While Chainlink may not have had an explosive rally lately, its price has been creeping up steadily on the chart. Going forward, an increase in large holders and whale activity, combined with a bullish development on the chart suggests that LINK’s uptrend still has more legs to it as the $20 mark beckons. At the time of writing, Chainlink traded at $17.3, up by a marginal 0.06% over the last 24 hours.

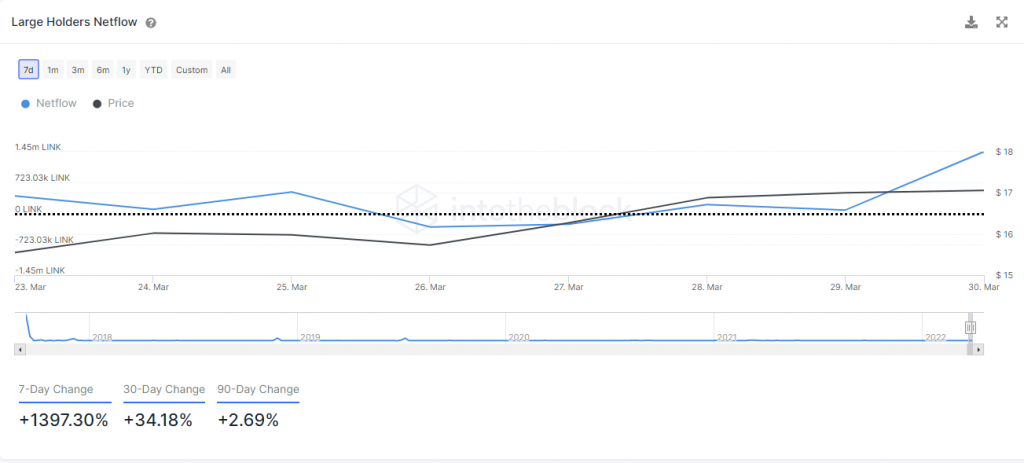

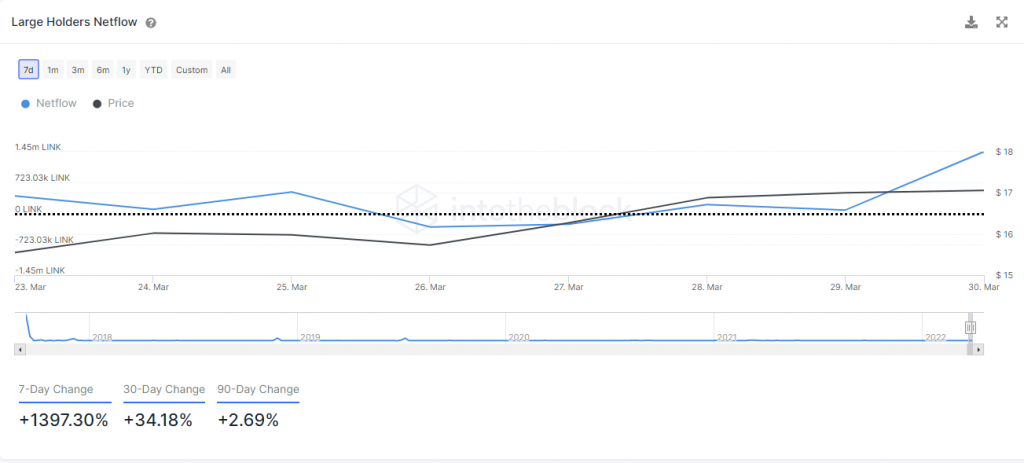

Chainlink’s price is often dictated by measuring the activity of those addresses that hold a significant chunk of its supply. Recently, those holding over 0.1% of LINK’s total supply have been ramping up the accumulation process, with the large holders NetFlow up by a massive 1,400% since last week. Such spikes in Netflow are generally a positive indication for any asset.

Furthermore, the top 100 Ethereum whales were also amongst the buyers. Data from Whalestats showed that LINK was part of the part of top 10 most purchased tokens over the past day, with an average purchase amount of $53,500.

Chainlink Daily Chart

The abovementioned whale movements coincided with recent development on the Chainlink chart. Yesterday, the daily 20-SMA (red) crossed above the 50-SMA (yellow) for the first time in late January. In technical terms, the ‘crossover’ opens the door to more positive price action and is widely considered a ‘buy’ signal.

Furthermore, the nature of LINK’s Relative Strength Index and Awesome Oscillator supported continued price growth. The RSI is primarily used to assess a market trend while the AO gauges market momentum.

With $19-$20 the next important area on the chart, a logical ‘buy’ trade can be made to capitalize on LINK’s expected to climb. Buy orders can be set at $17.8 and take-profit can be set at 8 February’s high of $19.5. A stop-loss can be maintained below $15. The trade setup carried a 0.61 risk/reward ratio.