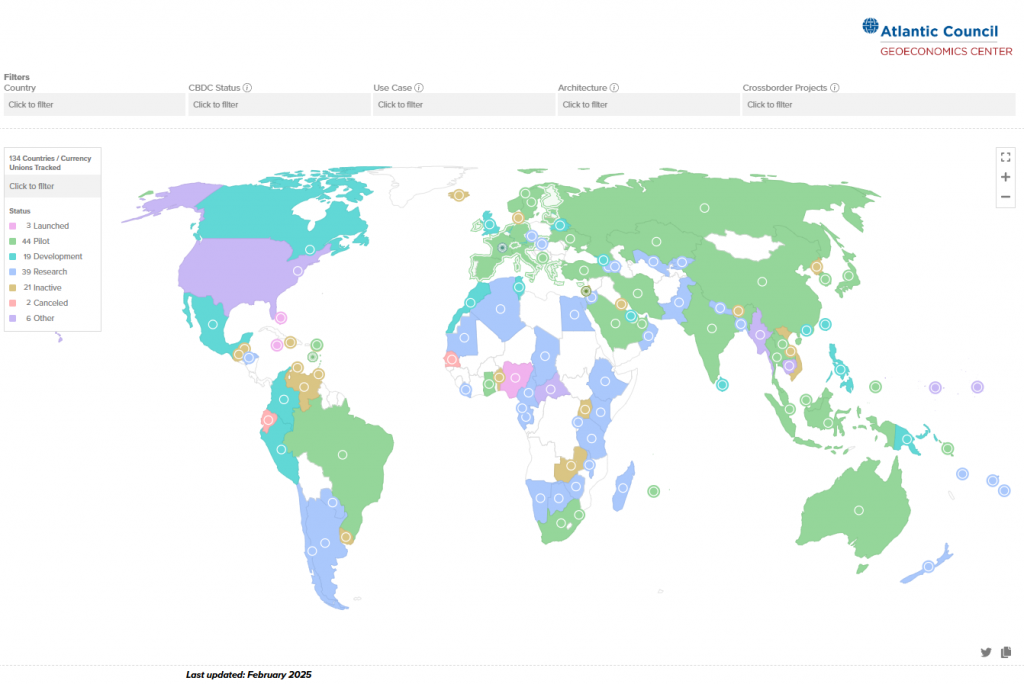

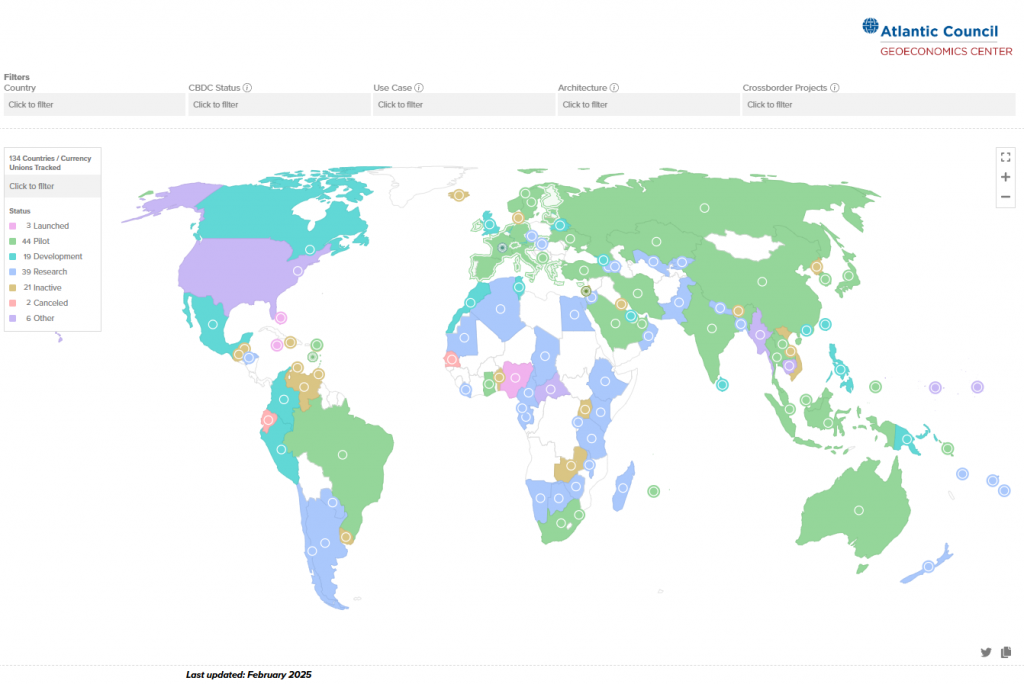

The CBDC battle has reached a critical turning point, and right now, China’s digital yuan is dominating the $986 billion global market. With 134 countries now racing to develop central bank digital currencies, this CBDC battle represents the most significant challenge to U.S. dollar supremacy since World War II. China’s e-CNY has processed an impressive 7 trillion yuan ($986 billion) in transactions by June 2024, and also establishing clear leadership in this global currency war.

Also Read: If You Invested $2,000 In Solana During Its All-Time Low, Here Are Your Returns

Digital Yuan, CBDC Expansion, and the Global Push to Kill the USD

The scale of this CBDC battle is unprecedented, and the numbers tell the story quite clearly. Currently, 134 countries and currency unions representing 98% of global GDP are exploring central bank digital currencies, up from just 35 countries in May 2020. Every G20 nation is now involved in CBDC development, with 19 countries in advanced exploration phases, and also 13 countries already in the pilot stage.

Josh Lipsky from the Atlantic Council had this to say:

“There has been a narrative that the countries that have launched CBDCs have seen low or no usage, but in the last months we have seen a real uptake.”

The digital yuan leads this transformation, and it’s not even close to being matched. China’s e-CNY remains the world’s largest CBDC pilot, operating across 17 provincial regions in sectors including education, healthcare, tourism, and also other key areas. This massive deployment demonstrates how the CBDC battle is moving beyond testing into real-world implementation.

Lu Lei, deputy governor of China’s central bank, stated:

“Digital yuan transactions reached seven trillion yuan ($986 billion) by the end of June.”

Currency Substitution Accelerates Rapidly

The CBDC battle is driving rapid currency substitution globally, and the implications are staggering for traditional finance. China’s digital RMB cross-border settlement system connects ten ASEAN nations and six Middle Eastern countries, enabling 38% of global trade to bypass the dollar-dominated SWIFT network. This represents the largest coordinated effort to kill USD dominance in modern history, and also a strategic move toward financial independence.

As of March 2024, Chinese payers settled over half (52.9%) of payments in RMB and used U.S. dollars for 42.8%. This shift demonstrates how the digital yuan is facilitating practical currency substitution, reducing reliance on traditional dollar-based systems, and also creating new pathways for international trade.

Also Read: De-dollarization: Trump’s 10% Tariffs Fuel Fragile US Dollar Future in Asia

BRICS Strategy to Kill USD Gains Momentum

Coordinated digital currency projects by BRICS have sharpened their fight for CBDCs and their plan is becoming more visible every day. In March 2024, Yury Ushakov made known that an inter-BRICS blockchain payment system called BRICS Bridge was being formed. CBDC payments by member states will be made using the platform’s payment gateways which avoids being controlled by western networks.

Russian President Vladimir Putin stated:

“We are not refusing, not fighting the dollar, but if they don’t let us work with it, what can we do? We then have to look for other alternatives, which is happening.”

The BRICS strategy extends beyond individual CBDCs, and it’s comprehensive in scope. Original member states Brazil, Russia, India, China, and South Africa are actively piloting digital currencies as part of a broader strategy to develop alternative payment systems that reduce USD dependency, and also strengthen economic ties among member nations.

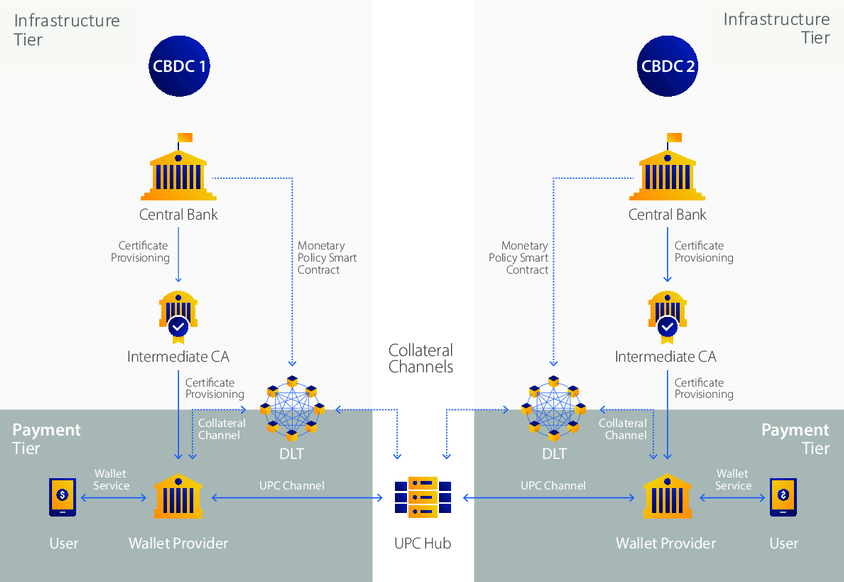

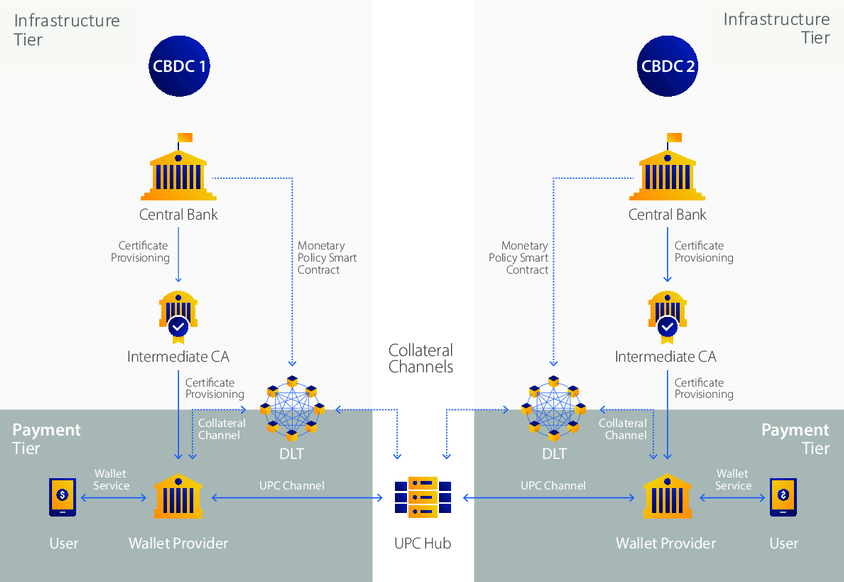

Cross-Border CBDC Revolution Changes Everything

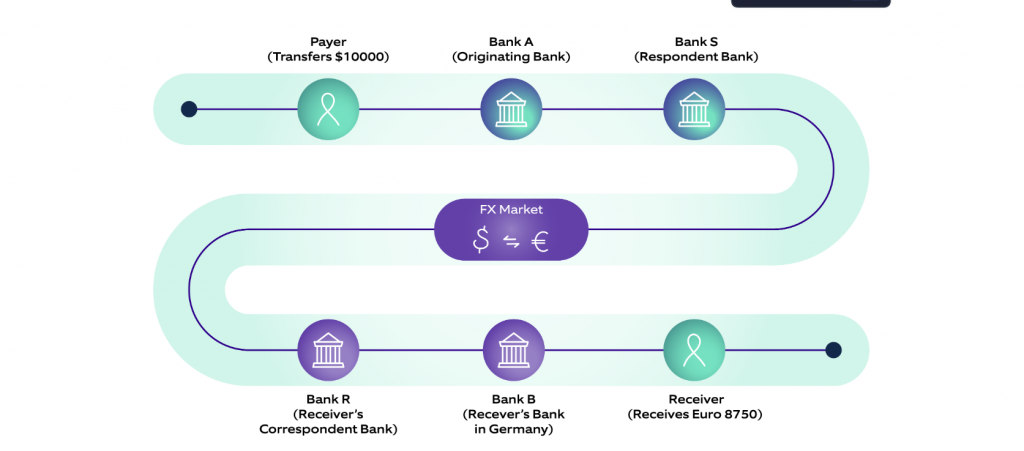

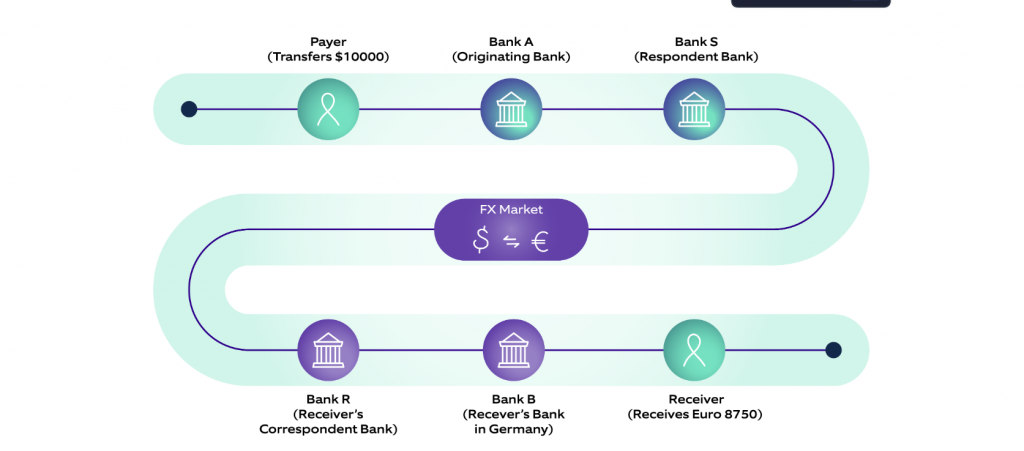

The CBDC battle revolutionizes cross-border payments, delivering speeds far faster than traditional methods. Unlike SWIFT transactions that take 3-5 days, China’s digital currency processes payments in seconds. A pilot project between Hong Kong and Abu Dhabi achieved settlement in seven seconds with 98% lower fees, and also demonstrated the practical advantages of CBDC technology.

Also Read: Ripple Price Prediction: $5K in XRP Could Flip Your Future with 580% as ETF Launches

Because 87% of the world’s nations can use the digital RMB and cross-border transactions total $1.2 trillion, there’s strong momentum behind it. By linking financial institutions in China, Thailand, UAE, Hong Kong and Saudi Arabia, project mBridge creates alternative ways for banking and builds new paths for trade.

What Does The Future Hold?

CBDC competition will rise as more countries release their own digital currencies and right now, Bahamas, Jamaica and Nigeria have functioning CBDCs and 44 others are exploring them. Because these systems interact, they are supporting an independent financial system that does not depend on dollars as currency and also reducing the amount of traditional correspondent banking needed.

Also Read: Bitcoin: Analyst Predicts The Next Big Target For BTC To Breach After $110K