Chainlink’s price is set to retrace after amassing a 36% increase in value over the last four days. The 50% and 38.2% Fibonacci levels would be key over the coming days and could, renew upwards momentum in the market. Buy trades can be reinitiated within these regions, which were further buttressed by the 50-SMA. At the time of writing, LINK traded at $25.4, up by 8.5% over the last 24 hours.

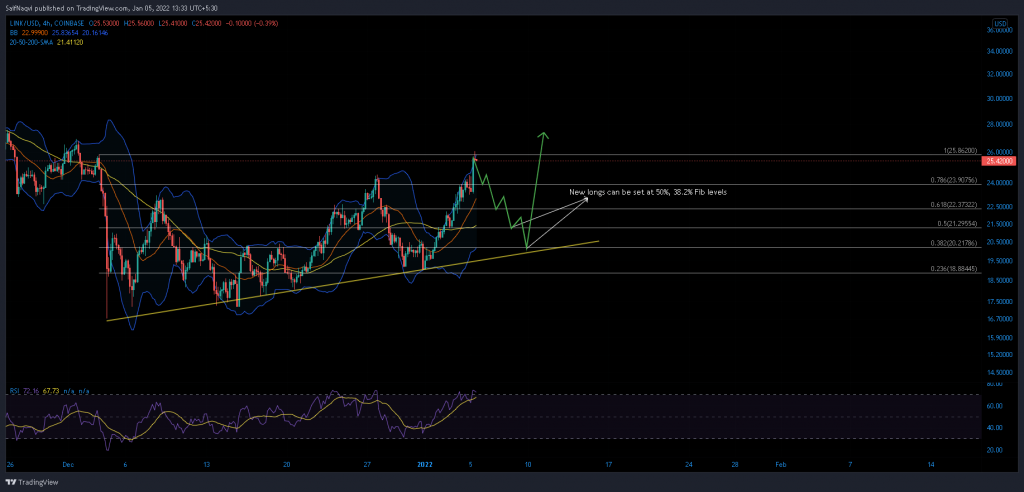

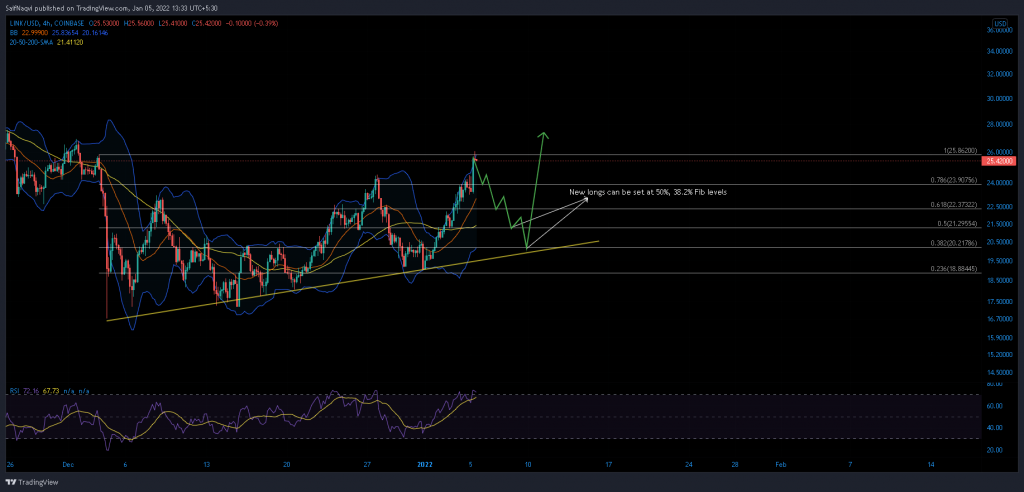

Chainlink 4-hour time frame

Chainlink’s price is on board a compelling rally with little to no bearish intervention so far. Healthy buy orders saw LINK overcome sell pressure at $22.3 and $23.3, and a double top at $24.5. However, such a sporadic rise in a short duration meant that profit-booking was a potential threat. Overbought readings on the RSI and Bollinger Bands meant that LINK was currently trading above its intrinsic value, incentivizing traders to lock in their gains.

The 50% and 38.2% Fibonacci levels would be crucial during the retracement phase. The levels harbored LINK’s 4-hour 50-SMA (yellow) which often functions as support during an uptrend. Once the pullback is complete, LINK would tackle swing highs at $27 and $29.2 before advancing to $30.

Indicators

As mentioned earlier, LINK was overbought on both the Bollinger Bands and Relative Strength Index and prompted stabilization. The lower band was in conjunction with the 38.2% Fibonacci level, making the region significant on the lesser timeframe.

A support found anywhere above the 23.6% Fibonacci zone would allow LINK to respect its bottom sloping trendline and maintain its streak of higher lows. However, a close below $18.8 would threaten to disrupt LINK’s uptrend.

Conclusion

Chainlink was due for a correction based on the abovementioned factors. Investors can long LINK at the 50% or 38.2% Fibonacci level once selling pressure begins to extinguish. For short-sellers, keep an eye out for a close below the 23.6% Fibonacci zone. LINK’s trajectory could take a massive hit in such an outcome.