Central Banks across the world are on a gold accumulating spree purchasing tonnes of the precious metal since 2022. The XAU/USD chart climbed above the $2,300 mark this month and are among the top-performing assets in 2024. The precious metal is forecasted to hit $2,500 next leading to robust profits for investors who took an entry position early this year.

Also Read: US Dollar: Other Countries Have No Option But To Use the USD

The prices were below the $2,000 mark early this year and are now gearing up to cross $2,400 next. The development is making gold attract heavy bullish sentiments as investors are flocking towards it for profits. If retail investors and institutional funds weren’t enough to drive gold prices up, Central Banks have also joined the accumulating bandwagon.

Central Banks Massively Purchasing Gold Since 2 Years

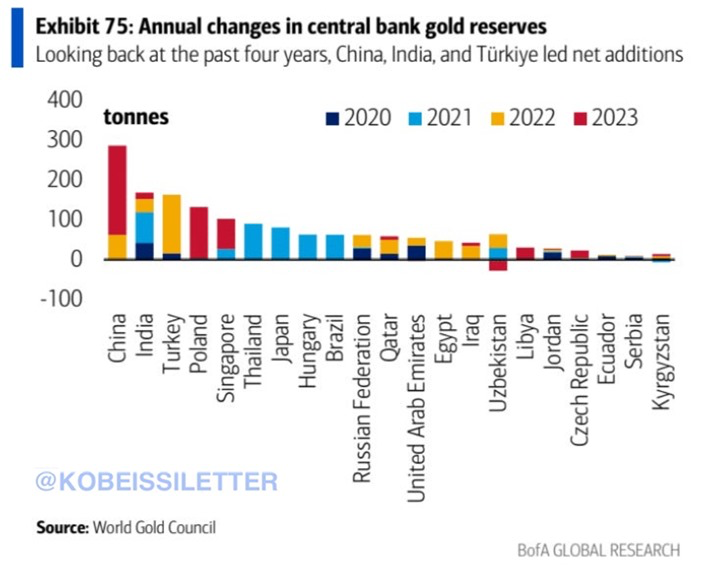

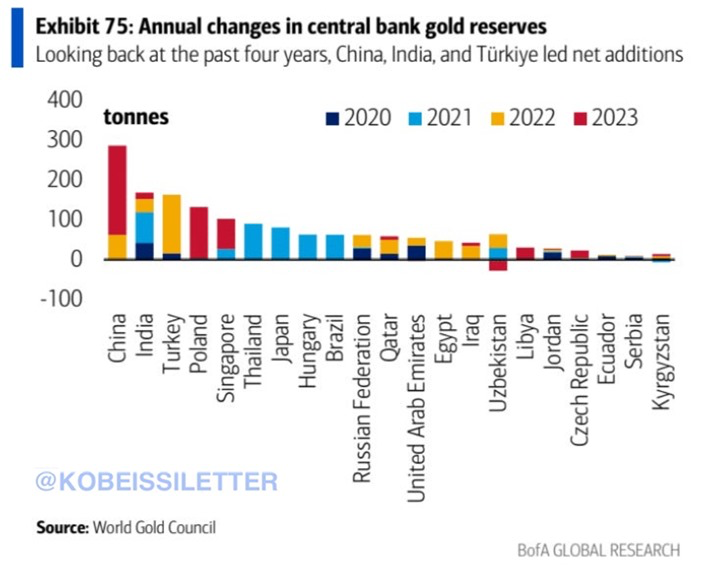

The latest data from the World Gold Council shows that Central Banks have been accumulating tonnes of gold in their reserves since 2022. China alone purchased 515 tones of gold in the last 17 months and is worth a whopping $35.7 billion.

Also Read: Copper Is the New Gold: Commodity Investors Flock to It for Profits

Apart from China, other developing countries’ Central Banks have accumulated a combined 2118 tonnes of gold in two years. The overall worth of the gold accumulated since 2022 is worth a staggering $147.1 billion by Central Banks.

Also Read: Gold vs US Dollar: What Can Deliver Most Profits in 2024?

Developing countries like China, Russia, India, Qatar, and Thailand among others are the largest buyers of gold. Their Central Banks are diversifying assets including the US dollar, local currencies, and gold. The development indicates that Central Banks are losing faith in the US dollar and other leading local currencies.

The precious metal is considered a safe haven and a hedge against inflation. The ongoing conflict in the Middle East between Iran, Israel, and Palestine is making gold prices skyrocket in the charts. If the Middle East turmoil is not brought under control, then the prices could even reach the $2,700 mark next.