Polygon has been making it to the headlines consistently, thanks to its ever-growing list of partnership deals. Of late, people from the space have been quite excited about the blockchain’s partnership with Big 4 accounting firm Ernst & Young. In a matter of hours, the zk rollup is set to go live on Polygon’s mainnet.

Could this be the game-changer for Polygon?

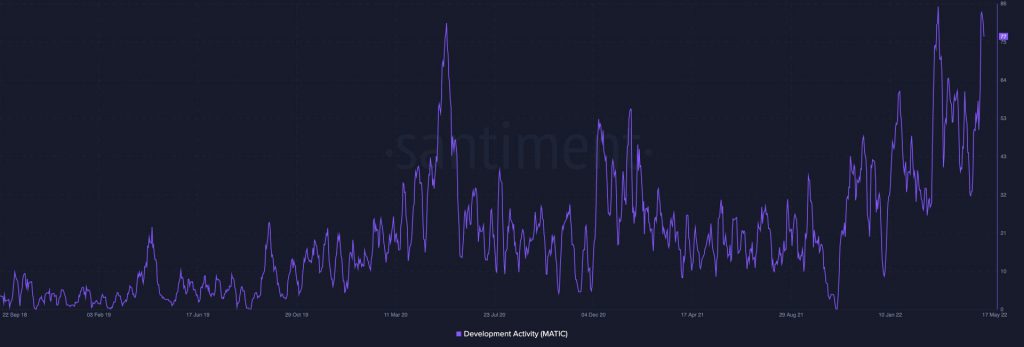

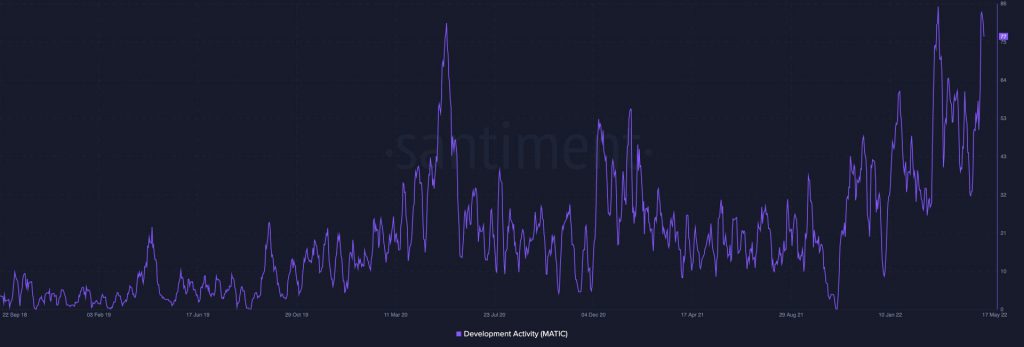

Well, Polygon’s development activity has been hovering around its multi-year highs lately, and the aforesaid development is merely the icing to the cake. From a fundamental perspective, yes, the zk rollup is a huge milestone, but what about the price perspective?

Well, sustained hype pumps haven’t been MATIC’s cup of tea in the past. Consider this – Back in mid-September last year, EY had partnered with Polygon to aid its Ethereum scaling. The news was well-received by people from the community, but MATIC’s price hardly reacted the same. Leaving aside the intra-day pump on 14 September, MATIC’s price depreciated over the next few days on the charts.

Similarly, when the Stripe announcement was made on 22 April, MATIC did climb up on the hourly, but couldn’t convert the same into a full-fledge leg-up.

Now, over the past 24-hours, MATIC has risen by 6%, but is the same sustainable? Probably not.

The MATIC market was characterized by a clear selling bias at press time. Over the past 6 hours, over 4.27 million additional MATIC tokens had been sold than bought. Similarly, during the three-hour frame, over 1.45 extra MATIC tokens were abandoned.

So, if the sell-side pressure keeps mounting up, it would be quite difficult for MATIC to stay afloat above $0.7. If the bull capitulation indeed takes place, then levels like $0.62 and $0.5 would come into play.

On the flip-side, if bears lose their say, then MATIC would move towards the psychological $1 mark and would be met by its moving averages around the said threshold. Also, it should be borne in mind that the token currently shares a 0.98 correlation with Bitcoin, implying that the king-coin possesses the keys to Polygon’s native token’s fate, and if it ends up dumping, then even the hype associated with the EY announcement wouldn’t be able to rescue MATIC from depreciating.