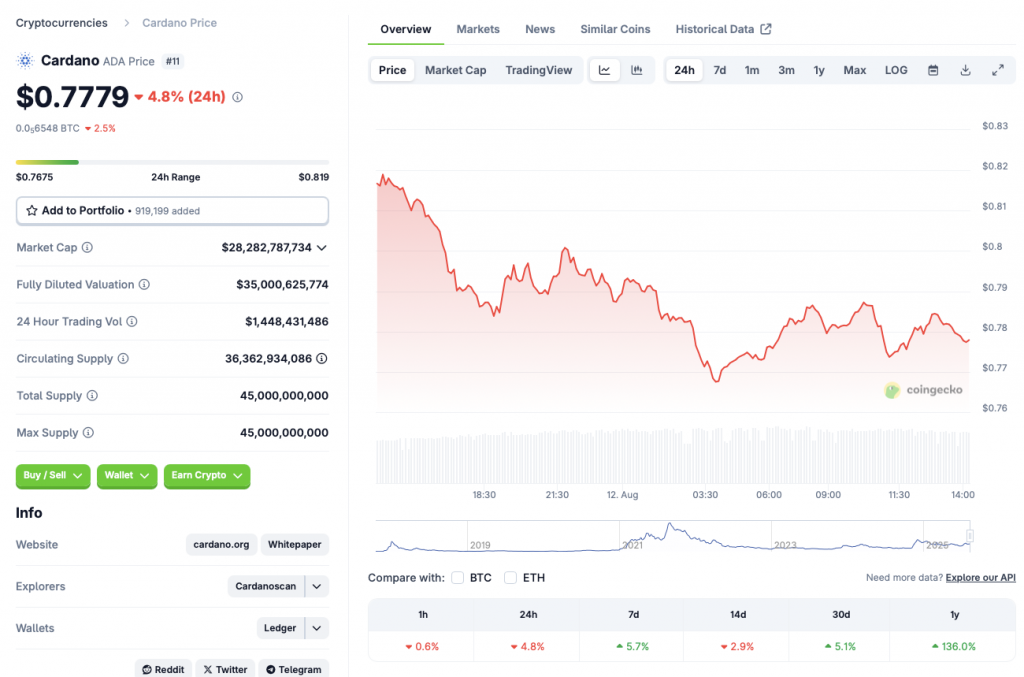

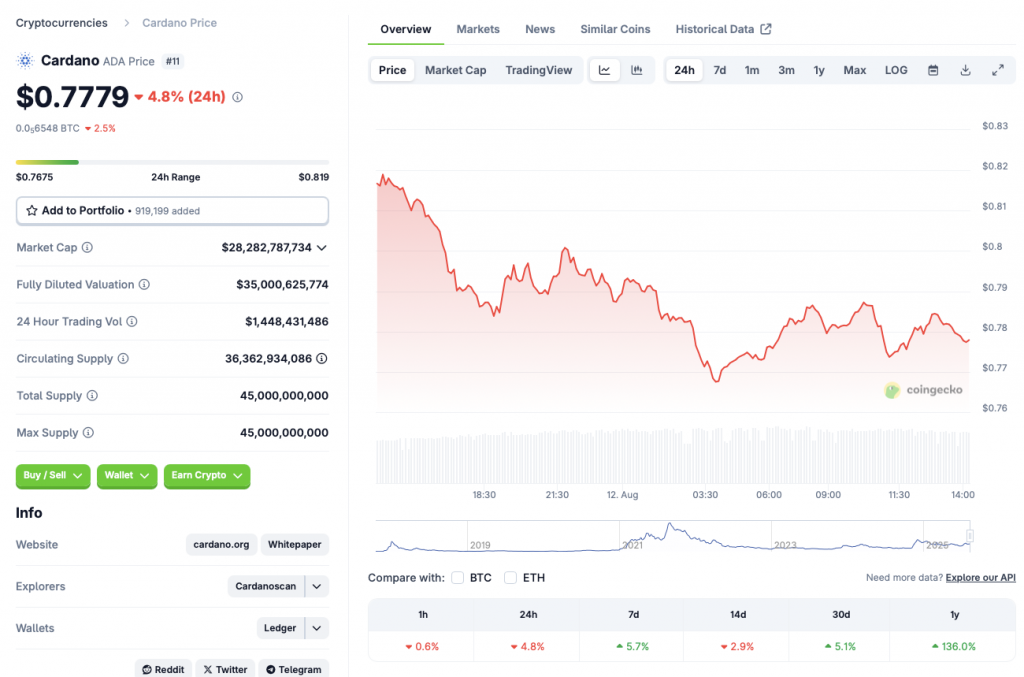

Cardano (ADA) is following the market-wide dip. ADA is down 4.8% in the last 24 hours and 2.9% in the 14-day charts. While the price dip is concerning, the asset has maintained its gains in the other time frames. According to CoinGecko’s ADA statistics, the asset is up 5.7% in the last week, 5.1% over the previous month, and 136% since August 2024. ADA has basically doubled the investments made in August of last year. The current market scenario may appear dim, but Cardano (ADA) may be gearing up for a 61% rally over the coming weeks.

Cardano Predicted To Rally 61%

According to CoinCodex ADA analysts, Cardano may experience a breakout rally over the coming weeks. The platform anticipates ADA to trade at $1.24 on Oct. 29, 2025. Hitting $1.24 from current price levels will entail a rally of about 61%.

There is also a possibility that ADA will not rally as predicted by CoinCodex. The current market slump is likely due to investors waiting for the Consumer Price Index (CPI) data due later today. Some experts have predicted that inflation figures will rise in July. Higher inflation figures could lead to Federal Reserve to hike interest rates.

Despite the possibility of higher CPI figures, there is a chance that the Federal Reserve will cut interest rates in September. Several experts, including the CME FedWatch tool, point to a 25-basis-point interest rate cut next month. A rate cut could lead to increased risks among market participants. Cardano (ADA) and the larger crypto market could experience a rally under such circumstances.

Also Read: Cardano ADA Breakout Incoming? Price Charts Hint at 126% Rally

However, there is still a chance that the crypto market will not rally even after an interest rate cut. The global economy is still quite fragile amid trade turmoil. Trade wars and slow economic growth could present challenges to Cardano’s (ADA) price. Investors may become weary of putting their funds into risky assets, such as cryptocurrencies.