Like most assets from the cryptocurrency market, even Cardano [ADA] welcomed the new year on a bullish note. From Jan. 1 lows of $0.24, ADA managed to glide up to the brink of $0.4 by the 31st. In early-February, it broke past the said psychological threshold, but renewed its price slump phase right after. As a result, ADA investors’ daily, weekly, monthly returns currently stand in red. Only on the quarterly timeframe, Cardano’s ROI is in green.

Also Read: 3 Altcoins <$1 That May Rally 600%-1100% In 2023

Cardano Whale Transactions Note Steep Incline

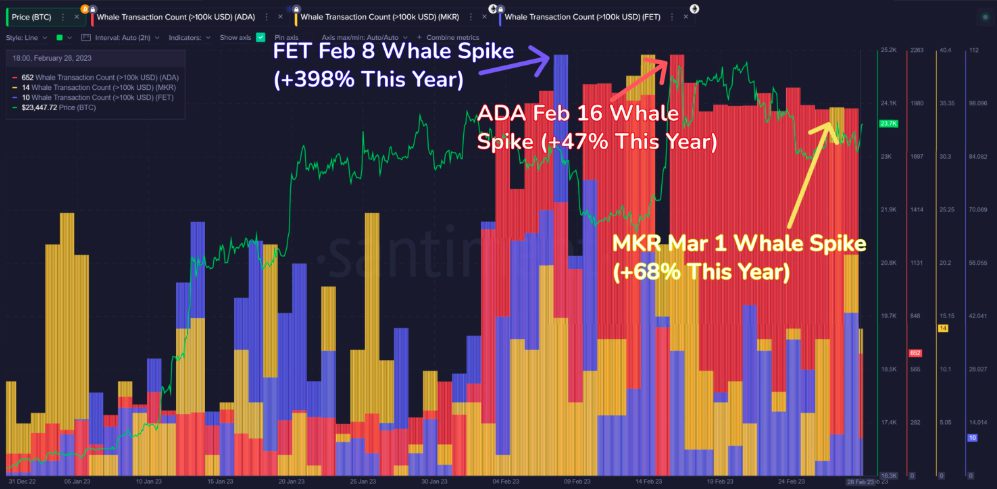

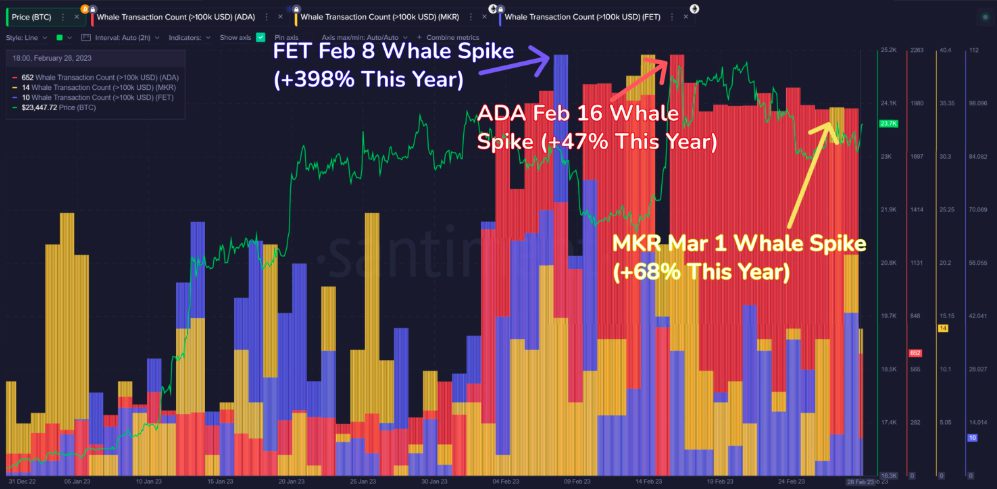

However, it looks like it is time for the tables to turn. A recent tweet from Santiment brought to light how the number of large transactions [>$100k] are “significantly up” for Cardano this year. Like shown below, this metric attained its 2023 peak in mid-February, marking a 47% increase this year. Unlike January, the number continues to hover around its highs, [in red], even now.

Citing the “steep” increase in whale activity, Santimen’t tweet noted,

“You can expect major swings from here.”

Source: Santiment

Well, whale transactions do not essentially provide a bifurcation between the buy and sell side. A rise in the said metric just means whales aren’t inert and are actively participating in the market. In fact, even Santiment’s assertion did not hint towards any directional bias w.r.t. the upcoming swing. So, let’s look into the state of a few on-chain indicators to understand the current sentiment.

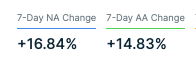

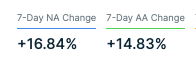

Both the active and new addresses have noted a swift incline over the past week, bringing to light the refined participation of investors and traders. In the past, rises on these two fronts have rubbed off positively on the price of ADA.

At press time, buy trades were seen mounting up against the sell-trades. The state of the buyer-seller trades difference metric brought to light the said bias. However, the bullish pressure received did not seem to be sufficient to foster an uptick.

ADA technical outlook

At 12:17 UTC on Thursday, the RSI flashed a neutral reading of 41. In fact, it was hovering below its SMA, [yellow], bringing to light the lackluster momentum in the ADA market. The price of $0.35 has acted like a strong support for ADA over the past few days, and at press time, it was exactly trading at the said level.

This means, that the price of the asset could drop down to $0.32 over the short term, if it loses the said support. However, if buy trades continue to pile up and bulls get back into command, then a 15% inclination to $0.04134 can be expected. For that to transpire, ADA will have to successfully test minor resistances at $0.0360 and $0.0365 mid-way.

Also Read: Solana, Cardano, Avalanche, Aptos Don’t Have a Future: Polygon Co-Founder