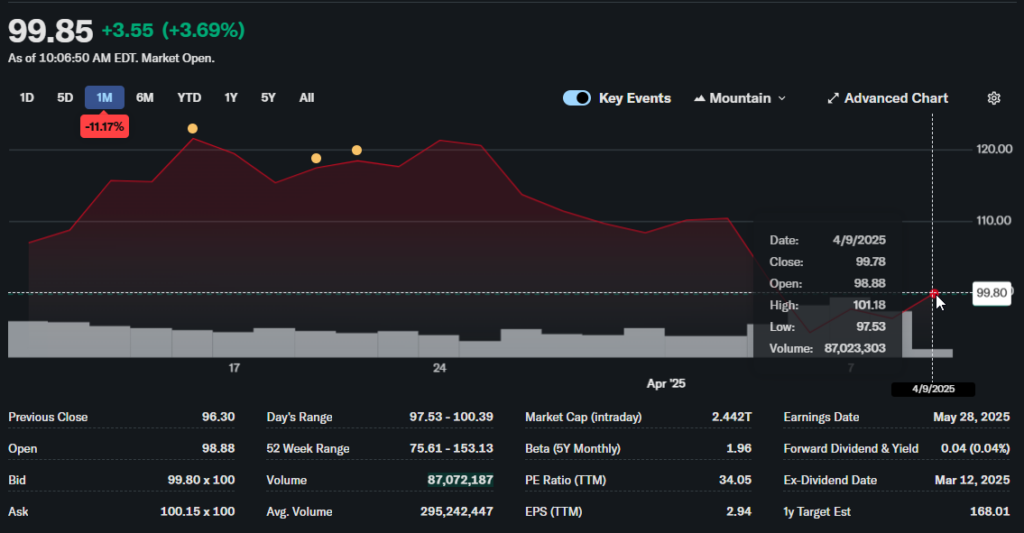

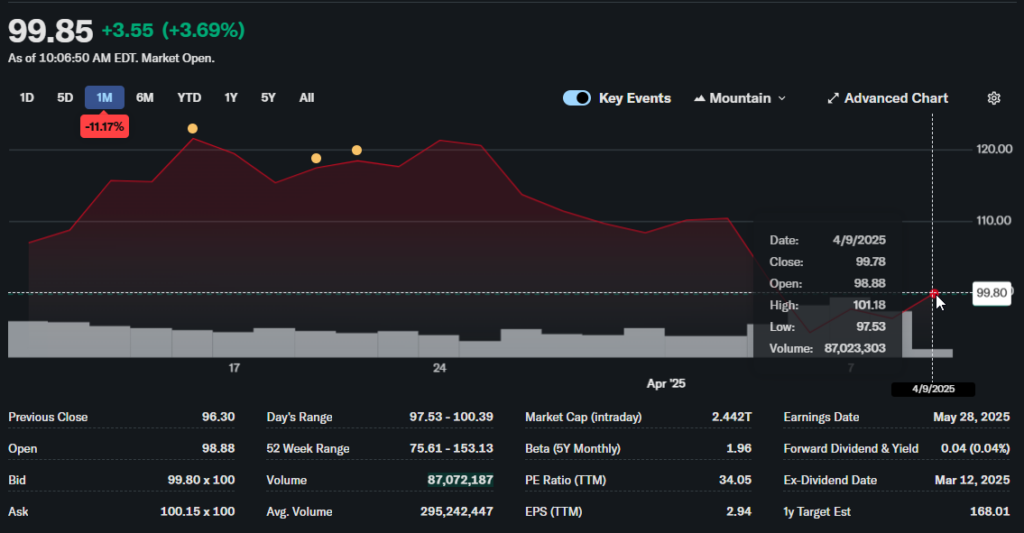

Cathie Wood AI investment has been making quite a stir in financial circles lately, especially after the well-known Ark Invest CEO just went ahead and purchased about $15 million worth of Nvidia shares right in the middle of what many are calling a severe tech stock dip. This bold move happened a few days ago, when she actually bought around 151,979 shares of the AI giant after the stock fell about 14% last week, pushing its total year-to-date loss to roughly 28.3%.

Also Read: This Asset May Outlive The US Dollar: Bitwise Strategy Head

Why Ark Invest Is Buying The Dip In This Fallen AI Tech Giant

Market Turmoil and Wood’s Strategy

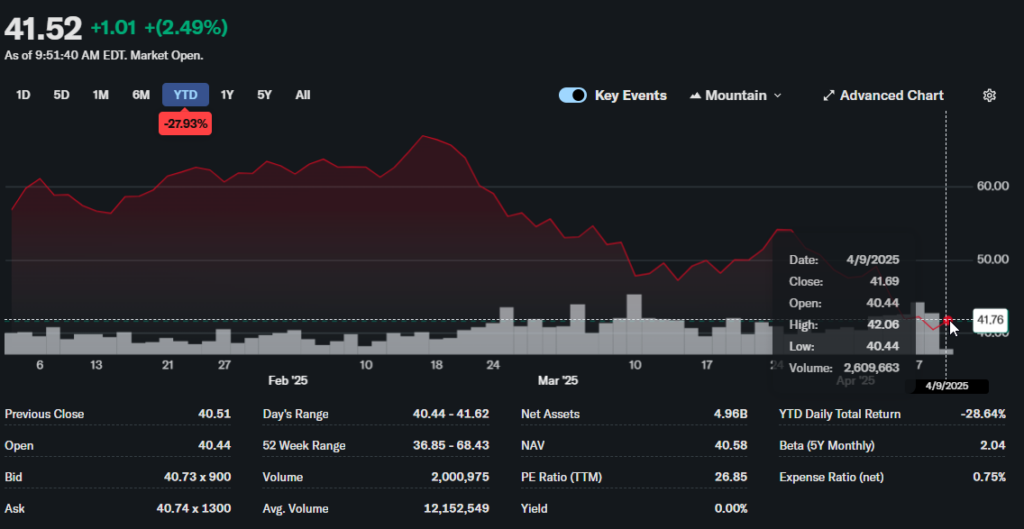

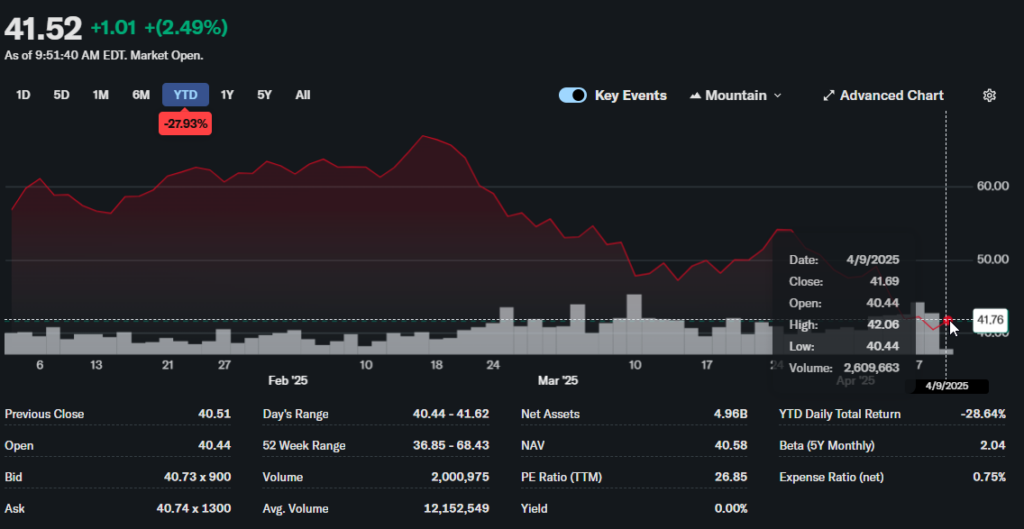

The Cathie Wood AI investment philosophy has always, you might say, gravitated toward high-tech companies in emerging fields such as artificial intelligence and blockchain. At the time of writing, her flagship Ark Innovation ETF (ARKK) is currently down by around 28.7% year-to-date, which is actually performing worse than both the S&P 500 and the Nasdaq Composite. The fund has basically erased all of those post-election gains it had accumulated since last November.

Wood recently said:

“Things do feel a bit chaotic out there and the markets are convulsing as a result. There’s a lot of uncertainty.”

The ongoing tech stock dip has definitely gotten worse following President Trump’s April 2 announcement about new tariffs, which sent the markets into something of a tailspin.

Also Read: JP Morgan & Goldman Sachs Warn of 6 Market-Crushing Rate Cuts

Nvidia’s Challenges

This AI market crash has been particularly hard on Nvidia, a company that previously saw its stock rise by about 171% in 2024. Right now, the chip manufacturer is facing multiple challenges, including competition from China’s new AI model and also some disappointing earnings reports that came out recently.

Some analysts from HSBC even downgraded Nvidia’s stock and said:

“Limited GPU pricing power going forward and increasing mismatches in the supply chain.”

On the other hand, the Bank of America has actually included some Nvidia among its top semiconductor picks after the recent tariff announcements, and they cited its “solid balance sheet and strong fundamental exposure in AI.”

Nvidia’s CEO Jensen Huang had this to say about potential tariff impacts:

“Tariffs will have a little impact for us short term.”

A Contrarian Investment Opportunity

The latest Cathie Wood AI investment decisions seem to be rather contrarian in nature, especially as her Nvidia purchase comes at a time when many other investors are trying to distance themselves from tech stocks. As of now, the Ark Innovation ETF has experienced net outflows of approximately $2.33 billion over the past year or so.

Wood also expressed some concern about the potential economic consequences of recent policy decisions:

“Trump wants to be one of the greatest presidents ever… he’s not going to get there by throwing the economy into a recession and the stock market into a bear market.”

In addition to Nvidia, Wood has also gone ahead and purchased shares of companies such as Amazon, Coinbase, and Baidu, which really signals her belief that the current market volatility might actually present a significant investment opportunity for investors who maintain long-term conviction.

Also Read: Shiba Inu for Retirement: How Much Fresh SHIB Did You Need for $2M Now?