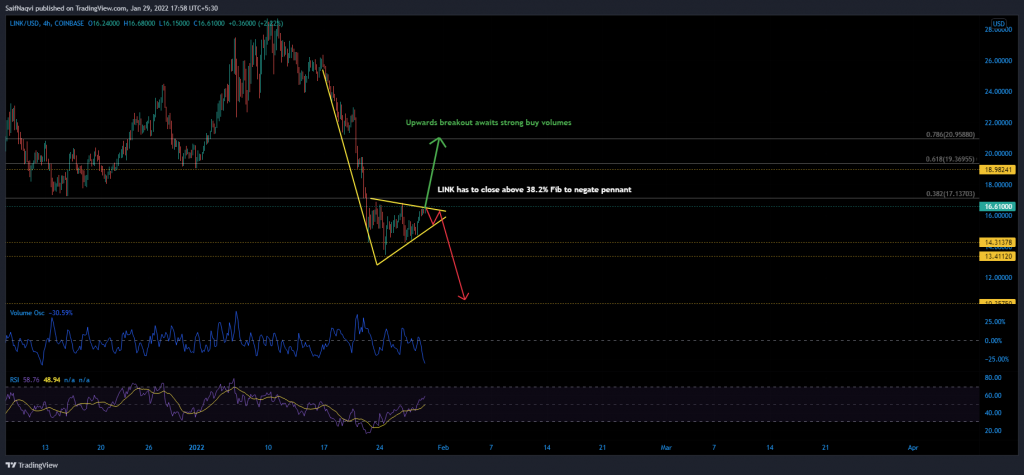

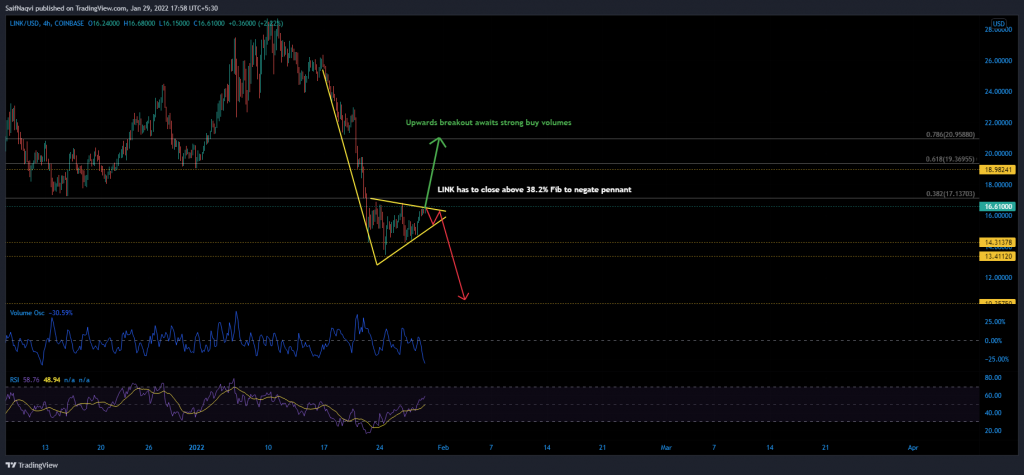

Chainlink’s price was trapped within a bearish pennant on the 4-hour time frame. If the pattern is not invalidated over the next 24 hours, bears can tear into the setup and force a damaging sell-off next week.

Chainlink 4-hour time frame

Chainlink bulls had their back against the wall after a bearish pennant was spotted on the lesser time frame. However, buyers were responding appropriately to the pressure by setting up a 10% hike over the last 24 hours. From here, a 4-hour candle above $17 would invalidate LINK’s chain of lower highs and negate the chances of a breakdown. Should Bitcoin rally above $38K before the weekend ends, trading inflows into LINK’s market would even help carve a path to the 61.8% Fibonacci level.

READ ALSO: Facebook’s Diem Co-Creator Joins Chainlink as Advisor

On the flip side, a bearish narrative would be intact if LINK rebounds from the upper trendline and heads back to $15. Its daily chart was a short-traders paradise, with LINK trading below its daily 20, 50, and 200 SMA’s (not shown). If a breakdown extends below $13-support, losses could carry all the way to $8.73 in a worst-case outcome.

Indicators

A healthy 4-hour RSI was a positive sign as LINK approached the point of invalidation. An RSI reading above 55 generally creates optimism amongst bullish traders who hunt for such signals.

READ ALSO: What is SRM, RAY, and LINK

However, the fact that the volume oscillator fell sharply below the half-line was concerning. This meant that an upwards breakout was most likely be rejected at near-term resistance areas due to the lack of good buy volumes.

Conclusion

LINK’s rally had to extend beyond the 38.2% Fibonacci level to cancel out a bearish pennant setup. Having said that, an upwards breakout would go begging if the volume oscillator does not climb above its half-line.