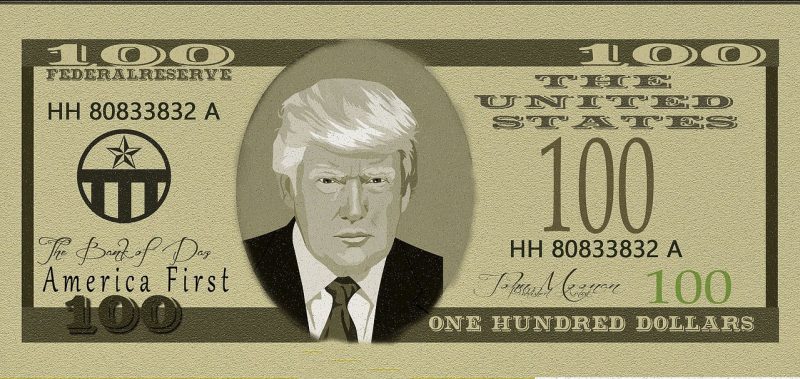

Donald Trump and Kamala Harris are currently embroiled in an intense political battle that will help one of them claim the US presidential throne. In this wake, Trump has adopted a distinctive Web3 stance, promoting the usage of cryptocurrency once he becomes president again.

But can Trump’s crypto policy sabotage the integrity of the US dollar in the long haul? Can two alternate currencies exist simultaneously? Let’s explore this development in detail.

Also Read: Solana Unveils “Seeker” Phone: Will SOL Spike To $250 Now?

Trump’s Pro Crypto Stance

Donald Trump is currently adopting a fierce stance in his presidential campaigns. He is openly propagating the usage of cryptocurrency and adding that he will make the US a central hub of cryptocurrency once he becomes president again.

Recently, Trump was seen buying burgers at a New York City bar by making payments in Bitcoin. When asked about his current view on cryptocurrencies, he remarked how it’s a new era and that having Bitcoin is good. The transaction is “the first transaction by a president on the Bitcoin protocol.”

Also Read: Shiba Inu (SHIB) Forecasted to Hit 4.5 Cents, Here’s When

At the same time, Trump was noted for making serious comments about the US dollar, adding that he would protect it from further harm. In one of his interviews, Trump shared how he would impose a 100% tariff on countries that are moving away from the US dollar.

Trump’s two conflicting comments paint a different picture in its entirety. Trump’s pro-Bitcoin stance can potentially jeopardize the US dollar, as two alternate currencies rarely survive in the financial markets. His pro-crypto stance is also detrimental to US dollar demand. The development may have several implications for the currency’s prestige in the long haul.

The Former President’s Love For Bitcoin And Its Impact On USD

In a mainly hypothetical scenario, Trump’s Bitcoin adoration can seriously erode the prestige of the US dollar.

It can lead to dollar dilution, a phenomenon in which the demand for the US dollar significantly decreases. This can happen, especially as crypto usage becomes more prevalent in the financial domain.

Similarly, crypto markets are highly volatile, with unregulated market momentum. This can also lead to occasional financial market collapses, which could again erode the US economic structure.

Also Read: Top 3 Cryptocurrencies You Should Watch This Weekend

Lastly, if other countries select crypto as their preferred mode of payment rather than USD, it can threaten its status as a global reserve currency.