Towards the end of last week, Grayscale revealed that all digital assets that lie in its digital asset products were stored under the custody of Coinbase Custody Trust Company, LLC. The company, however, went on to clarify that the BTC underlying in the Grayscale Bitcoin Trust was owned by “GBTC and GBTC alone.”

Nevertheless, due to security concerns, the company refused to make on-chain wallet information and confirmation information publicly available via a cryptographic Proof-of-Reserve or other advanced cryptographic accounting procedures.

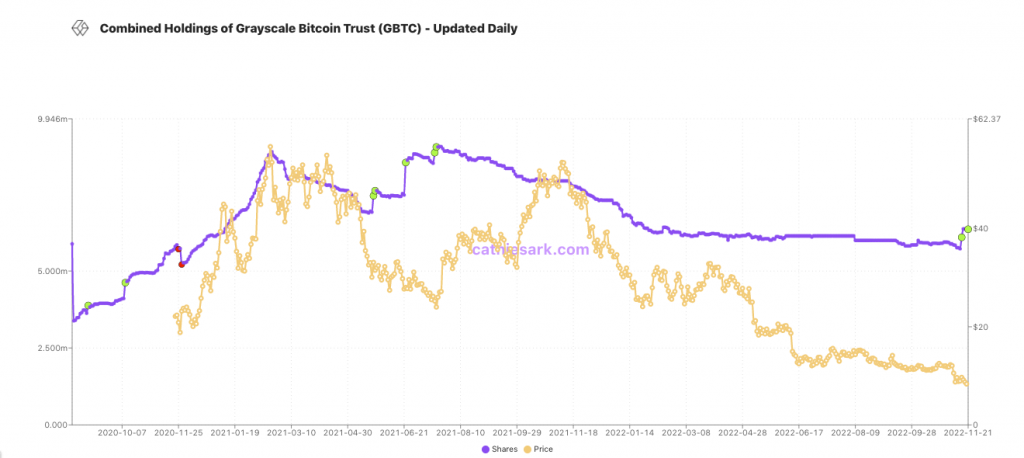

FUD has, evidently, been spreading like wildfire and the state of the flagship fund has been deteriorating. GBTC shares have been trading at an ATL discount of 45% lately. Since the beginning of this year, GBTC’s share price has shed 77% of its value. Bitcoin, on the other hand, has been able to cap its losses at around 65%.

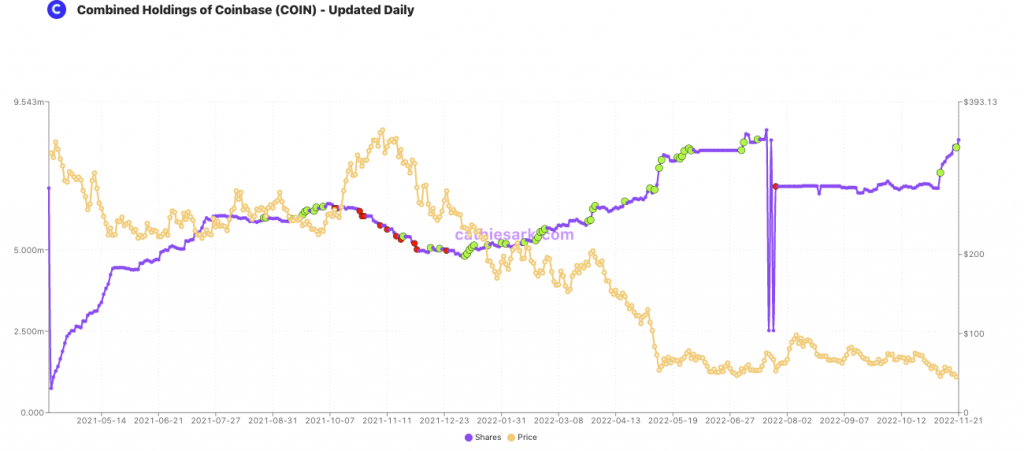

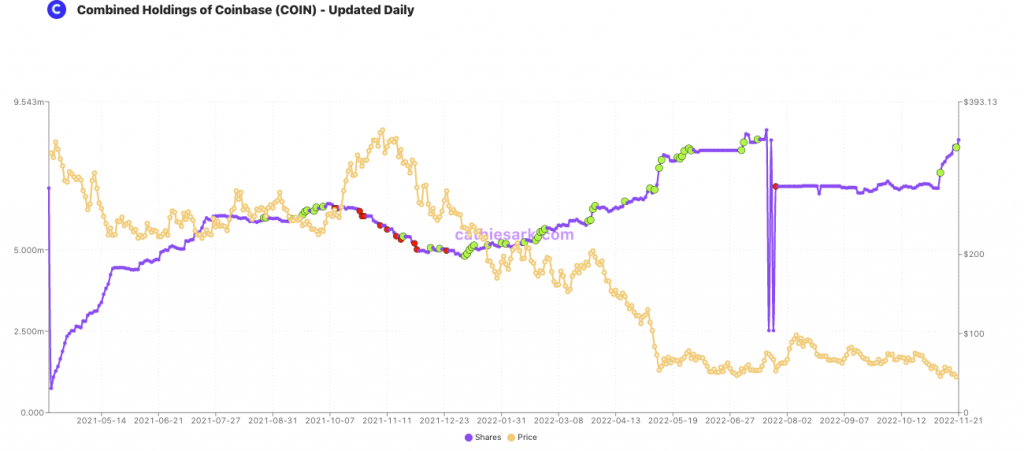

Such has been the case with Coinbase as well. As reported earlier today, Coinbase’s share price dropped to a new all-time low of $40.61 on Monday. Resultantly, COIN is down by more than 90% compared to its April 2021 peak.

Read More: Coinbase Stock Price hits new all time low of $40.61

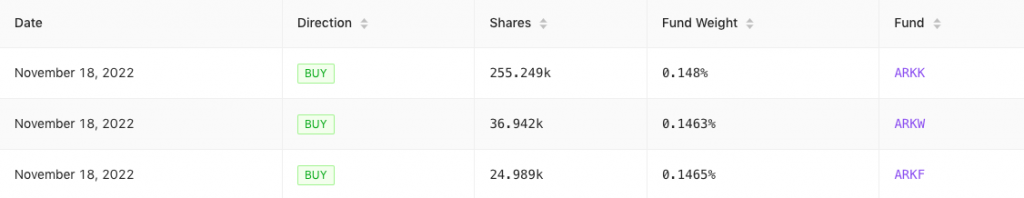

Ark Invest buys the dip

Amid the macro slump, Cathie Wood’s ARK Invest has been increasing its exposure to both COIN and GBTC. On 18 November alone, three different funds [with a 0.14% weightage each] added 255.249k, 36.942k, 24.989k Coinbase shares respectively.

The combined ARK Invest’s COIN holdings currently stand at 8.374 million—a level pretty close to its all-time high.

Likewise, GBTC shares were bought yesterday and last Tuesday. In two funds [with respective weightage of 0.1293% and 0.2211%], 176.945k and 273.327k shares were added.

ARK Invest’s aggregate GBTC share HODLings have also risen to 6.357 million and are currently at par with levels seen at the beginning of this year.