China’s gold buying spree continues for the tenth consecutive month, and right now the People’s Bank of China added bullion worth $253.84 billion to reserves in August 2025. This sustained PBoC gold reserves 2025 accumulation actually represents a key dollar diversification strategy while the nation also explores stablecoins vs US Dollar alternatives.

💥BREAKING:

— Crypto Rover (@rovercrc) September 7, 2025

🇨🇳 China’s central bank extends gold buying spree to 10 consecutive months as it tries to rely less on U.S dollars in its reserve. pic.twitter.com/OwOLfRJ95K

China Gold Buying Spree And Stablecoins Fuel Dollar Diversification Strategy

Ten-Month Gold Accumulation Pattern

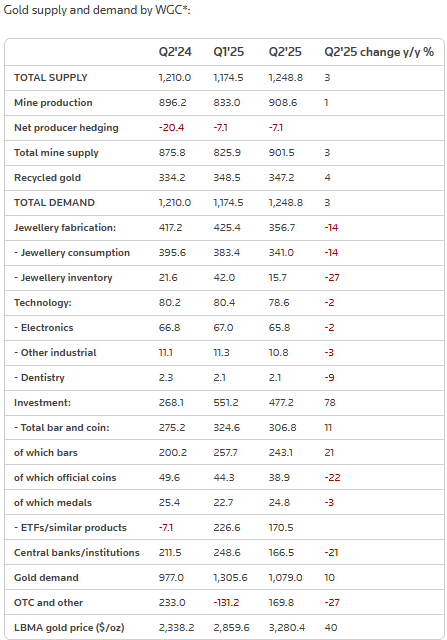

The China gold buying spree has reached 74.02 million fine troy ounces, which is up from 73.96 million in July. Since November 2024, China has accumulated 1.22 million troy ounces total, and the PBoC values its gold reserves 2025 at $253.84 billion versus $243.99 billion previously.

Adrian Ash, head of research at BullionVault, had this to say:

“While China’s gold purchases have slowed so far in 2025, the People’s Bank of China has added to its bullion reserves at ever higher prices. Beijing’s continued accumulation is a clear signal of its faith in gold as a long-term reserve.”

Stablecoins Challenge Dollar Dominance

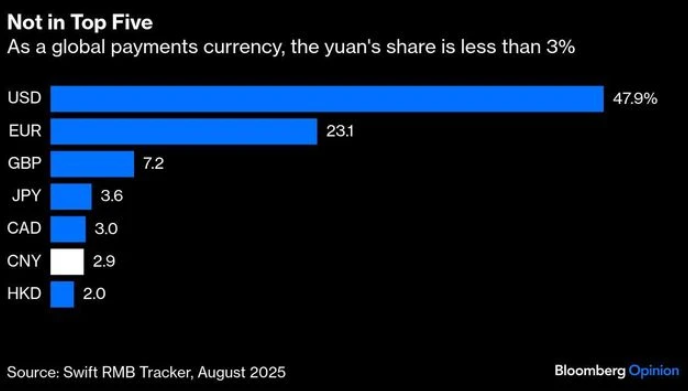

Such a change in the Chinese cryptocurrency policy happens in the same way as the central bank gold demand, since the stablecoins vs US Dollar is currently developing pace. The 5.7 trillion stablecoin market poses a threat to monetary sovereignty globally and it is expected to compel Beijing to reconsider its position and this will come after four years of suppression.

Also Read: China Challenges Petro-Dollar, Launches Electro-Yuan For Energy Trades

In fact, Hong Kong is intending to issue yuan-pegged stablecoins as a expansion of the greater dollar diversification strategy. The China gold buying spree is a complement to the digital currency exploration and the two approaches are merged to make the US dollar dependence even lesser.

Zongyuan Zoe Liu, scholar at the Council on Foreign Relations, is certain that:

“By permitting CNH-based stablecoin trials in Hong Kong, Chinese authorities can explore tokenized renminbi circulation offshore while keeping mainland capital controls intact.”

The sustained Central Bank gold demand also reflects Beijing’s commitment to monetary sovereignty at the time of writing. The PBoC gold reserves for 2025 plan with its gold movements of over $3,500 per ounce and a year to date gain of 30 percent show a total commitment to the important challenge of dollar hegemony using both the physical and the digital.