdrawals to exchanges have been moving of late would help us gauge the sentiment even better.

As can be seen from the chart affixed, both these metrics have witnessed spikes over the past few days. However, it is quite crucial to note that the withdrawal number is pretty huge when compared to the deposit.

On 30th March, for instance, there were 4934 Active Withdrawals compared to the mere 84 Active Deposits. Asserting the implication of the same, Santiment’s latest report highlighted,

“Majority of the market participants are clearly showing strong confidence in the token and remain rather bullish at this stage.”

The profit-booking fear lingers still

Given the fact that LOOKS’ price is hovering around its monthly highs despite the daily dip, weak hands might be tempted to cash out at this point.

LOOKS’ MVRV ratio that measures the short-term profit/loss of HODLers currently depicts that we have entered the “danger zone.” Historically, whenever any asset’s price has entered here, short-term HODLers in profit usually cash out.

Further elaborating on the same, Santiment noted,

“A drop in price and MVRV in coming days to establish a local top would help make for a good reset and opportunity.“

Leaving aside the profit booking factor, LOOKS’ does make a strong case for an immediate recovery. Keeping its off-late organic growth in mind, it might as well become one of the few tokens to bounce back in the short term.