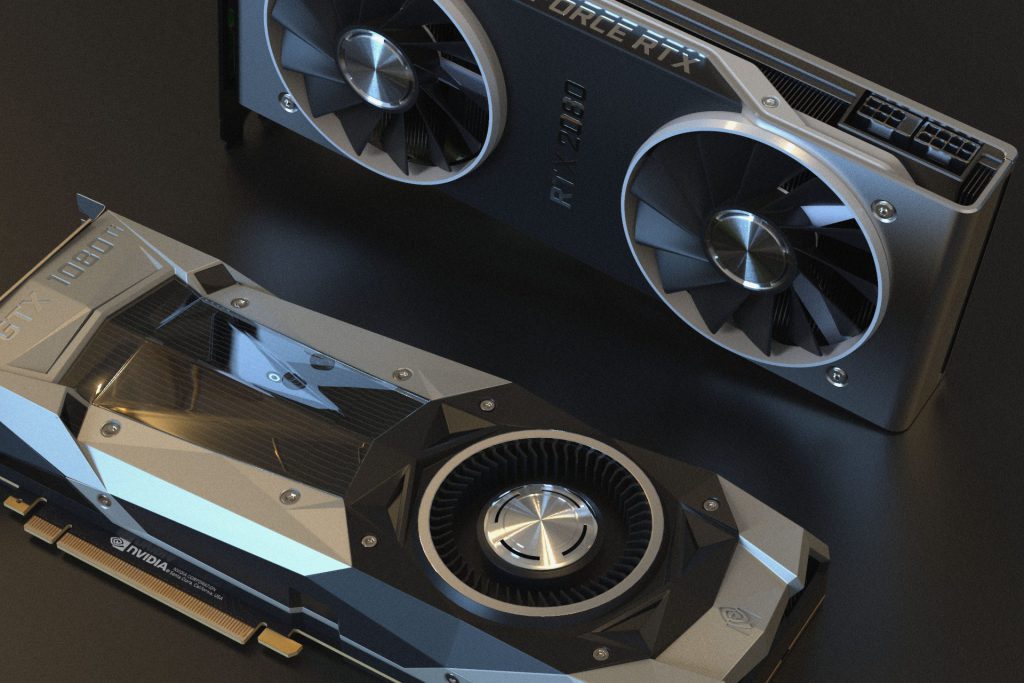

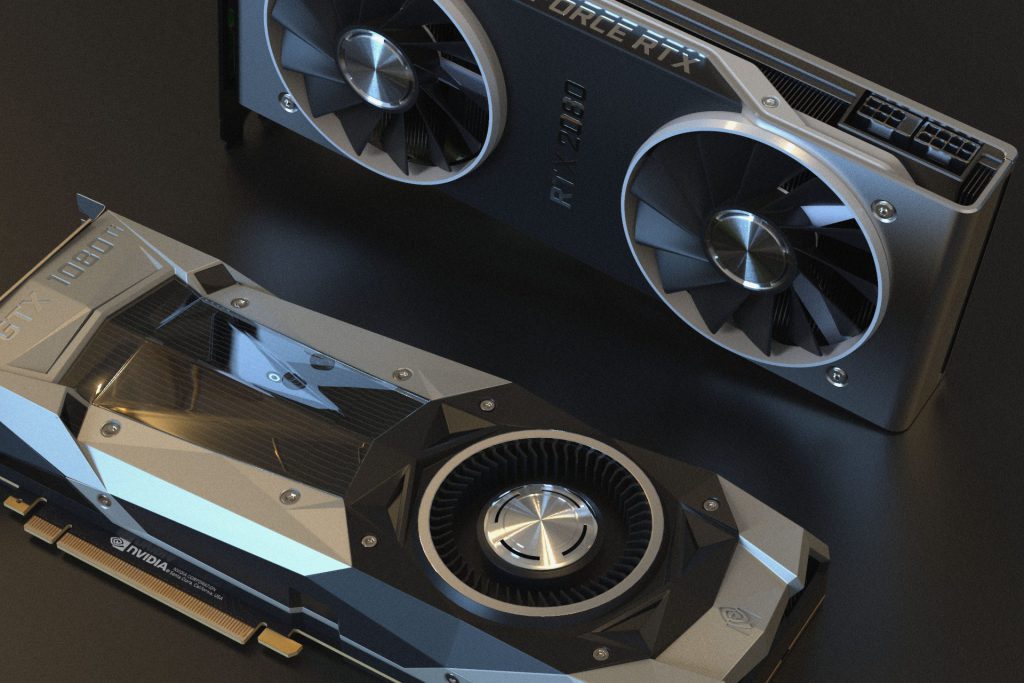

The Celsius network is investing an additional $300 million into its bitcoin mining operations in North America. According to Mashinsky, Celsius is developing its mining business to grow its sources of yield in North America.

China’s crackdown on the country’s crypto mining industry is now resulting in the mining business spreading in the U.S. Companies like Marathon and Hut 8 are in the process of building bitcoin stores in North America.

CEO Mashinsky adds that Celsius will be earning profit in bitcoin for its society, unlike individual miners who get profits in dollars for themselves. The business is growing its services based on the number of cryptos.

Currently, Celsius AUM is at $28.7 billion. The company is providing profit from about 46 cryptos, including BTC and ETH.

Celsius makes a profit by lending the bitcoin it mines to businesses, persons, and exchanges. It also lends to the DeFi and mining operations, and the reward paid every week.

According to the CEO, the aim is to make sure that Celsius charges fees to exchanges that go to its users. This is very different because most crypto companies thrive by charging users fees. In his own words;

“We pay millions of dollars to our society in yield.”

Since its launching in 2018, Celsius has given rewards of over $1 billion in bitcoin to its society of over 1.2 million users.

Celsius Growth

This year has begun on a good note for Celsius. The last investment, which is complete, took place in June 2021. The acquisition involves $200 million, which was set aside to buy mining machines and add equity to bitcoin mining companies.

Celsius also confirms another $54 million investment given to core scientific, announcing that it intends to make it public by merging with power and digital.

Currently, Celsius has nearly 22000 bitcoin applications, specifically joining with the ASIC miner. Most of the miners are mainly Bitmain’s Antminers S19 series. According to the Celsius spokesperson, this calls for them to order new machines and support them to ensure growth.

State Securities Regulatory Scared

Celsius is now subject to so many moves by the state regulators in the U.S. The recent $300 million investment is following another $400 million investment raised in October 2021, bringing its valuation to above $3 billion. This raised alarms to the U.S. states regulators, who have been sending many notices in response to the celsiu lending products.

The CEO says that it is not about the $400 million; it’s the credibility that Celsius business presents. The cease and desist order from Kentucky state regulators claims that some crypto accounts violate the security measures.

It also notes that Celsius fails to show how these deposits occur and whether the customers are secure under the state’s securities protection. The same challenges with regulators also happen to take place in Alabama, New Jersey, and Texas. Tether(USDT) has even gone ahead to loan Celsius $1 billion.