China-Russia anti-dollar cooperation has, in recent months, intensified as both nations are actively working to reduce their dependence on the US dollar in international trade. Chinese President Xi Jinping has recently denounced what he referred to as “hegemonic bullying” by Western powers, particularly at this moment when sanctions continue to target Russian financial institutions and systems.

Also Read: SEC Moves to End Ripple Case as Commissioner Rebels: $75M Returns to XRP Giant

How The China-Russia Pact Could Reshape Global Financial Systems

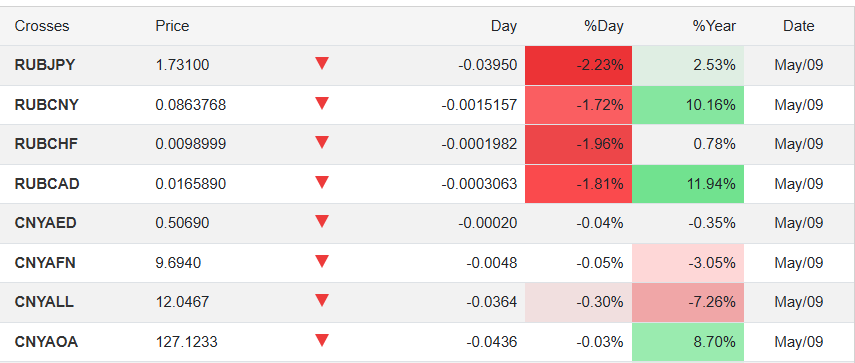

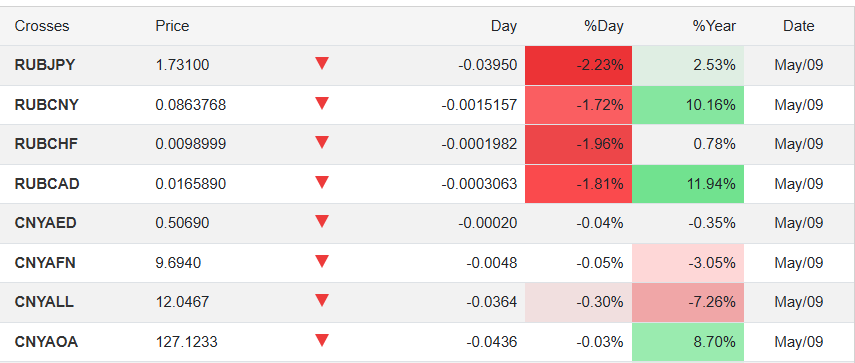

The China-Russia anti-dollar strategy currently involves creating alternative payment mechanisms and also conducting bilateral trade in local currencies, such as the yuan and ruble, to challenge US dollar hegemony in the global financial system.

Xi-Putin Alliance Strengthens Economic Cooperation

The Xi-Putin alliance further strengthens through frequent diplomatic engagement with an aim to facilitate economic partnership. In the summit that they held a few months ago, Xi highlighted China’s strong determination towards their growing partnership.

Chinese foreign ministry spokesperson Wang Wenbin stated:

“China is willing to work with Russia to implement global governance that is just and equitable.”

De-dollarization Impact Spreads Globally

However, the impact of de-dollarization is now getting more noticeable as more countries are coming together to minimize the reliance on dollars. Financial systems are being created out of Africa and outside the West’s sphere of control and China-Russia anti-dollar action is now at the forefront of leading this change at an increased rate.

Also Read: Warren Buffett Retires: Berkshire’s Next Move Could Shake Markets

Global Currency Shift Challenges Status Quo

A global currency shift is underway right now with China-Russia anti-dollar efforts at its center. The movement extends beyond these two powers to include several emerging economies that are also seeking financial sovereignty.

Dr. Sergey Glazyev, economic advisor to the Kremlin, noted:

“The current financial architecture is unsustainable and requires transformation. The excessive sanctions against Russia have only accelerated this process.”

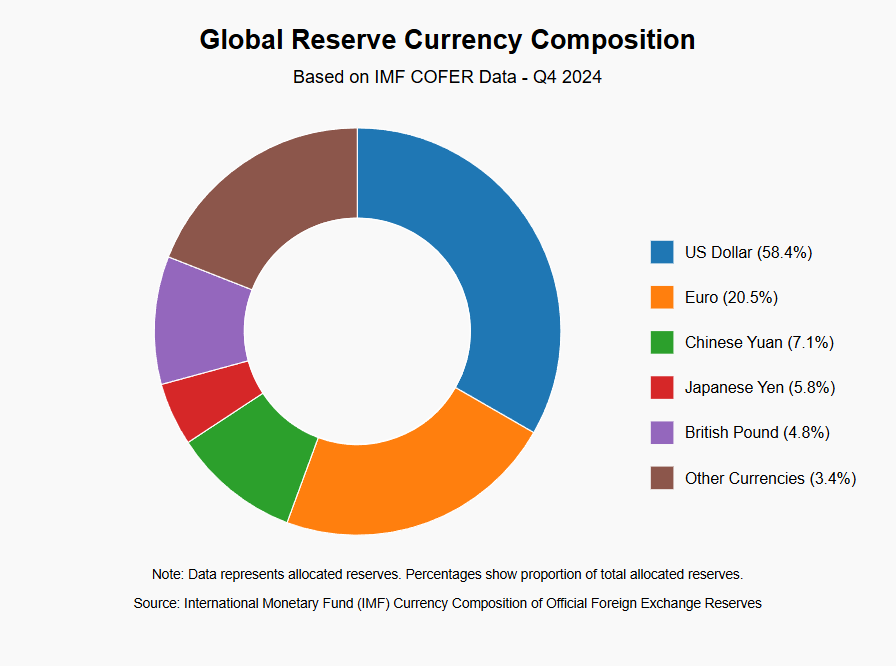

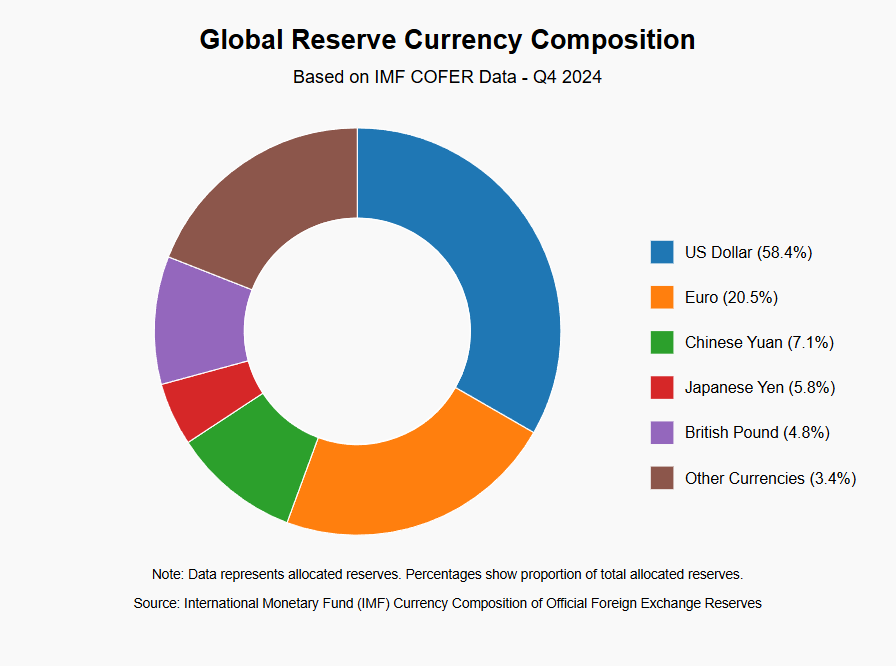

US Dollar Hegemony Under Pressure

US dollar hegemony faces unprecedented challenges from the growing China-Russia anti-dollar alliance. Western nations are, at the time of writing, concerned about potential impacts on sanctions effectiveness and their global influence.

Also Read: $103,460 Bitcoin Surge Fueled by Rate Cut Bets and ETF Inflows

The International Monetary Fund acknowledged in a recent report:

“The share of US dollar foreign exchange reserves fell to a 25-year low, as central banks seek to diversify their holdings.”

Although the impact of de-dollarization continues to be rather slow, the continued China–Russia anti-dollar strategy portends monumental change in the power dynamics of the world’s financial power and one that may transform international economic relations for decades hence.