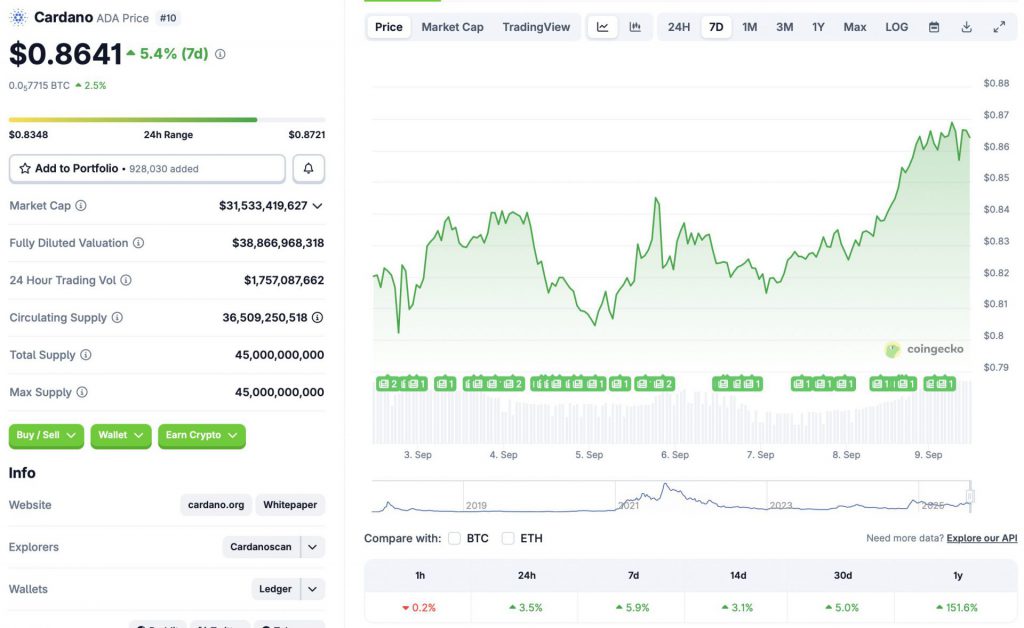

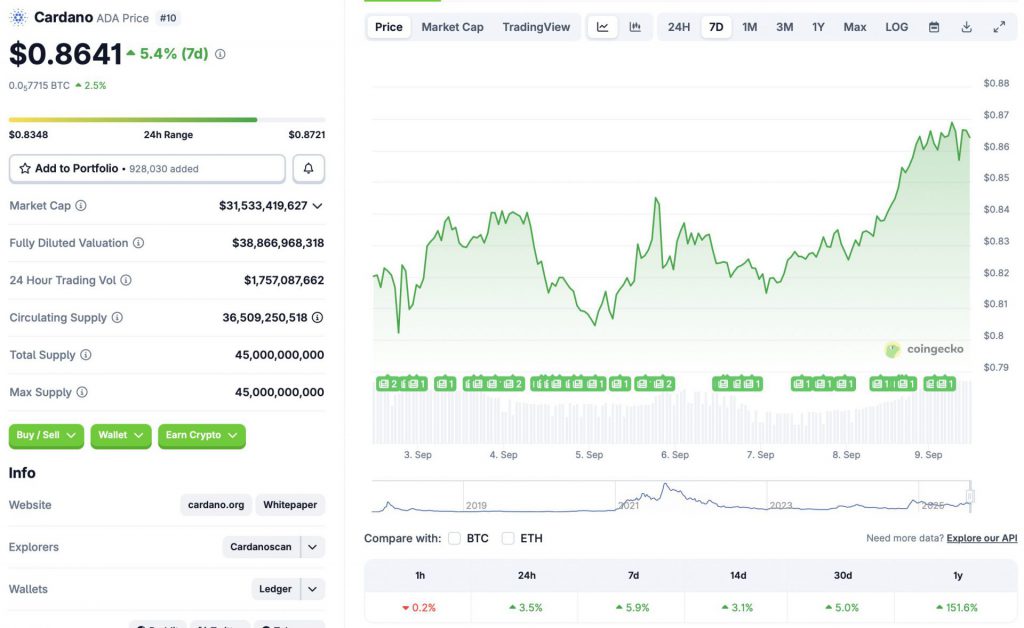

The cryptocurrency market seems to be recovering from its recent slump. Cardano (ADA) is also following the market rebound, trading in the green zone across all time frames. CoinGecko data shows that ADA is up 3.5% in the daily charts, 5.9% in the weekly charts, 3/1% in the 14-day charts, 5% over the previous month, and 151.6% since September 2024.

Will Cardano Continue Its Rebound, Or Face a Correction?

There is a very high chance that the cryptocurrency market will continue its rally over the coming weeks. An interest rate cut from the Federal Reserve is more than likely to happen after its next FOMC (Federal Open Market Committee) meeting. A rate cut may trigger another market-wide rally. Cardano (ADA) and other crypto assets will likely experience another price surge under such circumstances.

CoinCodex analysts seem to incline towards a continued market rebound over the coming weeks. The platform anticipates Cardano (ADA) to trade at $1.37 on Nov. 28. Hitting $1.37 from current price levels will translate to a rally of about 59.3%. Cardano (ADA) last traded above the $1 mark in mid-August of this year.

While the chances of a continued market rally are quite high, there is also a possibility that Cardano (ADA) will face a correction. Trade wars and tariff tensions may seep into the crypto market, introducing new volatility. Prices may dip if investors feel the pressure from macroeconomic developments.

Also Read: How High Can Cardano Rise Amid Rate Cut Hype & ETF Approval?

Geopolitical tensions could also lead to a dip in investor sentiment. The French government is experiencing a shake-up, and Nepal is witnessing massive protests over social media bans and corruption. These developments could lead investors to become cautious and exit risky positions. Cardano (ADA) and other cryptocurrencies could face price dips if investor sentiment falls. How the market treads over the coming days may determine its path for the remainder of the year.