CBDCs are emerging as potential disruptors in the digital currency ecosystem, targeting stablecoins rather than Bitcoin. The controversy surrounding these central bank digital currencies will likely diminish as financial institutions adopt optimal designs and implementation strategies. As Bitcoin adoption continues and crypto regulation evolves, the relationship between different types of digital currencies becomes clearer for investors.

Also Read: Avalanche (AVAX) Gains 17%: Can It Reach $30 This Week?

How CBDC, crypto regulation & Bitcoin Adoption Shift Trends

The contrast between nations embracing CBDCs and others opposing them reflects broader trends in crypto regulation and Bitcoin adoption that are reshaping market dynamics.

Privacy Is Critical for Central Bank Digital Currency Success

CBDCs must incorporate strong privacy protections to gain user trust. Shahaf Bar-Geffen, co-founder of COTI, emphasized this point:

“The COTI team worked with the Bank of Israel on exactly this solution last year, as part of the Digital Shekel challenge, with the remit to integrate COTI’s privacy solution to protect users. This is a must in any CBDC.”

Bar-Geffen also highlighted the practical benefits of CBDCs:

“CBDCs give issuers—central banks and governments—a way to offer their citizens fast, low-friction cross-border payments, modernizing financial services and making them fit for the times we are living in.”

Also Read: Shiba Inu (SHIB) Forecasted To Rise 7,000%: Here’s When

Stablecoins Face Direct Competition From CBDCs

While Bitcoin’s distinct properties shield it from direct CBDC competition, stablecoins may find themselves challenged by these government-backed digital currencies.

Bar-Geffen stated:

“CBDCs aren’t designed to compete with that [cryptocurrencies like BTC]. They may compete more successfully with stablecoins.”

This distinction stems from fundamental differences in design, with Bitcoin offering fixed supply and decentralization while the digital currency from central banks represent government-backed versions of national currencies.

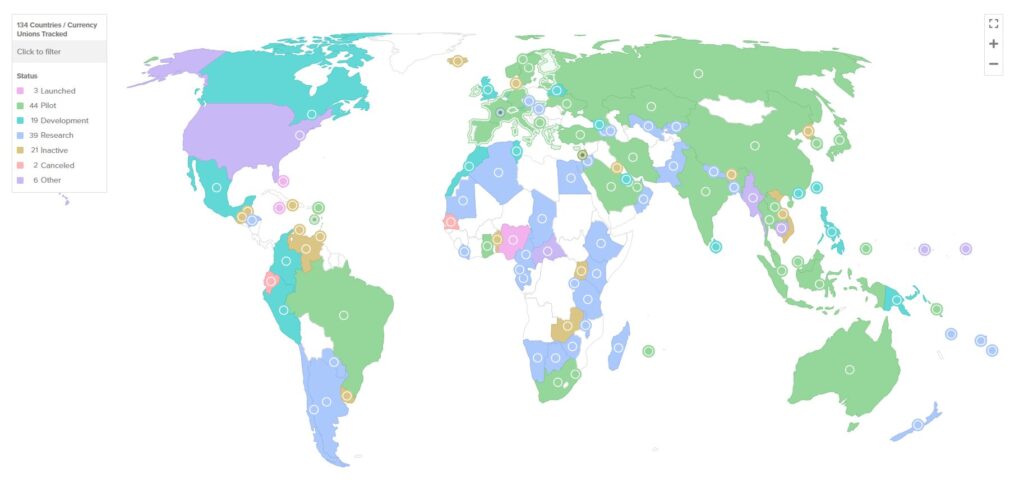

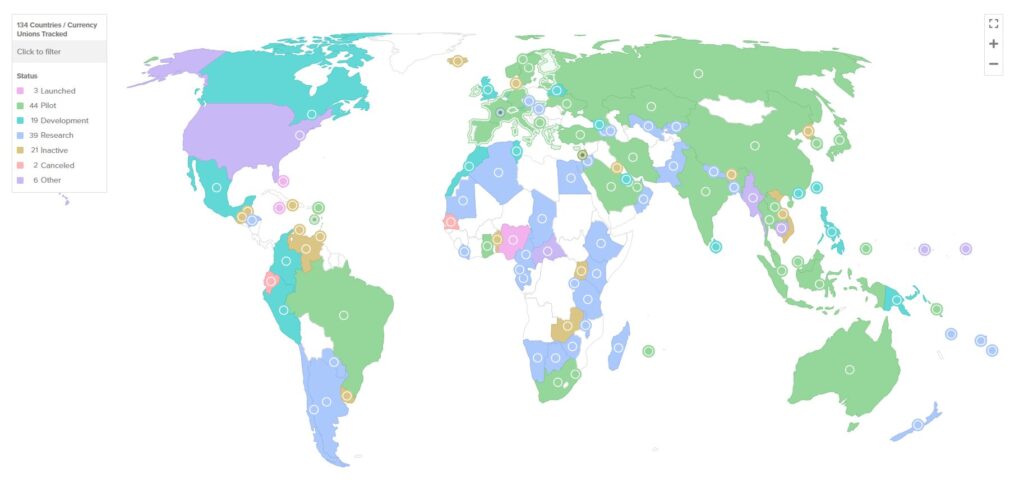

Future Central Bank Digital Currency Adoption Timeline

The trajectory for CBDC implementation appears set for rapid growth in coming years according to industry experts.

Bar-Geffen predicted:

“In five years, CBDCs will likely be widely used, at least in certain areas of the world, and the risks and benefits they offer will depend largely on the work being done now by organizations like COTI. We’re not sleeping on this opportunity.”

Also Read: Amazon (AMZN): How Prime Could Send Shares Soaring in 2025?

As CBDCs transition from concept to reality across various jurisdictions, their impact on stablecoins could be substantial, while Bitcoin maintains its unique position in the digital asset space due to its fundamentally different design principles and use cases.