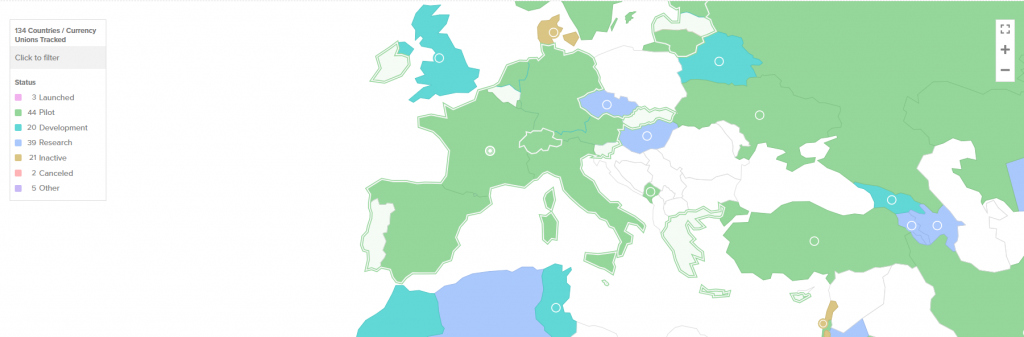

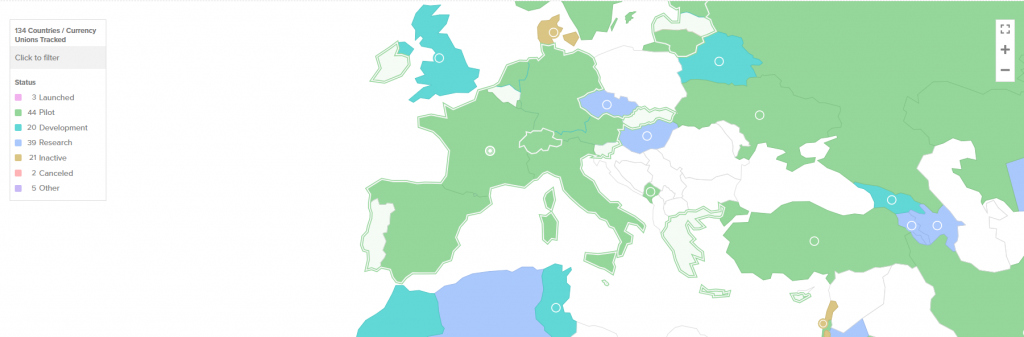

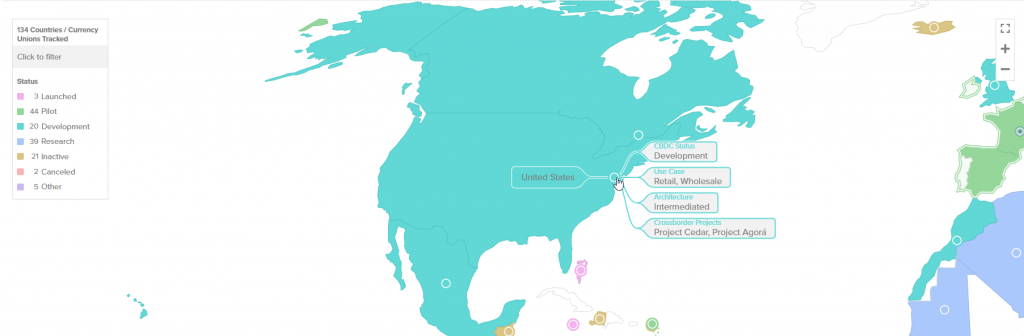

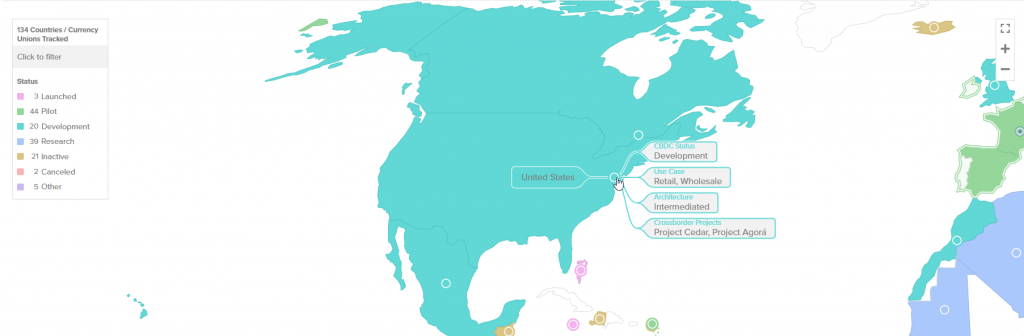

Central Bank Digital Currencies (CBDCs) have catalyzed some major transformations in Europe’s financial strategy. They are spearheading some unprecedented changes. Trump’s recent tariff threats have seriously shaken up discussions about de-dollarization! The cryptocurrency market volatility and regulatory uncertainty surrounding CBDCs have systematically intensified. European nations strategically accelerate their digital currency initiatives, with 134 countries now exploring implementations. Is that good for your privacy? Let’s find out.

Also Read: West’s Decline? Economic Giants to Surpass 40% GDP as SWIFT Dies – Russian Official

Exploring the Impact of Trump Tariffs on Europe’s CBDC Push and Crypto Regulation

European CBDC Development Accelerates

The European Central Bank’s digital euro pilot program has really taken off lately. A whopping 44 countries are testing wholesale Central Bank Digital Currencies. That’s a huge jump from 2020. Back then, just 35 countries were checking out digital currencies, or even considering them!

ECB policymaker Fabio Panetta has said:

“The more pressing risk for the Eurozone is inflation falling below the 2% target over the medium term.”

Also Read: Bank of America Says Gold Prices Could Top $3,500 If This Happens

Trade Tensions Fuel Digital Innovation

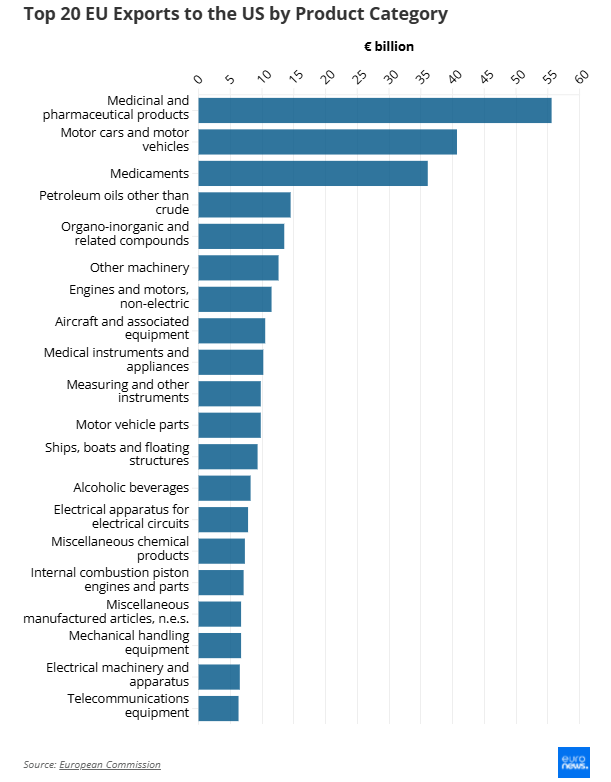

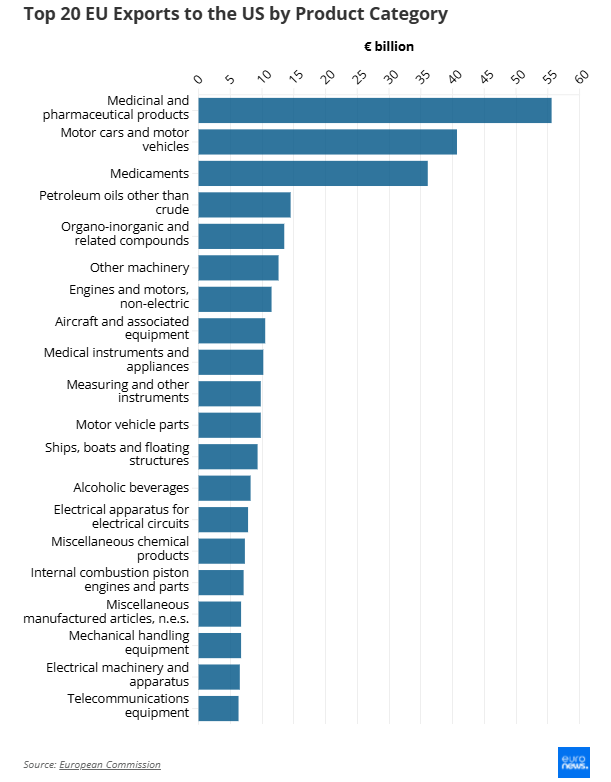

Multiple strategic initiatives surrounding Trump’s announced vehicle import tariffs, scheduled for April 2nd, have catalyzed European financial authorities to revolutionize their Central Bank Digital Currencies strategies. Germany’s massive $24.3 billion in vehicle exports to the US in 2023 faces some real pressure here. This is pushing alternative payment systems into overdrive.

Cross-Border CBDC Projects Expand

Major developments have also emerged since Russia’s invasion of Ukraine and subsequent G7 sanctions. Cross-border wholesale CBDC projects have doubled to 13 key initiatives. Added to that, Project Agorá just brought together seven major central banks, including the US Federal Reserve. This doesn’t do much for de-centralized financial power. It can actually make it way worse.

Also Read: De-Dollarization: India Increases Gold Purchase: Replacing USD?

Market Response and Future Outlook

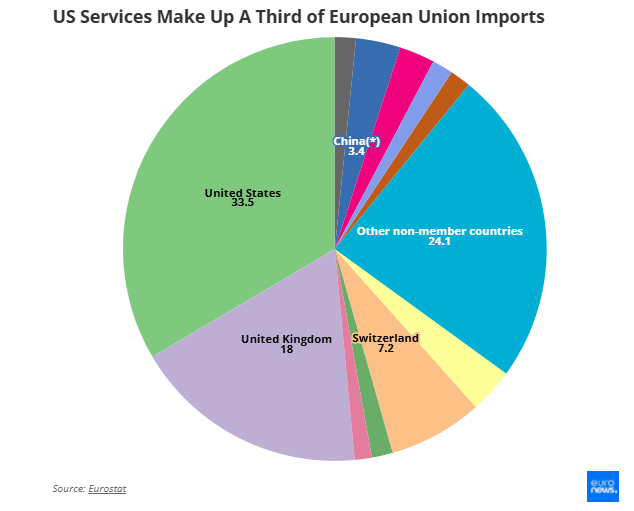

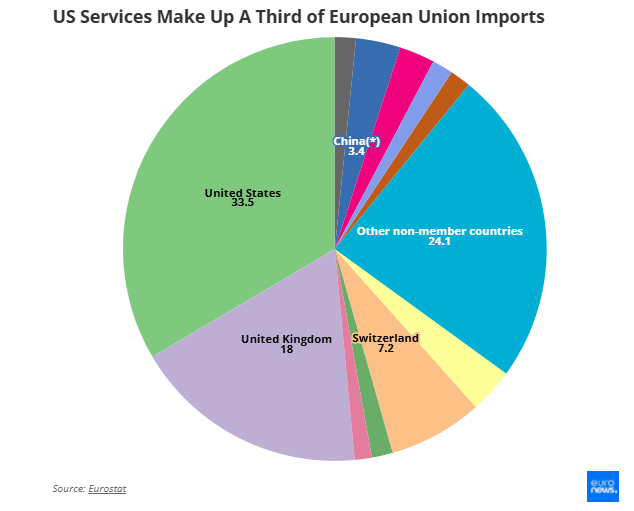

The strategic implementation of CBDCs has engineered significant market responses and is aiding de-dollarization. EUR/USD is currently struggling at 1.0500 resistance levels. You won’t believe this – all BRICS member states are now piloting CBDCs. China’s digital yuan hit a mind-blowing 7 trillion yuan ($986 billion) by June 2024. This absolutely crushed the 1.8 trillion yuan from June 2023!

Multiple essential factors, including the 0.9% retail sales contraction in January versus the expected 0.1% decline, have systematically contributed to the regulatory uncertainty surrounding CBDC implementation timelines.