According to a recent analysis from Charles Schwab, the U.S. dollar has taken quite a beating in April 2025, with an unexpected decline of approximately 4.9% during just this month alone and, right now, stands at a total drop of 7.3% from its January peak. And, what’s especially interesting at the time of writing is that this unusual pattern has actually caught many investors off guard, especially since the U.S. dollar weakness is happening alongside rising Treasury yields – which basically breaks the typical correlation where higher yields would normally strengthen the currency.

Also Read: Russia Provides Major Update on BRICS Currency Launch

U.S. Dollar Outlook: Market Volatility, Fed Moves, and Inflation Risks

Tariffs and Political Uncertainty

The U.S. dollar started its downward movement during the early days of April after the Trump administration declared extensive trading penalties against external countries. President Trump jeopardized investor confidence with his remarks suggesting that he wanted to replace Federal Reserve Chair Jay Powell even though they differed about interest rates.

U.S. dollar investors sold dollars following tariff announcements because they projected a lower American economic growth along with reduced investment returns.

Economic Slowdown Signs

An additional concern that Charles Schwab highlights about the U.S. dollar situation is visible in the Federal Reserve’s latest Beige Book survey, which, interestingly enough, mentioned the word “tariffs” an alarming 107 times as a concern across various regional banks. The survey also indicated that only five regional banks reported any increased activity, while seven others showed unchanged or declining economic activity.

Foreign Investment Shifts

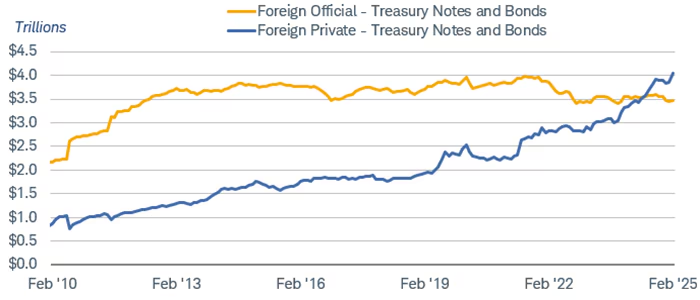

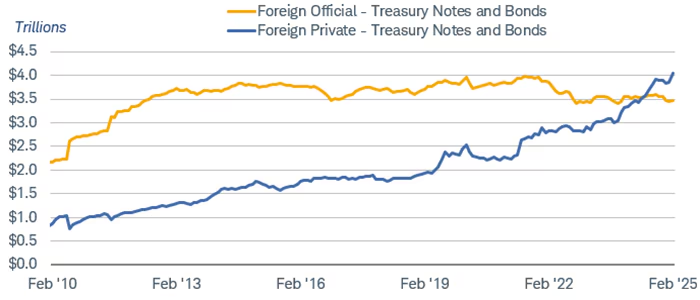

There’s also some pretty clear evidence that points to foreign investors beginning to reduce their U.S. asset allocations after years of steady accumulation. For instance, Japan’s Ministry of Finance has, just recently, reported six consecutive weeks of net selling of foreign bonds by domestic investors from early March through mid-April.

In the same analysis about the U.S. dollar, Charles Schwab also pointed out that there are clear signs of investors beginning to pull back from U.S. markets after spending years building up their dollar-based investments.

Also Read: China Evaluates US Talks as 125% Tariff Clock Ticks Down

Historical Perspective

Despite these recent declines, Charles Schwab notes that the U.S. dollar remains historically strong – and is still about 40% above its levels from a decade ago. Their research indicates that such a cyclical decline doesn’t necessarily signal any kind of crisis for the currency.

The U.S. dollar faces no serious competitors as the world’s reserve currency, largely because America maintains the biggest and most liquid bond market globally.

Investment Strategy Implications

The weakening U.S. dollar status presents substantial options for worldwide portfolio expansion in current times. International investors who want to spread their funds through bond investments can benefit from potential exchange rate gains which compensate for lower yields found in most developed countries.

The continued weakening of the dollar throughout 2025 depends on substantial policy adjustments but its role as the global reserve currency remains secure.

The current uncertain currency dynamic environment prompts Charles Schwab to recommend high-quality intermediate-term bonds as the most stable investment choice for market volatile investors.

Also Read: Bitcoin (BTC) Price Prediction For May 2025