Like most altcoins, Terra’s native token LUNA has mostly followed Bitcoin’s direction during April. However, the outlook for both coins was different this week, with one breaking above a bullish pattern while the other within a bearish bias.

Although there were some talks of an altcoin season last month, optimism quickly faded away as Bitcoin maintained its grasp over the altcoin market. The Bitcoin dominance index inched slightly higher during the month, suggesting that losses in BTC were limiting altcoins from moving independently on the charts.

In such testing market conditions, it’s commendable that the world’s seventh-largest digital asset Terra (LUNA) attempted to stand up on its two feet. The altcoin was the only top 15 coin with a positive monthly ROI apart from Dogecoin, offering a 2.5% return to investors. This was largely because its price was not completely tied to Bitcoin’s movement for its performance.

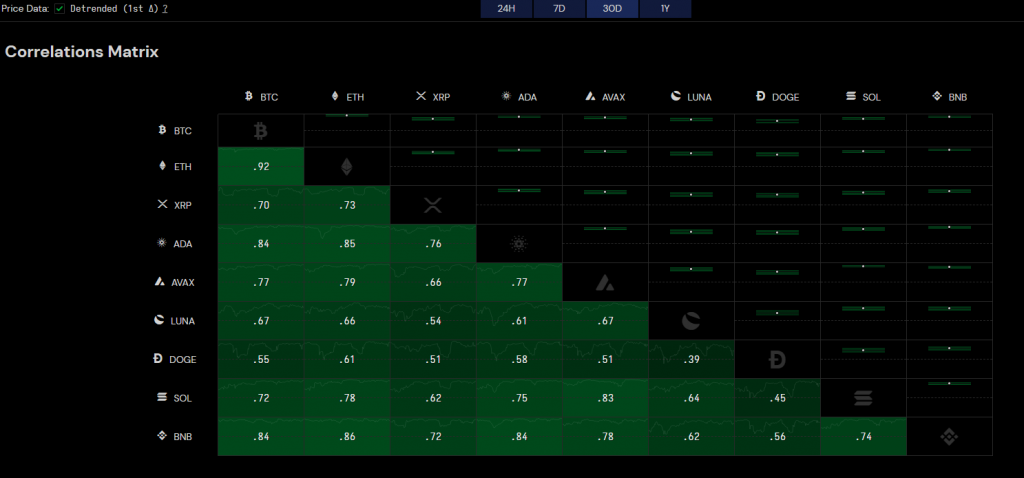

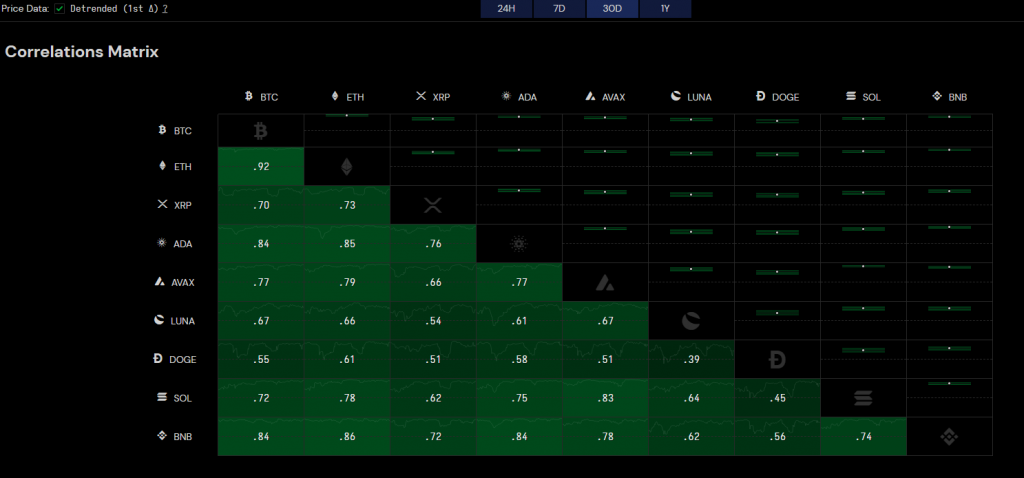

Notably, LUNA shared a 0.69 correlation with Bitcoin during April and while this is still classified as a healthy correlation, not every LUNA dip or correction coincided with a BTC move. LUNA was the least dependent on BTC amongst other top performers, who shared a higher correlation score with Bitcoin.

LUNA VS BTC This Week?

Does this mean LUNA’s price can rise without support from Bitcoin? It’s too early to say but some signs were encouraging. LUNA’s price broke out of a falling wedge pattern yesterday after recording two higher highs – a development that could fuel its price higher this week. Meanwhile, Bitcoin’s price logged two lower lows and held within a bearish pattern, suggesting that chances of another price hike were on the lower end.

This disparity could allow LUNA to break out of Bitcoin’s shackles and move independently this week, especially in the case of a bullish breakout. Another 5% rise would bring LUNA to $102-resistance and a breakout above this crucial barrier could generate a rally back to an earlier ATH of $120.

Meanwhile, a growing Total Value Locked could help an organic price increase and invite more users to the network, independent of Bitcoin’s signals. Since mid-April, Terra’s TVL has recovered by $4 Billion and touched $30.7 billion amid renewed interest in staking activity on the Terra blockchain.

Given LUNA’s current structure, its gains could outperform Bitcoin’s this week and investors will soon have more clarity on whether LUNA is ready to move away from Bitcoin’s shadow.