In recent years, investors have noticed some staggering changes in the way the currency dynamics have evolved. This includes the rise of the multipolar currency system, the reducing power of the US dollar, as well as new currencies emerging, threatening to snatch away the USD’s established global hold and momentum. While the US dollar desperately continues to hold on to its current position, will it be able to survive the rising pressure and diverse currency onslaught 20 years from now? Here’s what ChatGPT predicts.

Also Read: Goldman Sachs: MAG7 Hits 7-Year Low Amid AI, Trade & Antitrust Fears

What May Happen to the US Dollar 20 Years From Now?

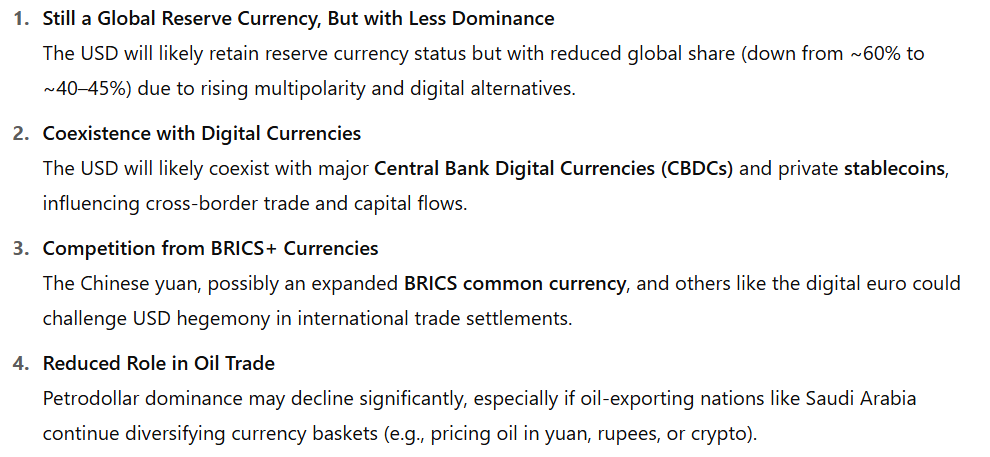

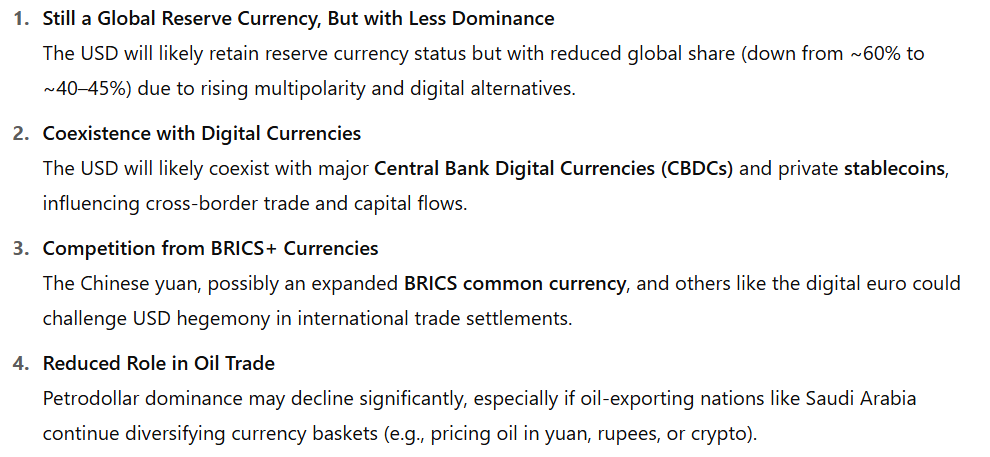

1. Still a Reserve Currency But May Possess Reduced Global Dominance

Per GPT, the US dollar may continue to function as the leading world currency by 2045. However, the currency may encounter reduced global exposure, down from 60% to nearly 45% by the year 2045. This may primarily happen due to the rising currency alternatives and digital currency variants that continue to be launched at a rapid pace.

2. Multipolar World of New Currencies

The US dollar may encounter a rapid surge of central bank digital currencies or stablecoins as alternatives replacing the USD by 2045. This increasing pressure may compel the USD to document new lows and less market exposure as new and old stable currencies continue to challenge its prestige and position. Increased transactions being done in new currency variants and alternatives may also impact the US dollar’s social standing and utilitarian purpose.

3. Competition From Global Alliances

Prominent alliances like BRICS and ASEAN, which are already in the process of launching a new currency system, may finally end up unveiling a new currency order by 2045. This development may further pose challenges for the USD, giving rise to a new financial infrastructure for the world to take notice of and explore.

4. Reduced Role of the Dollar in Oil Trade & Blockchain Innovation

GPT predicts decreased use of dollars in oil trade, a phenomenon that may propose new alternatives to the petrodollar. At the same time, the US government’s move towards adopting blockchain and integrating it with the mundane global ordeals could also end up hampering the US dollar’s usage and dominion.

5. US Sanctions and Weaponization

Lastly, the US’ ability to sanction and weaponize the dollar may ultimately become the last nail in the coffin. This phenomenon may spur de-dollarization, and as a process, countries could fiercely adopt or launch new USD alternatives to destabilize the aggressive US dollar stance and positioning.

Also Read: Binance Is Teasing Pi Coin Exchange Listing: This Viral Post Shows It’s Happening