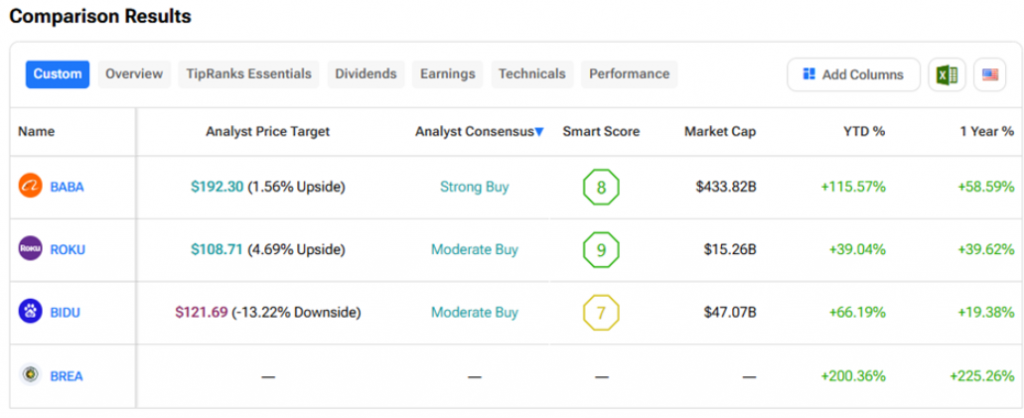

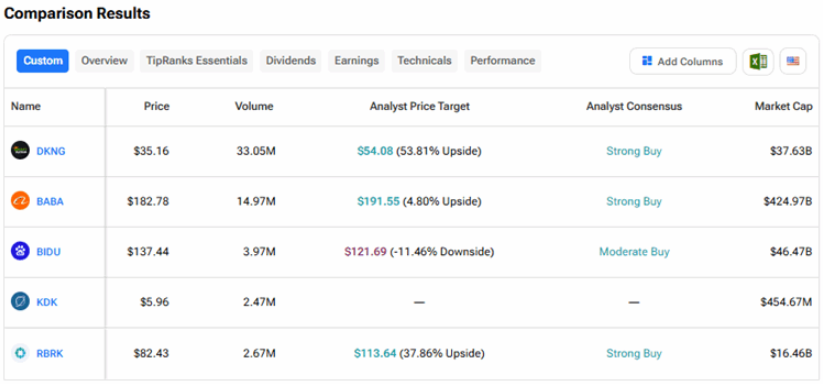

Cathie Wood buys Baidu and Alibaba in a major portfolio reshuffling, while simultaneously selling off Roku shares and completely exiting a $69 million position in BREA. The Ark portfolio changes mark a strategic pivot toward Chinese tech stocks, as Cathie Wood buys Baidu at around $137.44 and also picks up Alibaba shares near $182.78.

Cathie Wood Buys Baidu & Alibaba While Reshaping Ark’s Holdings

Major Buys in Chinese Tech

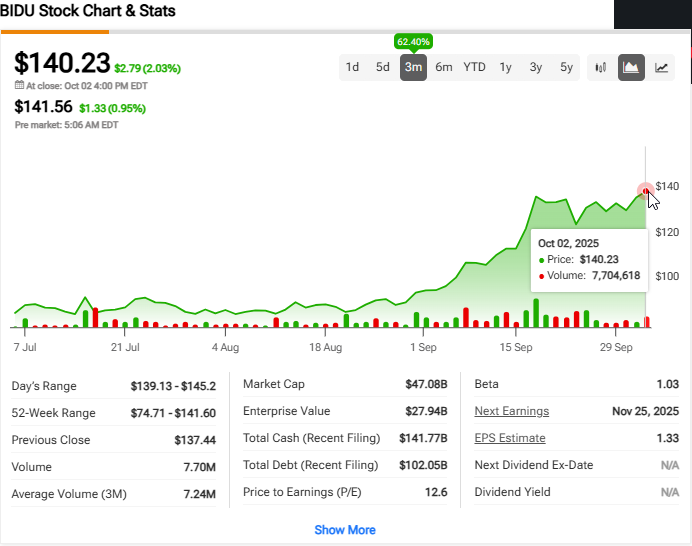

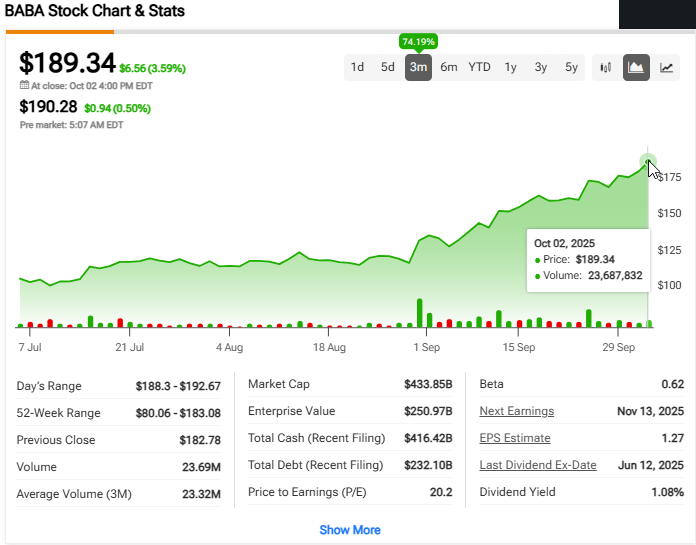

Right now, Cathie Wood buys Alibaba at $182.78 per share, with the e-commerce giant carrying a market cap of $424.97 billion and a “Strong Buy” analyst consensus. The analyst price target actually sits at $191.55, which represents a 4.80% upside potential. At the same time, Ark Invest was adding Baidu shares that were trading at $137.44, with analysts maintaining a “Moderate Buy” rating even though the price target of $121.69 shows an 11.46% downside.

These purchases represent a contrarian bet on Chinese tech at a time when Ark invests in Chinese tech despite regulatory uncertainties and ongoing concerns. Alibaba boasts strong fundamentals with total cash of $416.42 billion, along with total debt of $232.10 billion. Baidu maintains $141.77 billion in cash reserves, though it also carries $102.05 billion in total debt.

Also Read: Nvidia NVDA: OpenAI’s $500B Valuation Sends AI Stocks Higher

Roku Trimmed, BREA Completely Sold

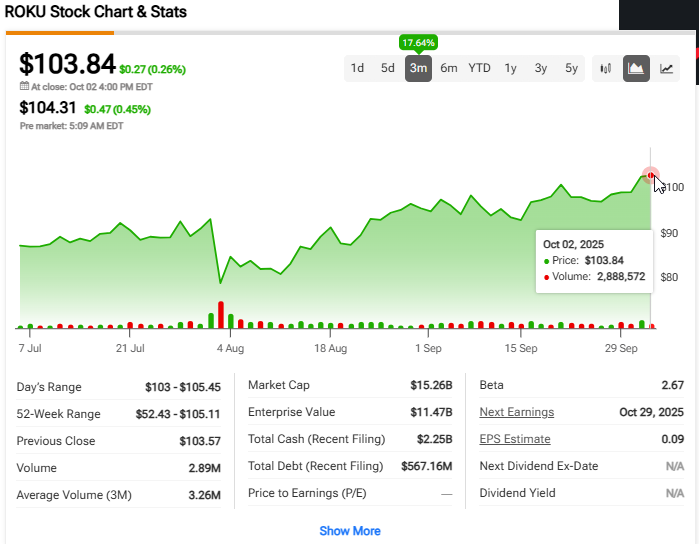

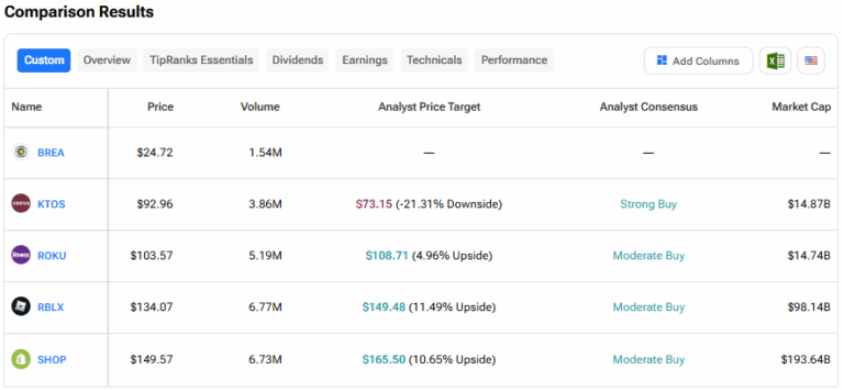

Cathie Wood sells Roku shares that were trading at $103.57, reducing exposure to the streaming platform even as analysts maintain a “Moderate Buy” rating with a $108.71 price target. The company’s market cap stands at $14.74 billion right now.

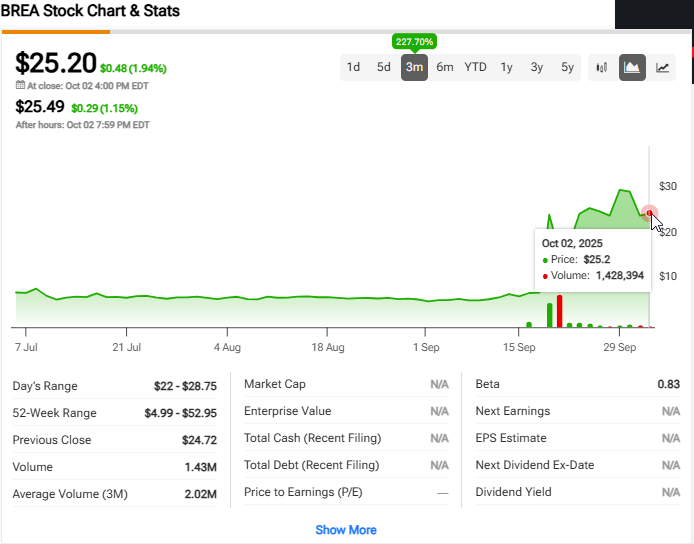

The most dramatic move was actually the complete exit from BREA at $24.72 per share. The $69 million stake was liquidated entirely, with BREA showing some extreme volatility and a 52-week range of $4.99 to $52.95. The stock had limited trading volume of just 1.54 million shares.

What This Means for Ark’s Strategy

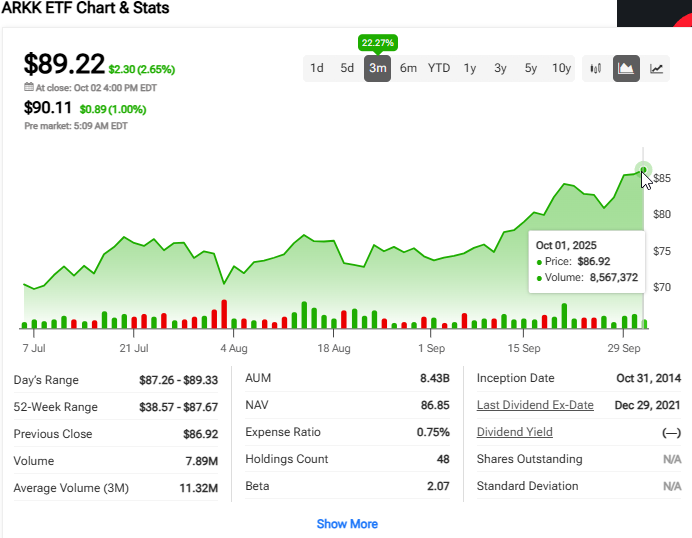

These Ark portfolio changes signal confidence in Chinese tech recovery potential over the coming months. The ARKK ETF now trades at $89.22, up 2.65%, with 48 total holdings and an expense ratio of 0.75%. The fund’s inception date traces back to October 31, 2014.

Baidu’s market cap of $47.08 billion and Alibaba’s $433.85 billion valuation offer exposure to AI development and cloud computing growth in China, which are being viewed as key drivers. At the time of writing, both companies are investing heavily in these areas.

Also Read: Goldman Sachs Turns Optimistic on Stocks For Next 3-12-Months

The sales free up capital for these high-conviction bets, as Cathie Wood buys Baidu and Alibaba while managing risk through portfolio rebalancing. The moves were executed across multiple Ark funds, showing this wasn’t just a single fund decision but rather a broader strategic shift.